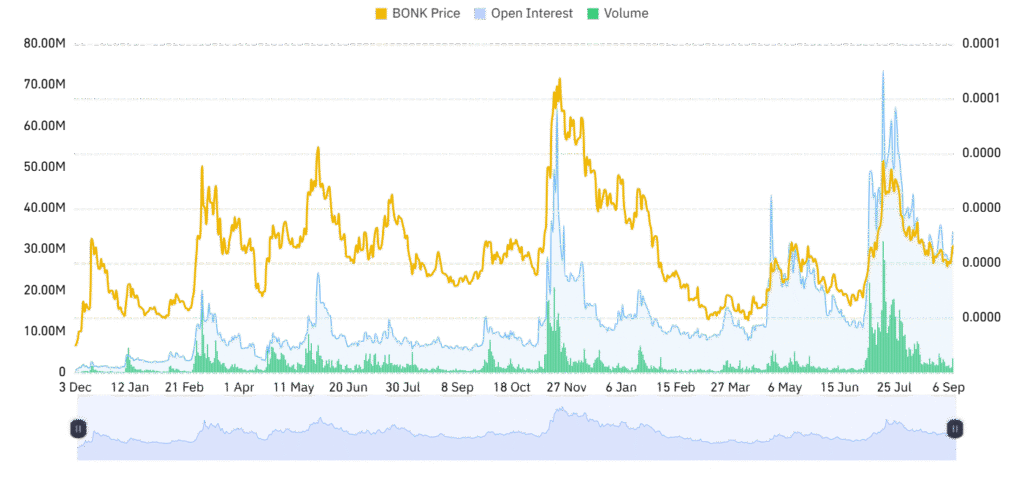

BONK is moving on a positive trajectory despite an already bullish market backdrop. In the last 24 hours, the token climbed 6.57%, adding to its impressive weekly gain of 15.08%. At the time of writing, BONK trades at $0.00002362.

Trading activity has also strengthened, with volume reaching $522.13 million, marking a 52.1% rise in one day. Market capitalization now stands at $1.91 billion, reflecting strong inflows of speculative interest.

The surge comes as BONK benefits from technical and market-driven catalysts. Analysts point to a breakout pattern that has caught the attention of traders seeking short-term opportunities. This shift in momentum highlights BONK’s ability to capture investor focus in a crowded digital asset landscape.

Bonk Breakout signals bullish trend

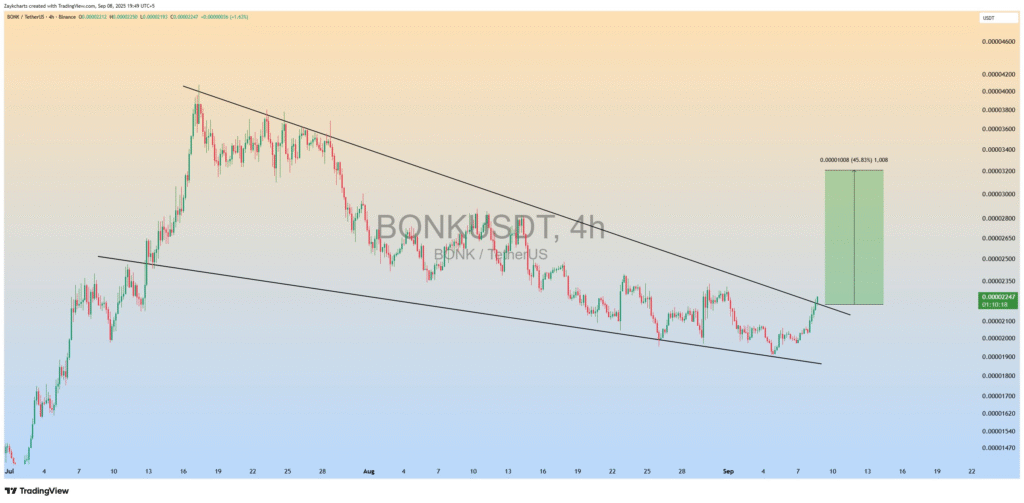

Technical indicators show that BONK is breaking out of the falling wedge formation in the 4-hour chart. These patterns typically indicate bull reversals, and the recent breakout is evidence of new buying demand being built. Strong bullish candles in the chart accompany the breakout, which is a sign of new entries.

Active resistance is within the $0.00002450 – $0.00002500 zone. However, a sustained rally above this area would cement bullish supremacy and provide the foundation for a move up into the anticipated target of $0.00003200. The target is a potential 35-40% rally through the measured move of the wedge.

Support current remains in the region of $0.00002200 through $0.00002250. Holding this region is crucial, as any breakdown through implies that the breakout is rendered invalid and the drop re-pushed south near the $0.00002000 region. Traders watch signs of how buyers will be holding the breakout belief through this level.

Market sentiment strengthens

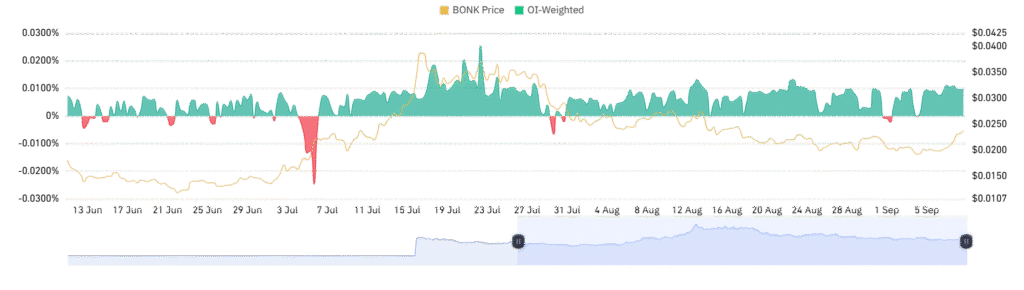

Besides the prices movement, the BONK is seeing more action. However, the open interest surged 6.41% to $35.20 million as the leverage crowd is becoming active again. The OI-weighted funding rate is at 0.0099%, meaning the longs are paying the shorts, and the market in general is bullish.

This is the market that holds promise along with risk. Though the structure is favorable for further upside, overcrowding longs may render BONK susceptible to spiky pullbacks should the sentiment reverse quickly. The equilibrium at the moment remains favorable for continuation with the target at $0.00003200 in the spotlight.