Pudgy Penguins (PENGU) is gaining strong traction in the market as its price continues an impressive upward trajectory. Over the last 24 hours, the token surged by nearly 14.78%, extending its bullish trend from the past week where it gained 9.66%.

At the time of reporting, PENGU is trading at $0.03573 with a market capitalization of $2.24 billion. The 24-hour trading volume has risen sharply to $1.01 billion, marking an increase of 224.09%.

This surge in volume highlights renewed interest from both retail and institutional participants. The strong turnover reflects growing conviction that the project may sustain momentum if current conditions hold. The combination of price gains and liquidity influx underlines the positive sentiment surrounding the asset.

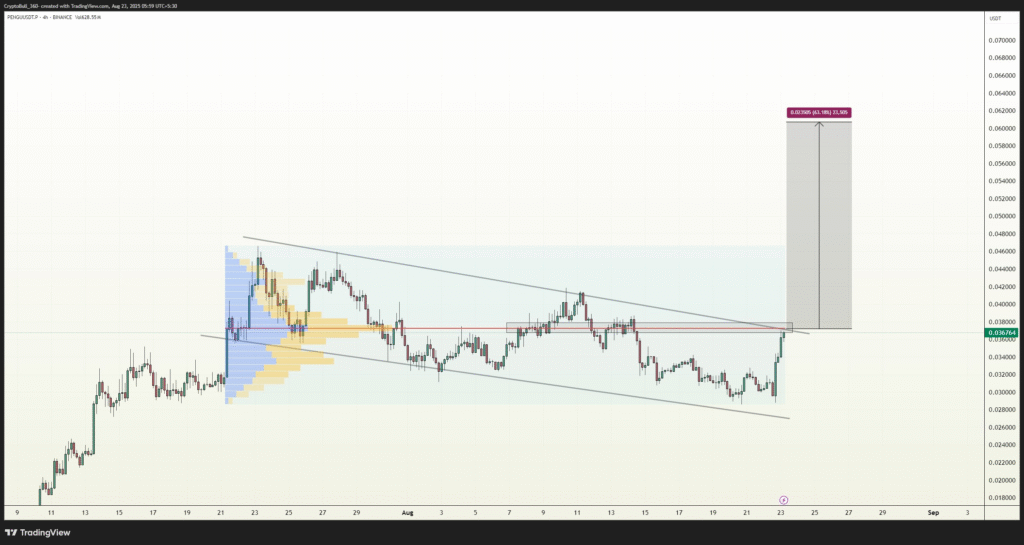

Breakout from descending wedge formation

Technical indicators suggest the rally is more than just short-term speculation. The PENGU chart shows a descending wedge pattern that has now broken to the upside. This formation, typically seen as a bullish reversal signal, has developed over the past month with lower highs and lower lows converging toward a tighter range. The breakout above the upper trendline has pushed the price higher, supported by strong volume inflows.

Technicians estimate the upside target at $0.0625, or about 63% above the breakout. The target uses the height of the wedge on the breakout price. The area at the breakout in the $0.036 to $0.038 area will now serve as a key support area. Trading above it will continue to encourage visiting higher levels, but a breakdown under $0.033 could temper the bullish agenda.

The volume profile provides additional conviction. The main node is in the area between $0.032 and $0.034, establishing a stable support base. The low-volume area between $0.038 and $0.048 implies that after the price breaks through this area, it could gain momentum upwards because there will be limited resistance.

PENGU derivatives data reinforces bullish outlook

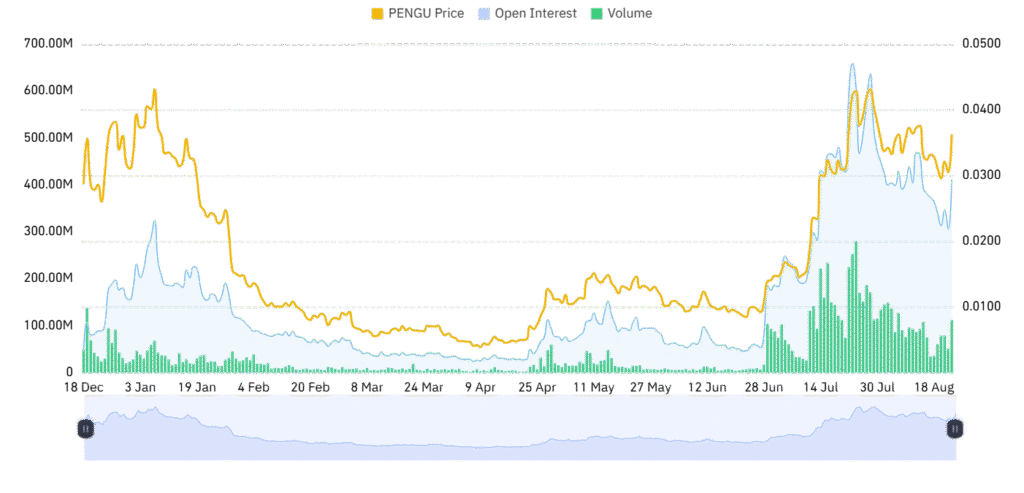

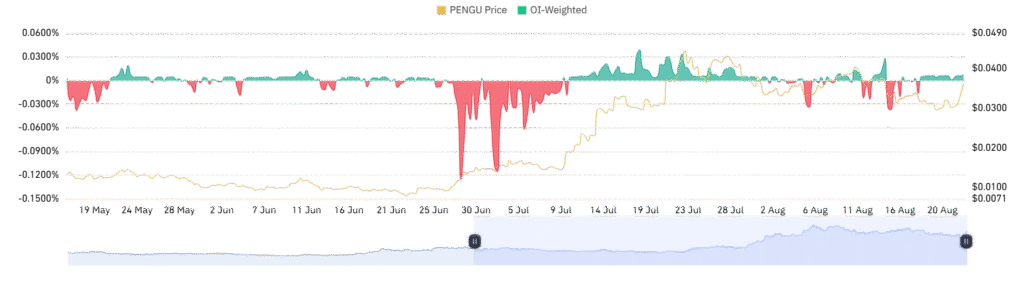

The positive sentiment is also reinforced by the activity in the derivatives market. Open Interest has increased by 30.29% to $412.81 million, as capital flows into future positions. This rise accounts for increasing participation by traders as well as greater confidence in the direction of the price rise.

The OI-weighted funding rate at 0.0070% reflects a subtle long bias without aggressive leveraging that would invite steep corrections. Increasing trading volume accompanies this trend to affirm good market participation driving the rally. Individually, the price breakout, volume upsurge, and Open Interest increase constitute a favorable setup for subsequent bullish moves.

Though optimism prevails, bulls are cautioned to be aware of abrupt surges in funding or abrupt Open Interest surges as signs that the market might be overheaating. For the time being, the structure and the data remain in favor for sustained upside potential.