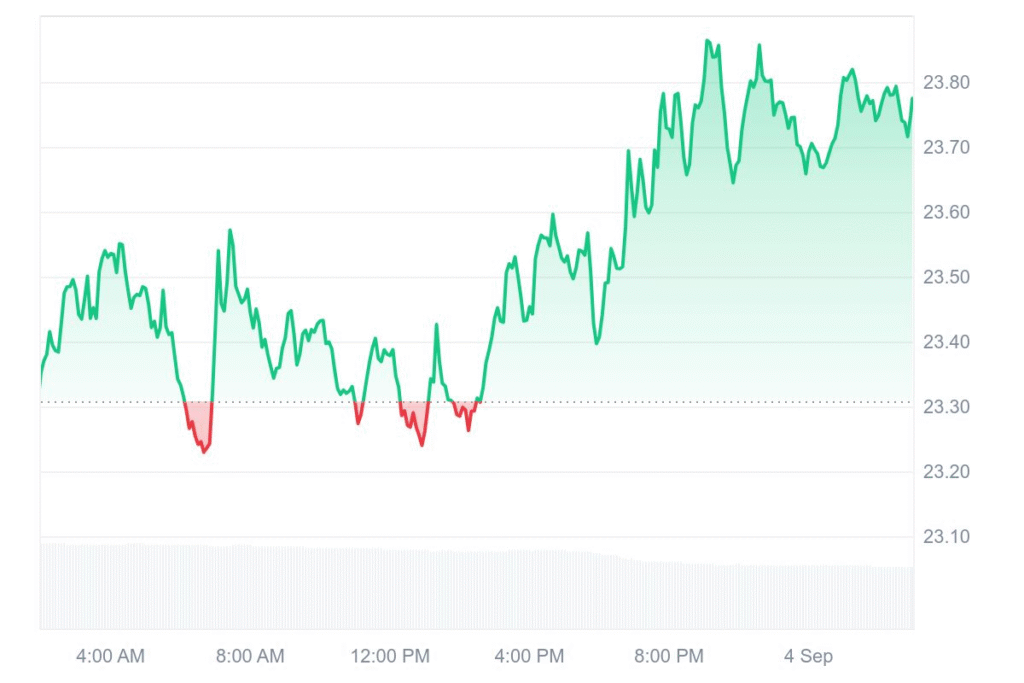

Chainlink (LINK) is currently trading at $23.77, rising 1.25% today. The 24-hour trading volume drops to $865.64 million, down 26.97%. Over the past week, LINK slips 0.89%, maintaining the $23.77 mark. Investors watch closely as the token stabilizes near this key support zone.

Despite muted movement, LINK shows resilience. Buyers defend the $22–23 range. Sellers remain cautious, keeping momentum subdued. Traders anticipate a potential breakout once the $26–27 level clears. The market watches for signals of institutional entry.

LINK files for spot ETF

According to crypto analyst Tall Man Crypto, Chainlink achieves a major milestone. LINK becomes the official oracle provider for U.S. government economic data, including GDP, inflation, and consumer spending. This move strengthens its role in DeFi, TradFi bridges, and real-world asset integrations.

The market reacts slowly to this development. LINK also files for a spot ETF, signaling potential institutional inflows. Analysts believe this could mimic BTC and ETH ETF surges. Smart money quietly positions itself, while retail investors have yet to join. This creates a rare opportunity for early adopters.

LINK price predictions for 2025

DigitalCoinPrice predicts LINK could hit $52.23 by year-end 2025. Analysts note that LINK may surpass its previous all-time high of $52.88. The forecasted trading range lies between $47.01 and $52.23, showing strong upside potential.

Changelly expects LINK prices to fluctuate between $17.94 and $21.60, averaging $25.25. Meanwhile, September 2025 projections place LINK at $22.86–$24.33, with an average near $23.60. Investors calculate potential ROI at 3% to 8.6%, depending on market entry. LINK’s trajectory suggests careful monitoring and strategic planning.