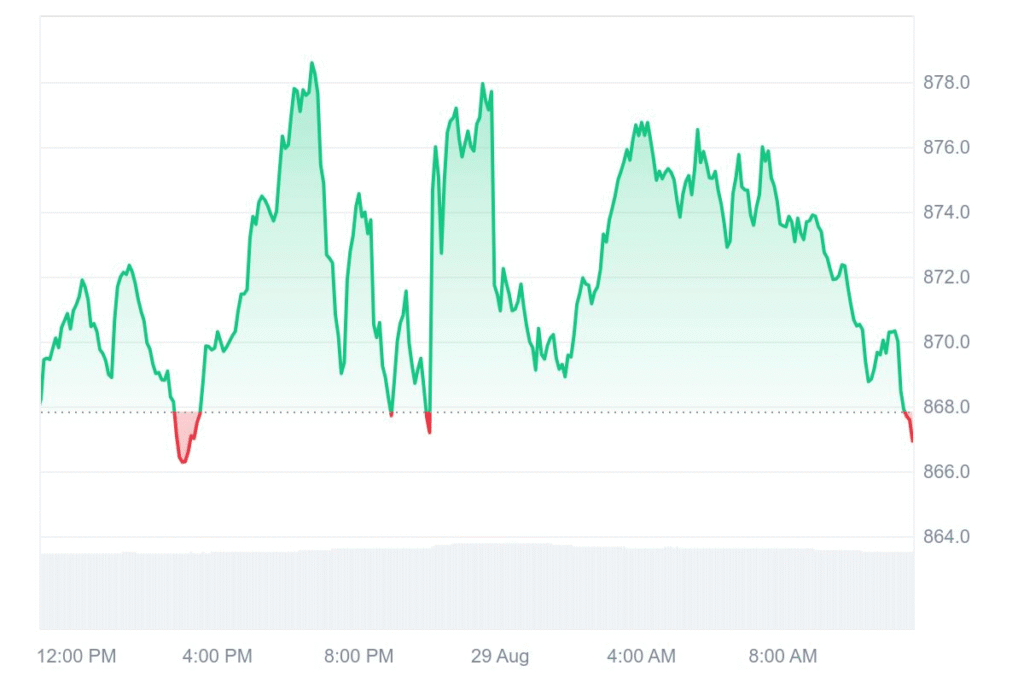

BNB is currently trading at $866.93, falling by 0.42% today. Trading in the last 24 hours was $2.6 billion, a gain of 2.67%. BNB was up by 2.35% in the last seven days, a indication of stable buyer demand. Investors are cautiously optimistic as the coin trades close to its earlier highs.

Technicians clarify that BNB has broken through its record high at $869. This triggered a pattern in the direction that the price is hitting new highs, and buyers are pushing it higher. Short-term trends are bullish. Medium- and long-term charts also suggest strong upward momentum. Support levels are strong at $800 and $750, and they offer some safety for traders.

Market sentiment strongly bullish

From CoinCodeCap Trading, BNB’s next big target lies between $963 and $1,000. Resistance break out indicates buyers took up supply in an efficient manner. The continuation is preferred by momentum while a bearish MACD cross was observed 28 days ago. RSI is neutral, keeping growth healthy and unsaturated.

If BNB goes beyond $800, the $1,000 target becomes more attainable. Resistance points at $870 and $963 are next-day obstacles. The market distinctly favors higher prices. Speculators are gazing at virgin territory. Analysts note volatility abounds, yet bulls dominate the charts.

BNB price predictions for 2025

Future outlooks until 2025 are inconclusive. DigitalCoinPrice forecasts that through the end of years, BNB will surpass $1,902.73, intermediate objectives at $899.70. Top performers anticipate high upward shifts should resistance at $800 persist.

The more conservative outlook is provided by Changelly. They suggest a trading band of $574.03-$625.17 and an average of $676.31. Analysts anticipate bottoms by August-2025 at approximately $610.33 and highs at approximately $646.90. Future returns suggest a moderate negative trend, signaling volatility ahead.