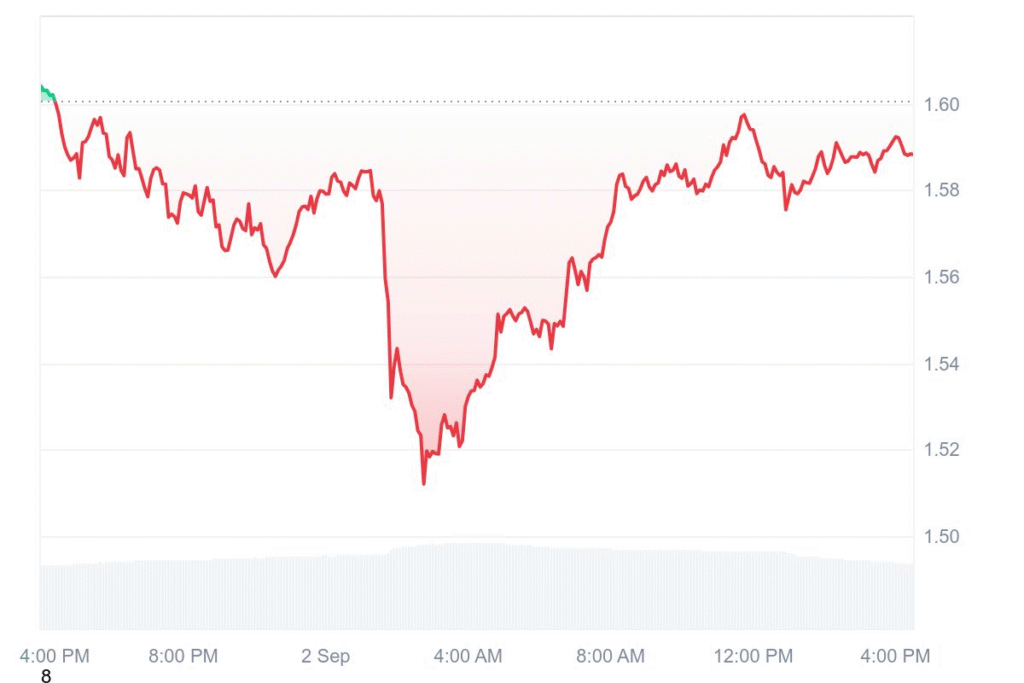

Celestia TIA is currently trading at $1.58, having dropped 0.53% during early September. A 24-hour trade volume of $91.98 million was realized while showcasing a 2.32% growth. TIA’s price within a week has declined by 2.33%, a sign of moderate weakness. Traders are keeping a keen eye on major levels of support especially around the area between 1.55–1.60.

Traders remain vigilant because TIA is nudging against support. A small shift in demand has a chance to trigger a broader swing. Technicians say that current trend shows buyers’ indecisiveness. Traders closely observe TIA for any reversals or selling pressure signs.

Bearish Continuation Signal Emerging

Crypto observer Alpha Crypto Signal notes a descending triangle forming on TIA charts. Support appears strong around $1.55–$1.60, but breakdown risk is present. This pattern has a habit of telling investors a bearish continuation is likely. Should bears penetrate levels of support, the next big target is around $1.25–$1.30.

That being said, a breakout above $1.80 will invalidate bearish pressure. That could swing momentum in buyers’ direction. Until TIA crosses above this barrier, experts remain cautious. The coin continues to be in a high-risk environment due to investors considering risk versus reward.

TIA price predictions for 2025

DigitalCoinPrice is forecasting TIA has a possibility to reach $3.48 in December 2025. Some professionals even foresee a possibility to go past a record high at $20.91. Top market participants point out a possibility to rebound in event bullish circumstances materialize. Trading during early January in 2025 demonstrates volatility but plots out foundations for a possibility to progress.

But a less sanguine outlook is provided by Changelly. They predict a minimum $1.20 and a maximum $1.38. For September 2025, TIA could average $1.32 with corresponding ROI within -70%. Mixed signals are sent to investors because projections span such a wide range that management of risks will be critical in the coming months.