Arbitrum is trading at $0.5519, down 4.14% in the last 24 hours. Its market cap value stands at $2.92 billion, and trading volume has jumped 37.59% to $980.64 million. Right now, there are about 5.29 billion ARB coins in circulation.

Breaking its 200-day range of consolidation after months of sideways action, Arbitrum has generated fresh buzz in the market. The most important change occurred when the token crossed the $0.50 resistance level, which is now serving as support. Experts expect that this change will indicate a shift from accumulation to expansion.

Trading volume supports the breakout strength, and larger volume levels boost the move. Analyst Crypto Maverick noted that the breakout formation shows the market direction is held by the buyers. Traders are now focusing on the $0.74 resistance level, expecting it to lead to a rise toward $0.95.

Technical levels shape near-term outlook

Since June, the volatile movements have strengthened the technical pattern. Analyst Crypto Monkey says the $0.74 level is an important resistance. If Arbitrum holds above this level, traders expect the price to climb to $0.85 and eventually reach $0.95.

The indicators remain convergent with bullish sentiment. Analyst Byzantine General noted that increased open interest indicates that the market is preparing for higher prices. Funding rate stability is also indicative of managed momentum and minimizes the possibility of an overcrowded rally, with favor towards more pronounced price expansion.

Volume is playing a big role right now as overall trading activity keeps rising. The breakout looks supported by strong market participation instead of just short bursts of low liquidity. This makes the bullish setup stronger and shows that the move above $0.50 wasn’t just a temporary jump.

On-Chain growth strengthens market outlook

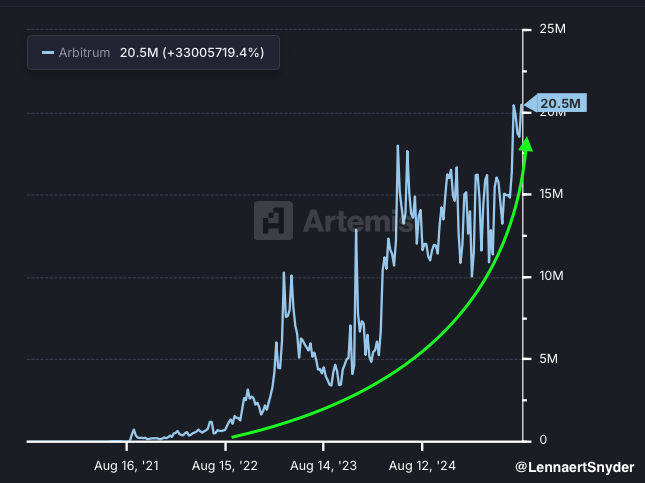

Arbitrum’s network activity keeps growing steadily. Analyst Lennaert Snyder pointed out that in just six months, weekly transactions have doubled and crossed 20.5 million. The rising demand for block space shows a strong base that often supports upward trends, even when the price pulls back for a while or moves sideways near resistance.

On-chain activity usually validates technical patterns, and in this case, expanding usage supports the bullish breakout. Stronger network adoption combined with a confirmed structural breakout creates an environment where upside resistance levels face higher chances of being retested and potentially cleared in the near future.

Arbitrum needs to hold $0.50 and break $0.74–$0.95 to maintain momentum. If it does, the next target could be $1.20, signaling potential growth beyond consolidation.