NEAR is showing a neutral trend as the cryptocurrency’s price attempts to stabilize in the face of continuous pressure from neutral trading emotions. In the past 24 hours, the cryptocurrency has dropped by 1.16%, while weekly data indicates further drops of 17.35%.

Today, NEAR is trading at $2.41, with a market cap of $2.99 billion, which is a large cryptocurrency valuation. At present, the 24-hour trading volume is $150.75 million, which has registered a steep drop of nearly 34.66% against the previous trading session.

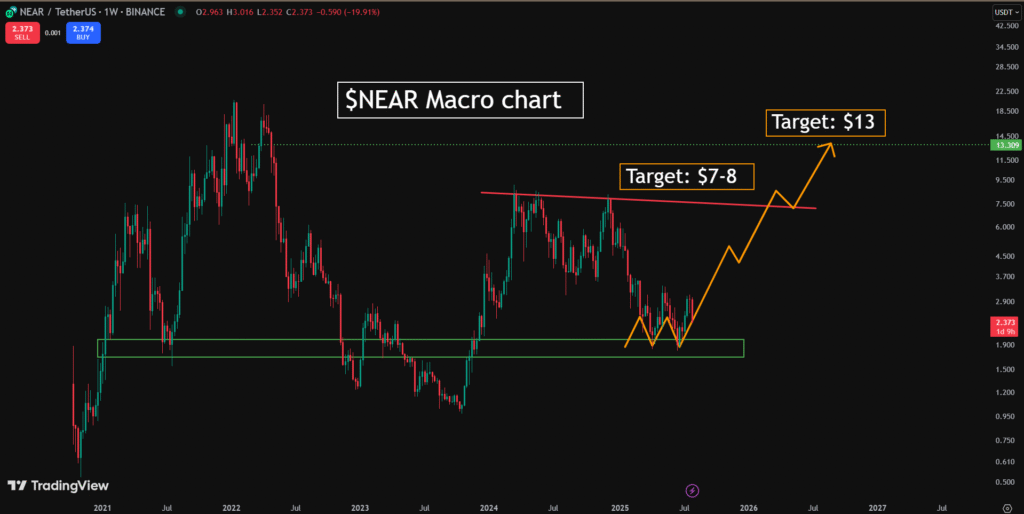

The weekly NEAR chart on Binance shows the asset is trading at about $2.37 after navigating the long-term bear trend. The price action is registering a reversion to the prior support area of $1.90 to $2.30, which had strong buyer interest in the past.

There is the possibility of a macro reversal formation in progress on the chart, which would either be in a double or triple bottom formation. The resistance zone of the neckline is $7 to $8, the zone that has rejected the price multiple times in the past.

NEAR breakout levels and long-term price outlook

A breach above this resistance area would suggest a long-term reversal in the bull direction, possibly towards $13. The accumulation support in the area of the green-shaded region of the chart is at $1.90 to $2.30, the most crucial level for bull traders.

Conversely, the inability to hold the $1.90 floor support can invalidate the bullish setup and bring about additional bear pressure. Another crucial risk is rejection at the $7 to $8 resistance area, which can bring about extensive spells of price consolidation.

Optimistically bullish traders can establish positions in the $2.00 area, with protective stops in the area south of $1.90. Those who require additional corroboration can wait for a powerful close above $8 before targeting the next major resistance at $13.

Traders can wait for a confirmed breakdown beneath support or a failed breakout in the $7–$8 resistance region. Such breakouts could offer opportunities to take shorts, particularly in the event the broader market mood stays unenthusiastic in the days to come.

Market players will closely watch the behavior of the price at the historic support zone to determine if the reversal is sustainable or if the correction continues.