Dogecoin has regained some momentum despite recent market challenges. Over the past 24 hours, the token has climbed to $0.2568, reflecting a 0.73% daily increase.

Prices fluctuated between $0.2520 and $0.2570, with noticeable volatility in early trading sessions. Market capitalization has risen to approximately $38 billion, while 24-hour trading volume surged by 12%, signaling sustained buying interest and improving investor sentiment.

Recent weeks brought selling pressure and investor uncertainty, raising concerns over further declines. Yet, the US Department of Government Efficiencies DOGE has sparked renewed optimism. Developments from the department, which shares the memecoin’s name, have captured investor attention. Analysts believe that positive updates could substantially influence Dogecoin’s market performance.

Dogecoin dividend proposal sparks optimism for price surge

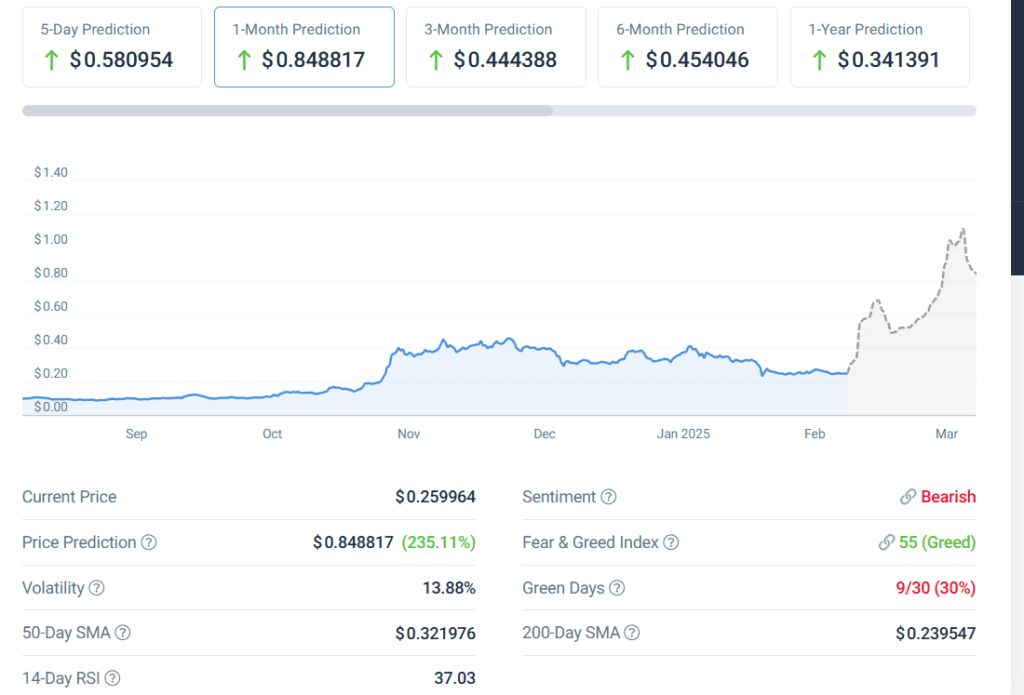

Market watchers are closely monitoring the US DOGE Dividend proposal, which may attract new buyers and reduce selling pressure. Analysts suggest that successful implementation could trigger significant upward movement. According to Coincodex, if this scenario materializes, DOGE could surge by 234.70%, potentially reaching $0.853256 by March.

Beyond short-term gains, speculation is growing around Dogecoin’s long-term prospects. Market chatter includes bold forecasts, with some suggesting DOGE might reach the $5 mark during a possible DOGE supercycle. Historical data shows that each cycle often leads to dramatic price shifts, fueling optimism among investors. The current price movement echoes previous patterns, hinting at the potential for larger rallies.

At the time of writing, Dogecoin trades around $0.2536, with intraday swings between $0.2426 and $0.2556. Analysts note that sustained buying momentum could push the token toward higher resistance levels in the coming weeks.

Historical patterns suggest potential for gains

Trader Tardigrade points to similarities between Dogecoin’s current macro chart and past market cycles. The analysis compares price patterns from 2014-2017 with the 2021-2024 cycle, both showing extended periods of consolidation followed by sharp upward breakouts. If the trend repeats, DOGE could soon experience another substantial rally.

The chart analysis shows Dogecoin tightening its price range, with green trendlines indicating potential breakout zones and orange areas marking past accumulation phases.

A breakout above the current consolidation could spark significant gains. Technical indicators support this outlook, with the MACD showing a bullish crossover and the RSI at 42.11, signaling improving buying pressure without overbought conditions. Recent price action reflects a recovery from declines, with sustained movement above $0.00001000 possibly leading to further gains, though resistance near $0.00001500 remains a challenge.

While speculation remains high, analysts advise monitoring key resistance and support zones closely. Sustained momentum, market sentiment, and external factors like the US DOGE Dividend proposal will likely shape Dogecoin’s price trajectory in the coming months.