Ethereum (ETH) is riding a wave of strong momentum, showing an impressive price surge as it benefits from renewed confidence and growth across the broader crypto market. The ETH is currently trading inside a wedge pattern, which often leads to a bullish reversal. If a successful breakout occurs, then it will lead to a maximum resistance zone around $8000.

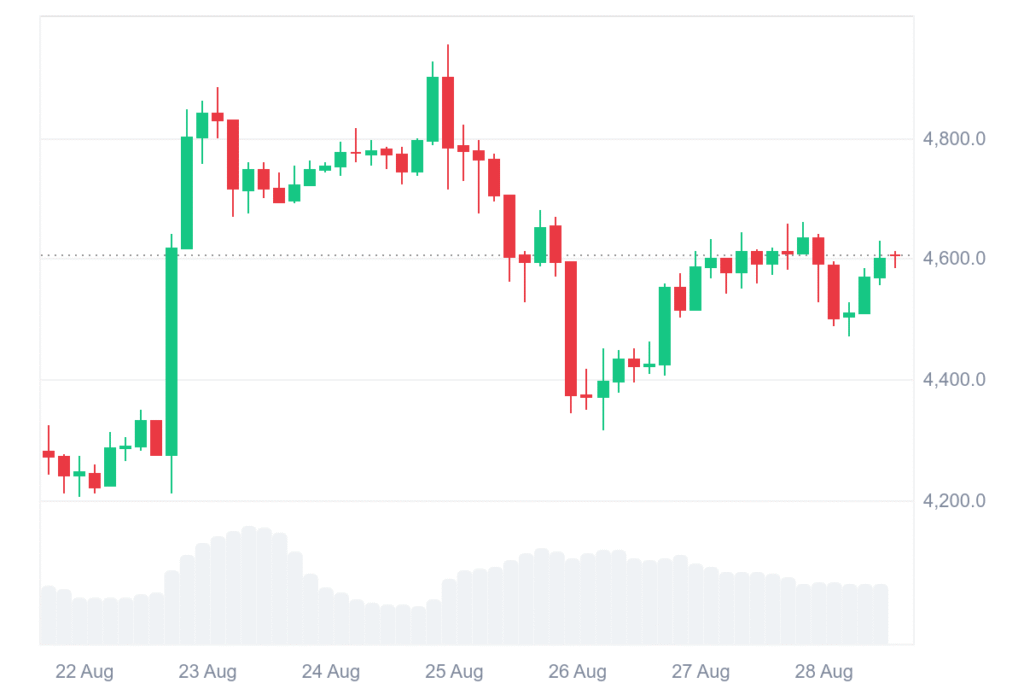

At the time of writing, ETH is trading at $4,607.89 with a 24-hour trading volume of $40.48 billion and a market capitalization of $556.11 billion. The ETH price over the last 24 hours is up by 0.21%, and over the last week it is also up by 7.27%, with a high potential for the next major rally.

ETH closes a bullish monthly candle; $8K is in sight.

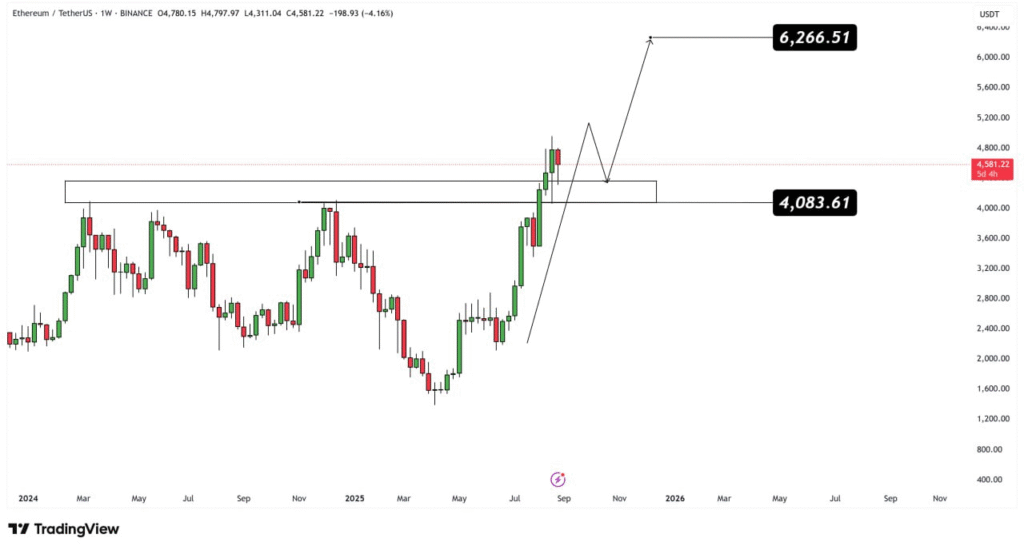

A prominent crypto analyst highlighted that Ethereum ($ETH) has just closed a bullish month-long candle above a very important supply zone that had been capping its rise for months. Although this breakout is still not a traditional textbook breakout, analysts confirm momentum is not in question, and if this candle does not complete a breakout, its next one probably will.

For investors, it is a make-or-break time in the marketplace. Investors positioned at or near cycle bottoms, in the mid-zone, or in a breakout at the broadening wedge continuation pattern are already positioned. But for investors holding out on the sidelines, this breakout bid may become their last chance to buy before Ethereum launches into what most are referring to as its euphoria rally.

The question is now how far Ethereum can travel in this second leg. Technical analysis implies a careful target in the area of $8,000, a level that is also synonymous with the 1.618 Fibonacci extension and final target in line with Ethereum’s broadening wedge formation. Both indicators provide a compelling case for further gains into fresh territory.

If Ethereum achieves this target, it would not only exceed its prior all-time high but also rewrite the larger altcoin marketplace direction. As bullish sentiment is back in play and technical formations are in position, several months ahead might prove determining for Ethereum’s long-term marketplace story.