Jupiter (JUP) is currently navigating a complex price path, balancing between immediate growth and lingering weekly setbacks. Over the past 24 hours, Jupiter has climbed by 0.84%, displaying resilience despite a broader market condition that remains uncertain. However, the past week has not been as favorable, with the token losing 8.56% in value.

At the time of writing, Jupiter is trading at $0.4935, backed by a market capitalization of $1.5 billion. The trading volume over the last 24 hours sits at $46.15 million, representing a notable decline of 24.35%.

This dip in activity suggests reduced participation, even as price levels attempt to stabilize near the $0.50 mark. Such mixed signals highlight a market in transition, searching for a stronger trend direction.

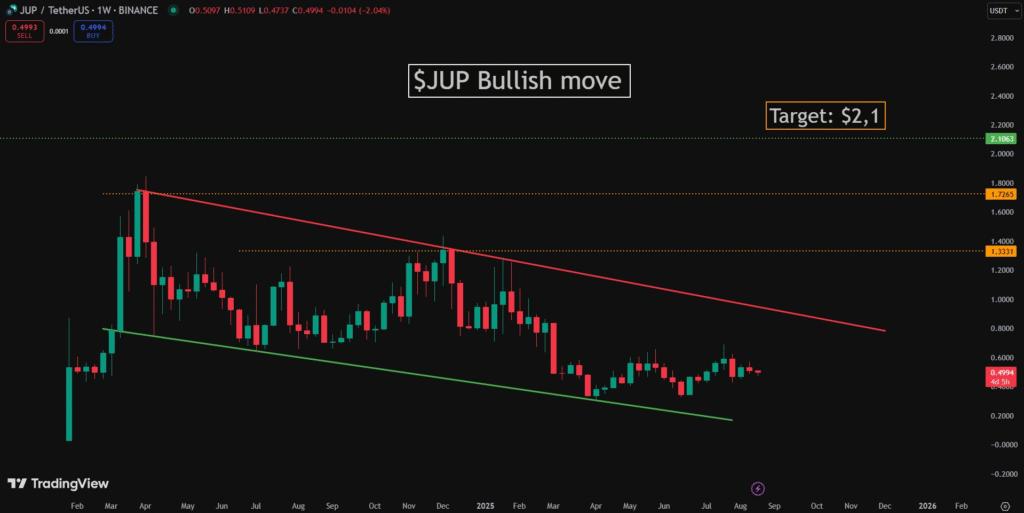

Jupiter Chart structure points toward possible breakout

Technically, the weekly chart of the JUP exhibits a descending channel structure, a pattern that is frequently attributed to a trend reversal that is about to occur. Currently, the price is located near the center of this channel at $0.4994, suggesting that there is consolidation in place. Both resistance and support levels have been repeatedly respected, further establishing the legitimacy of this structure.

A major breakout would be a rise above the $0.75–$0.80 resistance area. That would carry the price to $1.33 and $1.72 as the next stops, with a larger bull target at $2.10. It would be a strong upside rally and could turn overall sentiment around decisively.

However, the breakout has not occurred, and the trend is still technically bearish until further evidence is presented. In case the resistance is solid, JUP could revisit lower support zones, potentially below $0.40. Traders are thus cautioned to exercise prudence and wait for definitive evidence prior to entering bullish positions.

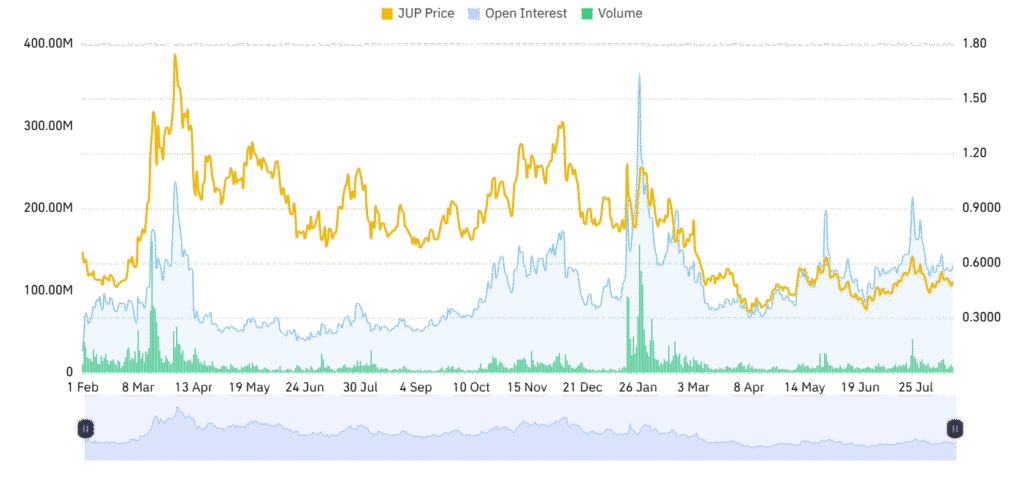

Derivatives market reflects cautious optimism

Derivatives market adds another dimension to the future outlook of JUP. Current Open Interest is $126.19 million, down by 1.46% in the last day. It is a sign that there has been closing of some positions, reducing speculation.

Nevertheless, the price has kept fairly stable, implying that the decline may be more about leverage purging than a shift into bearish pressure.

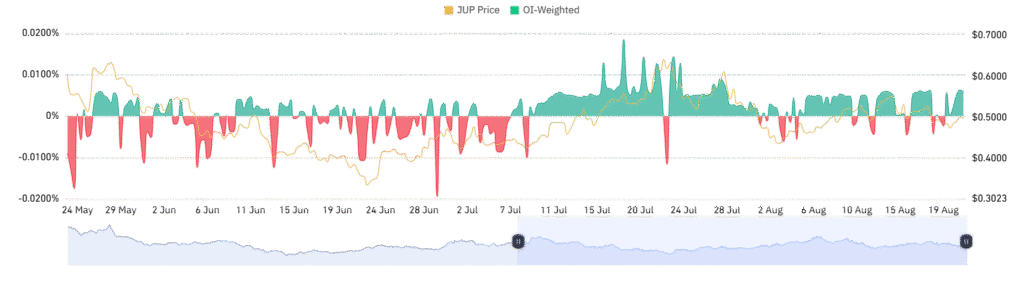

Additionally, the OI-weighted sentiment is at +0.0060%, a slight but positive signal that traders are gradually leaning to the bullish side. Statistically, great upswings in JUP have happened before when both sentiment and Open Interest have increased in conjunction, especially near strong resistance levels.

Should that same momentum grow anew, it could provide the spark for the breakout technicals are calling for. Sentiment presently resides in the neutral-to-bullish area, awaiting a catalyst to affirm the market’s direction.