Dogecoin is facing significant pressure as the broader cryptocurrency market remains in a prolonged bearish phase. The price has dropped sharply over the past day, marking an 11% decline. It started around $0.2285 before falling to $0.2030, with sharp declines in the early hours.

Despite the downward movement, the 24-hour trading volume surged 150%, indicating heightened market activity. Dogecoin’s market cap stands at $30 billion, reflecting its continued relevance in the crypto space despite current volatility.

Market trends indicate growing uncertainty, with external factors influencing price action. Analysts suggest that macroeconomic concerns, particularly U.S. tariff policies, could be contributing to Dogecoin’s struggle to find stability.

Dogecoin faces macro pressure from U.S. tariff policies

Dogecoin’s price decline appears tied to ongoing U.S. trade policies, particularly Donald Trump’s firm stance on tariffs against Mexico and Canada. Similar economic concerns contributed to a broader market decline earlier this month. The lack of policy shifts suggests that Dogecoin could continue facing challenges in the short term. If global trade tensions persist, market sentiment may remain bearish, making it difficult for the asset to sustain upward momentum.

However, historical trends provide a different perspective, with analysts noting similar downturns before major bull cycles. Traders are now monitoring key support levels to determine the next potential move.

Analysts highlight key support levels and future trends

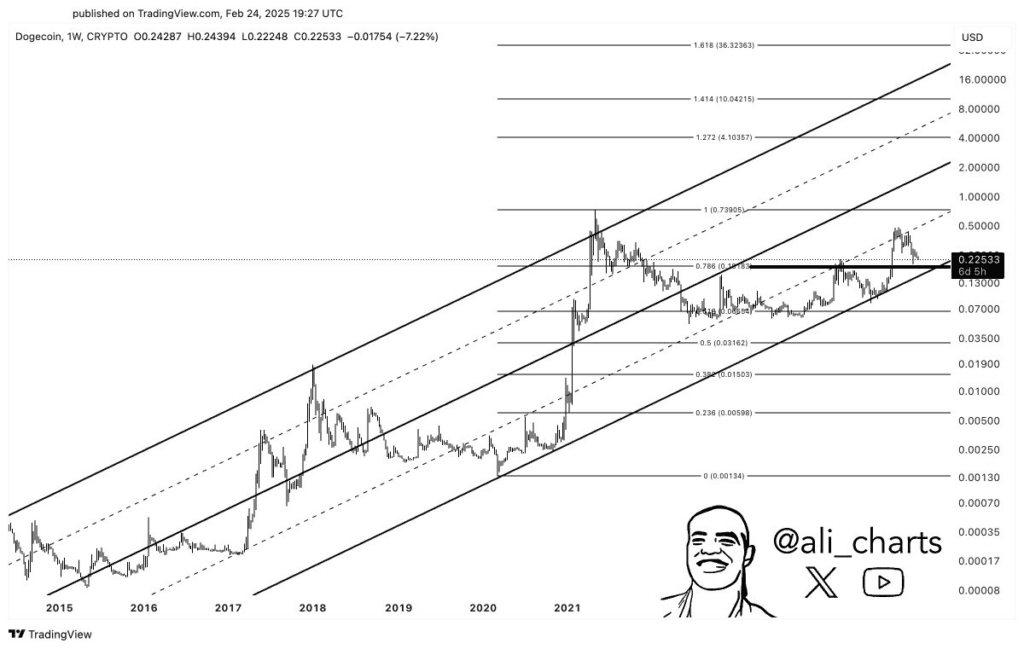

Trade Tardigrade analyzed Dogecoin’s historical price cycles, emphasizing how deep pullbacks have preceded major upward trends. In 2017 and 2021, Dogecoin experienced a decline of 60% and 56%, respectively, before entering sharp rallies. The current cycle has seen a 57% pullback, suggesting a potential 2025 price surge if past patterns repeat.

Ali Martinez pointed to $0.19 as a critical support level, warning that a drop below this could accelerate losses toward $0.060. Fibonacci retracement levels confirm the importance of maintaining support, as breaking below it may trigger further declines. On the upside, resistance at $0.22-$0.25 remains key for potential recovery, with stronger resistance at $0.30.

Technical indicators like the MACD confirm a bearish trend, with the MACD line below the signal line and a deepening histogram. Traders should closely watch the $0.19-$0.22 range to determine Dogecoin’s next move in the market.