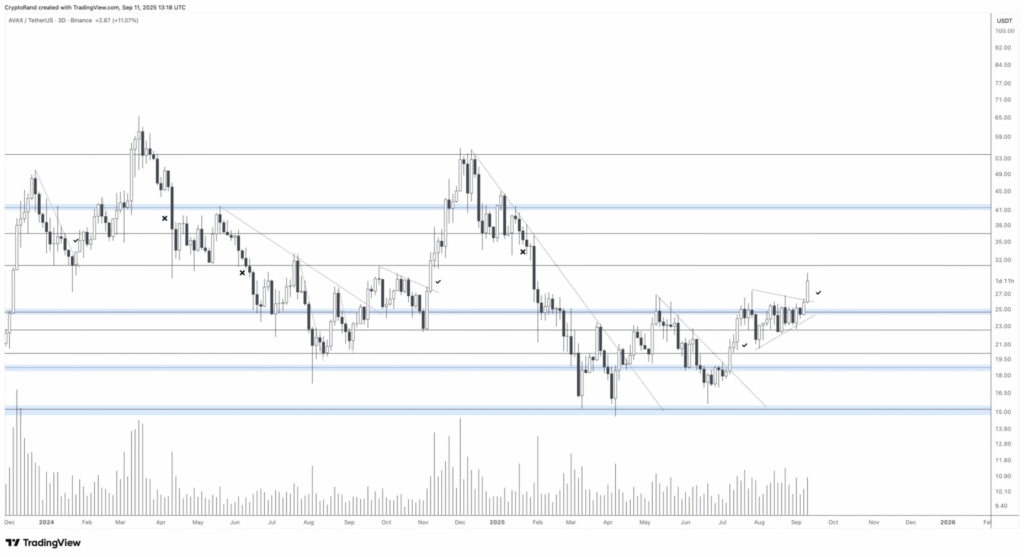

Avalanche (AVAX) has registered a decisive breakout after a period of lateral consolidation that lasted for weeks. AVAX gained 1.09% in the previous 24-hour trading session and has climbed a cumulative 18.93% in the current week. The asset is currently valued at $28.99 and has a $12.24 billion market capitalization.

Despite a 49.21% drop in 24-hour trading volume, the price activity is strong, indicating investor confidence. The breakdown from the $24.50–$27.00 range is a change in sentiment as higher lows formed enduring buying demand, propelling the price upward.

AVAX technical confirmation of bullish trend

The large and strongly momentum-backed break-out candle on the 3-day chart confirms the legitimacy of the movement. The previously seen resistance point at $27.00 becomes support and an important level for a continuation of the uptrend. The successful re-test on the zone would continue to be favorable for a movement higher into the next resistance at $31.50-$32.00.

That level would put $38–$41 in sight, with a stretch to $49 should the condition in the market be favorable. The inability to hold $27.00 would, however, result in AVAX sliding back to $24.50 or lower, back into its earlier range.

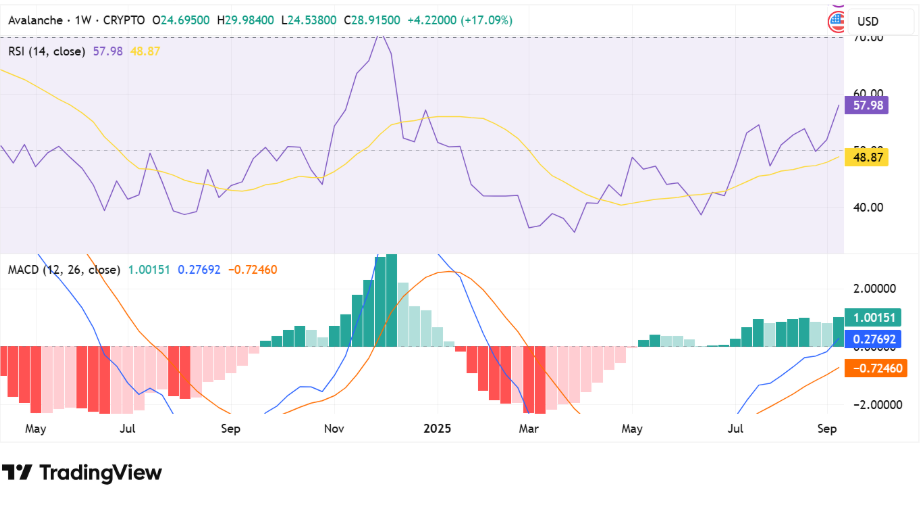

Momentum indicators support bulls

Technical indicators support the bullish case. The weekly Relative Strength Index (RSI) is at 57.98, well above the neutral 50 level, indicating increasing buying strength with leeway to increase prior to overbought conditions.

The MACD is also in a bullish phase and has a robust crossover and growing histogram, indicating that the upward pressure is ongoing. The two indicators are both favorable for the bulls and are indicating that the breakout may be the start of a continuing rally and not a short-term movement.

So, Avalanche has the potential for additional increases as long as it is above $27.00. On a close above $32.00, the subsequent bullish legs would be confirmed, and the bulls would be in full charge of the trend.