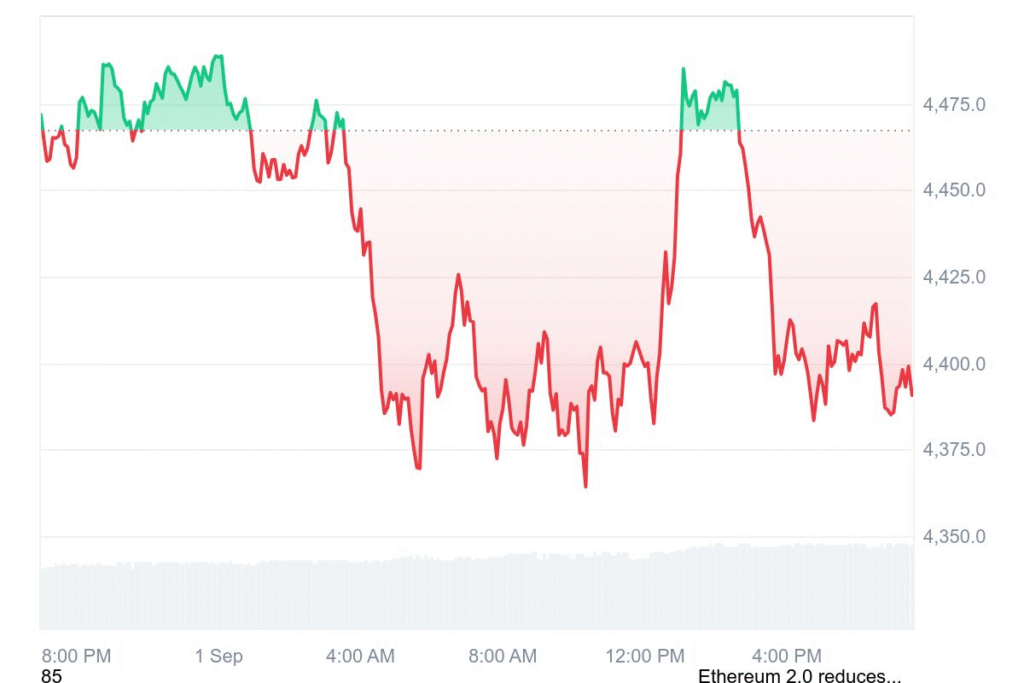

Ethereum (ETH) is currently trading at $4,392.47 and has shed 1.66% so far today. Traders witnessed a higher volume of trading up to $32.53 billion. That is a 34.84% greater activity level in the last 24 hours. Ethereum fell 5.66% in the last seven days and closed at $4,390.72.

Analysts anticipate volatility will dominate. Traders are eyeing the $4,500 resistance level. It could trigger a brisk bull move on a break. Alternatively, rejection can send prices below significant supports of $4,200 and $4,000 or perhaps $3,800. Following sessions are significant for the momentum of ETH.

Key support zones to watch for ETH

Crypto analyst Crypto King notes that ETH is currently testing resistance. It can activate powerful buying interest if it breaks above $4,500. Failing to do so can bring the market seeking support at lower regions. All levels of support are capable of holding short-term upsurge potential.

Investors are optimistic yet cautious. They are always on the lookout at both the technicals and sentiment. Minor changes may spark big moves because of the trading volume of ETH. Traders are cautioned to plot their entries and exits based on these important levels. Timing will prove crucial when exploiting trend.

Ethereum price prediction 2025

DigitalCoinPrice is forecasting ETH may touch $9,584.51 at the end of 2025. Experts believe it might first cross $4,953.73. Market leaders expect that the prices of Ethereum may remain at $8,748.10 and $9,584.51. It may not be smooth sailing but bull runs may continue.

Changelly is expecting a higher range in 2025. It may go down to $3,330.88. It can go up to $4,293.38. September projections estimated the average at $4,814.81. Potential returns lie between 9.3% and 33.8%. Analysts suggest staying updated regularly to find out where Ethereum is headed.