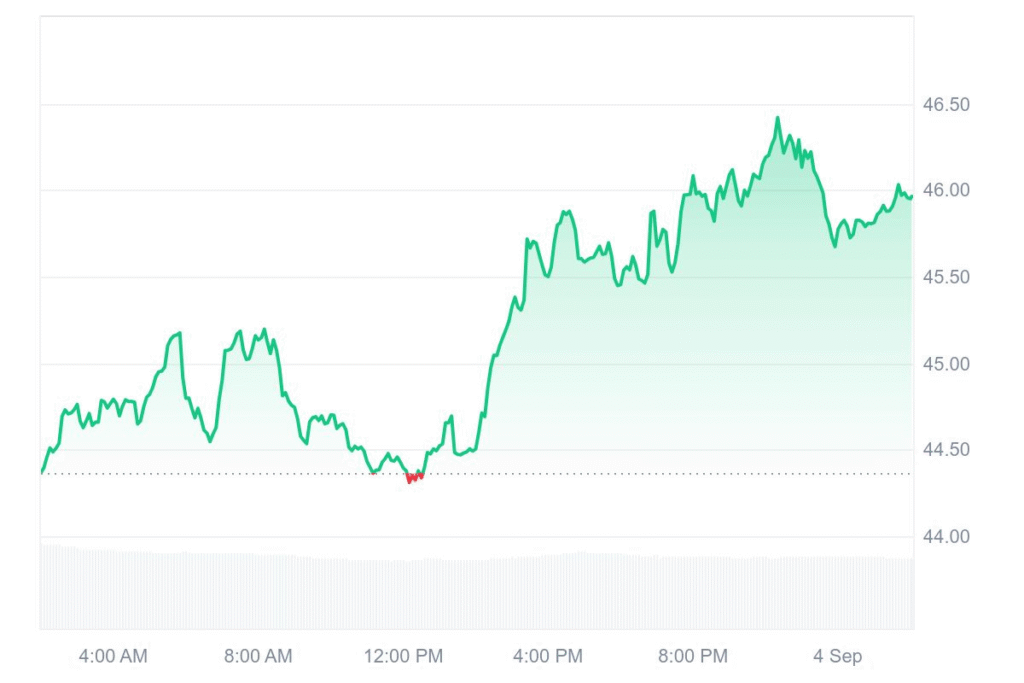

Hyperliquid HYPE is trading at $45.93, having risen 3.47% in early trade. The last 24 hours recorded $208.28 million in volume, down 16.27% from yesterday. For its part, the last week has been unkind, with HYPE down 6.5% from its last high. Traders observe that $30-35 continues to be a major support area, and aggressive buy orders can be spotted on dips.

Market observers are monitoring liquidity levels that are now comparable to those of certain centralized exchanges. Derivatives market growth on the platform remains strong with open interest reaching $1.84 billion in July. Comments from analysts are that it puts Hyperliquid firmly in contention to be a major player in the decentralized perp space.

Market Sentiment Shows Optimism Around HYPE

Crypto analyst Tall Man Crypto highlights key developments behind HYPE’s growth. BitGo just became a member to offer custody services, and an exchange-traded product (ETP) is commencing in Europe soon. These initiatives are putting in place institutional-grade infrastructure underneath a platform already exhibiting robust growth.

Traders mention that such action can propel HYPE to its next all-time high of $51.07 or even further. With growing liquidity, massive swings are possible for market players. The overall sentiment remains buy on dips, hold on to base, and catch possible wave rides up.

HYPE Price Forecast 2025

DigitalCoinPrice also predicts HYPE to potentially cross $100.66 by December of 2025. Technical analysts identify mid-term targets of $51.07, and such a positive thrust can take it to still more new highs. Market leaders expect that with support levels, the coin must retain very strong performance.

Conversely, CoinCodex provides a more subdued outlook. Following last month’s 21.02% decline, HYPE can potentially slump down to $37.46 in September. The website projects a trading corridor of $33.33 to $46.15. Short sellers can expect a possible 27.41% gain should these forecasts come to pass. Traders must now balance a situation of high bullish potential with significant risk to the downside.