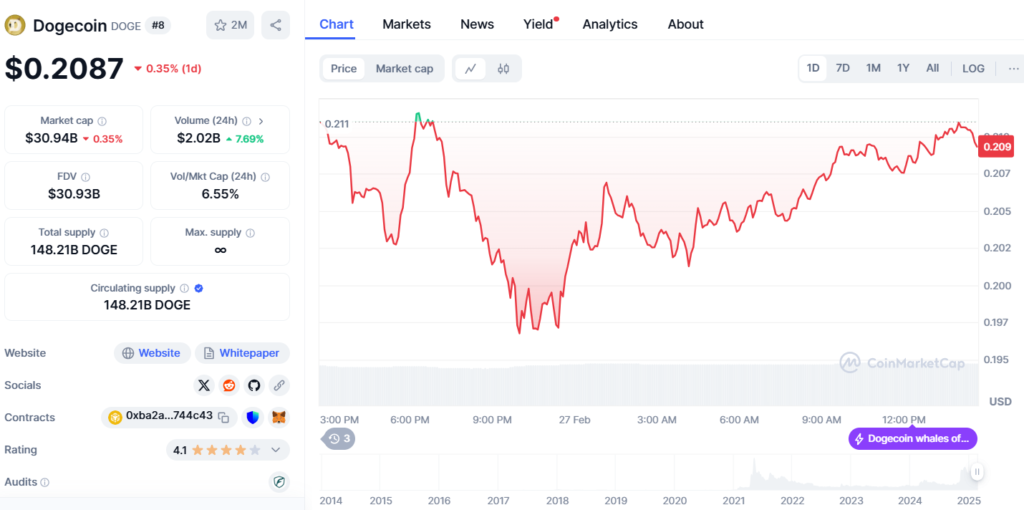

Dogecoin has declined over 6% in the past 24 hours. The price fluctuated between $0.195 and $0.2126 before settling at $0.210. Dogecoin’s market capitalization is $31.2 billion, with a trading volume of $2.02 billion. The lower trading activity indicates reduced investor interest, contributing to the recent price movement. Analysts believe this price drop aligns with historical cycles, where Dogecoin has experienced corrections before recovering.

Analysts predict DOGE rebound if support holds at $0.20

Analysts closely watch Dogecoin’s price action, noting that it is moving within a falling wedge pattern. This pattern often signals a potential breakout if key levels hold. Crypto analyst Bithereum stated that DOGE could drop to $0.20197, a level tested multiple times in previous market cycles.

Despite the decline, some analysts anticipate a reversal, with price projections reaching up to $0.45 if bullish momentum strengthens. The pattern suggests a familiar trend where Dogecoin sees pullbacks before attempting a rally. However, for a recovery to materialize, DOGE must hold above its critical support at $0.20. If selling pressure continues, the price may dip further before any potential rebound.

Technical indicators show mixed signals for Dogecoin

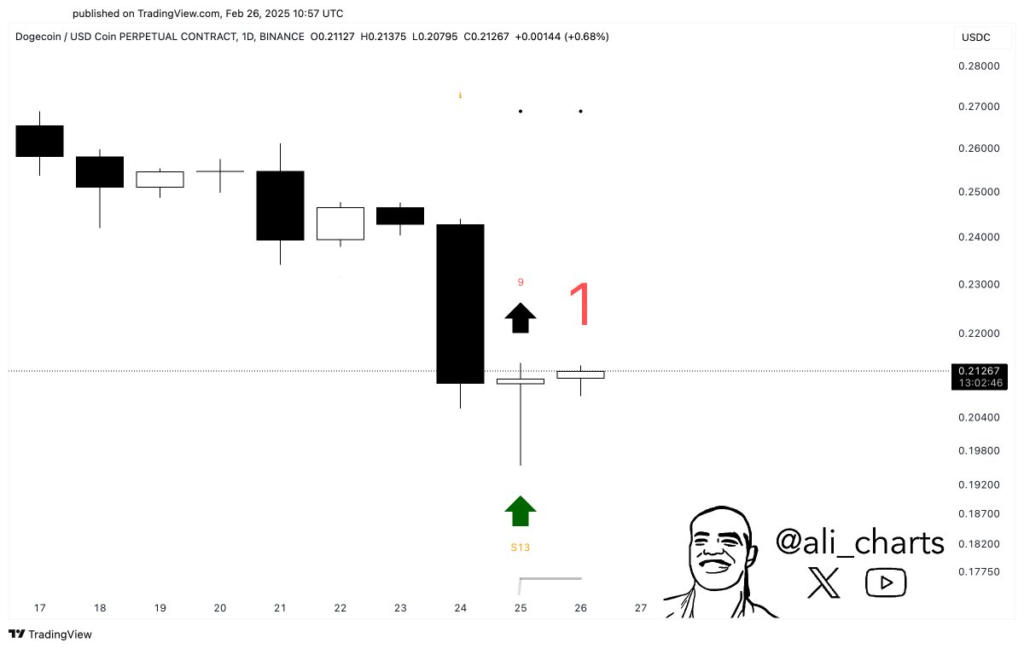

Technical analysis suggests Dogecoin is approaching a crucial moment. Analyst Ali pointed to a TD Sequential buy signal on the daily chart, which historically indicates trend reversals. The signal appears after an extended bearish phase, suggesting that selling pressure might be easing.

The Relative Strength Index (RSI) stands at 30.16, nearing oversold conditions. If the RSI rebounds, DOGE could see an upward move toward $0.22-$0.25. However, continued selling could push it lower to $0.19-$0.18. The MACD line remains negative, reinforcing bearish pressure. A potential bullish crossover could confirm an uptrend, with price targets around $0.28-$0.30.

Recent market trends and investor sentiment will play a key role in determining Dogecoin’s next move. If the price maintains support at $0.20, a breakout could be possible. However, failure to hold this level may lead to further declines before any recovery.