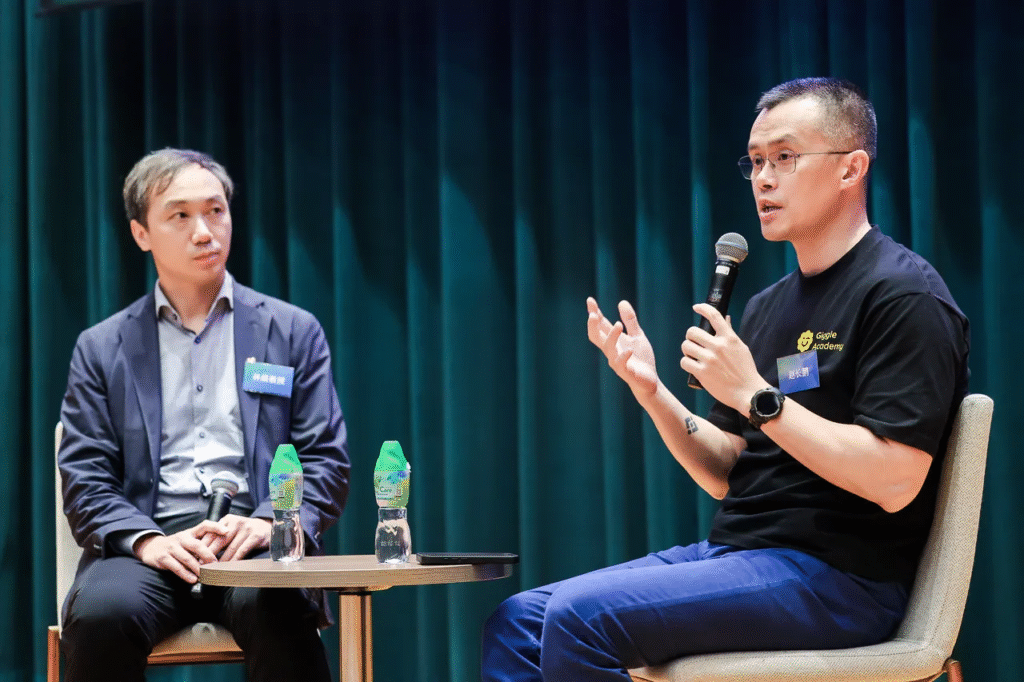

At the CryptoFi Forum in Hong Kong on 27 August, Binance founder Changpeng Zhao started by talking about the development of stablecoins and their contribution to the development of digital finance. He added stress on the manner blockchain is increasingly shaping the system of payments and trading. Stable coins were central to what he was saying, testifying to their ever-growing impact on markets worldwide

CZ expounded that stablecoins have evolved from mere refuges from volatility to very useful tools that advance the impact of the U.S. dollar. Their evolution is a testament to the need for dollar-pegged assets where access to banking is still limited. Binance’s early adoption of USDT made trading easier and cemented stablecoins as a pillar of crypto infrastructure.

The discussion further identified national strategies with stablecoins. Americans are not frequent users of them when it comes to making transfers, but foreign individuals are highly reliant on these tokens. This, CZ maintains, makes the role of the dollar stronger worldwide. He further commented that since stablecoins go beyond national borders, they diffuse monetary influence very far beyond traditional mechanisms. Governments now see them as potential tools of monetary strategy despite problems of capital control.

RWA and Stablecoin lessons for adoption

Zhao then went on to talk about real-world asset tokenization, known herein as a trillion-dollar opportunity. It is nevertheless undertated and with its complexity. Liquidity is the first failure. Not very liquid securities such as real estate after tokenization are unable to provide deep order books. When assets are tokenized, investor demand decreases because of slippage and low liquidity.

It is regulatory. Jurisdictions differ when it comes to the regulation of financial products, and this requires companies to acquire several licenses before they can roll out services. As a result, it is slow and expensive and discourages participation.

Finally, flaw within mechanism design continues. Tokenized securities tend not to mirror underlying prices, disrupting the logic of arbitrage. Without greater connection between assets and their tokenized representations, faith within these products will find it hard to gain momentum.

Even with these problems, CZ vehemently argued that stablecoins are a success of tokenized finance when properly designed. He argued that large markets must take advantage of this window or lose control. For Asian hubs like Hong Kong, doing something now can put the region ahead when the next push of digital finance arrives.

From centralized to decentralized

CZ did cover exchanges’ futures too. He is confident decentralized exchanges will come to dominate and overwhelm centralized exchanges. Direct control of wallets and complete transparency are the strengths of DEXs, yet on-boarding is still not settled. Currently new members decisively choose centralized exchanges due to their simpler interfaces. Eventually innovation of wallets’ useability and cost reductions will bring about a change.

It was a simple lesson for Hong Kong. Development of decentralized system can discourage liquidity but progressive regulation and transparency can turn the city into a global trailblazer. When blockchain adoption continues its evolution trajectory, Zhao summed up that decentralized infrastructure will redefine value flows across markets.