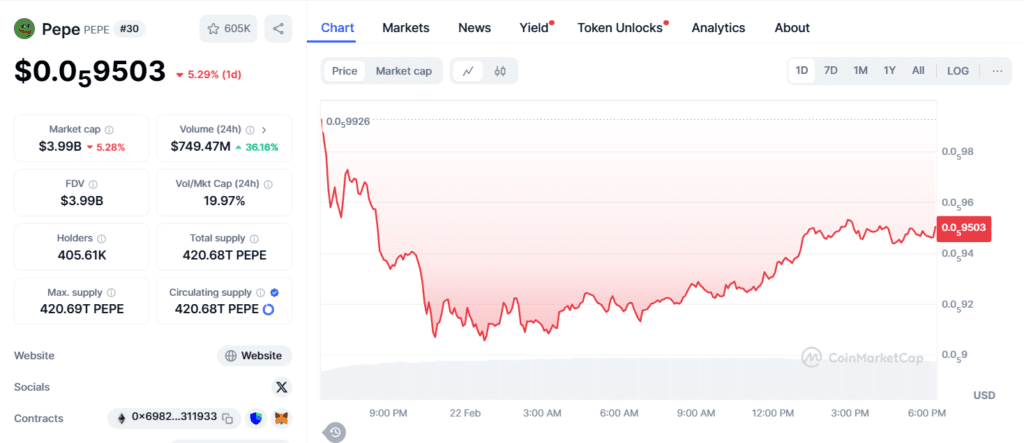

PEPE has seen significant price fluctuations, reflecting the unpredictable nature of meme coins. The frog-themed token, which quickly gained popularity, has struggled to sustain upward momentum in early 2025. Over the past 24 hours, PEPE dropped by 4%, bringing its price to $0.00009482.

Earlier, the coin peaked near $0.00009903 before facing substantial selling pressure. Despite this decline, trading volume surged by 55%, suggesting heightened market activity. The increased trading interest amid price volatility indicates both speculative trading and community-driven support. PEPE’s market capitalization also fell to $3.98 billion, underscoring the bearish sentiment, although a slight price rebound later in the day showcased renewed buying interest.

PEPE’s bullish momentum: The PO3 pattern indicates a breakout

An analysis of recent price movements highlights a PO3 (Power of Three) market structure consisting of three phases: accumulation, manipulation, and distribution. Initially, PEPE experienced a prolonged accumulation phase, where the price remained range-bound as buyers gradually built positions. This was followed by a brief manipulation phase marked by a sharp price dip, aiming to flush out weaker holders.

Currently, the distribution phase appears to be underway. Analysts note that PEPE has broken out from the manipulation zone around $27.625, indicating the beginning of an upward trend. This breakout aligns with expectations of increased bullish momentum as market manipulation subsides, potentially pushing prices toward higher resistance levels if buying interest persists.

Factors driving PEPE’s future price trends

Several elements continue to influence PEPE’s price trajectory. Community engagement plays a pivotal role, as meme coins heavily rely on social sentiment and online excitement. PEPE’s active community could sustain price stability if enthusiasm remains high. Additionally, broader crypto market trends, especially during bullish phases, may help propel PEPE higher.

Despite these challenges, PEPE’s robust trading volume and recent technical patterns suggest the potential for short-term gains. Still, market participants should remain cautious as volatility and speculative behavior continue to drive price movements.

Technical indicators show mixed signals for PEPE

Technical indicators suggest a potential shift in momentum for PEPE, though signals remain mixed. The Relative Strength Index (RSI) currently stands at 39.28, indicating mild buying pressure as it moves away from oversold territory but remains below the neutral 50 level. The 14-day RSI moving average at 36.23 reinforces the gradual recovery outlook. Meanwhile, the Chaikin Money Flow (CMF) reads 0.04, signaling modest capital inflows, which hints at cautious investor re-entry.

PEPE’s price action has consolidated following recent declines, with support levels stabilizing near previous lows. If the RSI breaks above the 50 threshold and CMF strengthens, PEPE may test key resistance zones observed in prior rallies. However, failure to sustain upward momentum could lead to further price consolidation or potential downside pressure.