The parent coin of Pudgy Penguins (PENGU), showcased stable growth through recent technical and fundamental analysis. Since the past couple of months, the coin has steadily recovered from an initial steep drop, suggesting increased confidence and market momentum from investors.

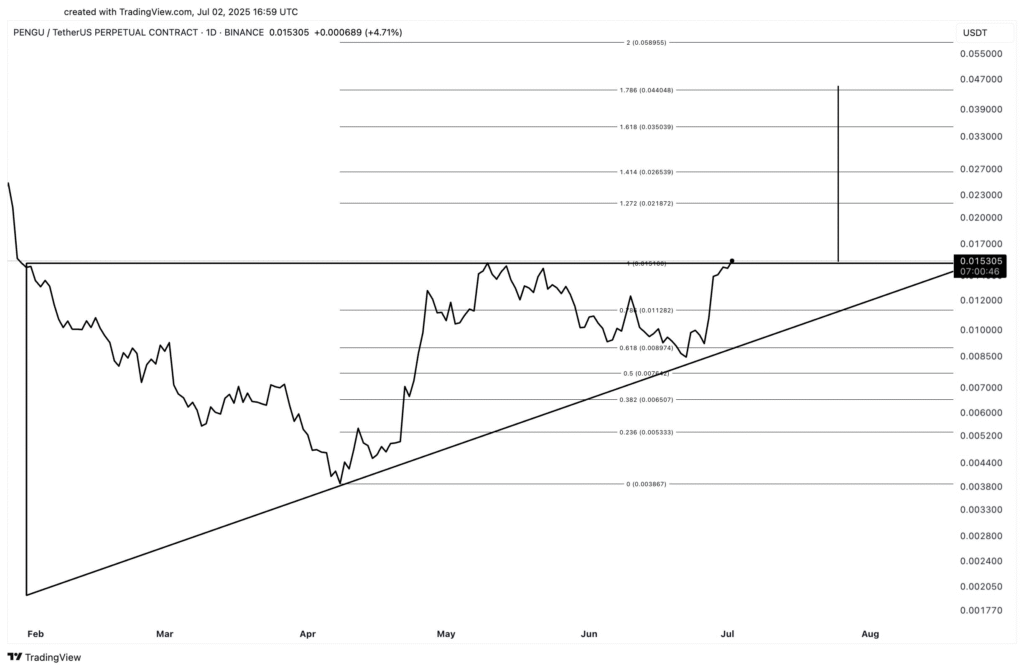

Latest facts confirm that the price of PENGU is targeting a critical threshold that can stimulate a significant upside direction. Seven-month detailed chart analysis from the period between January and August reveals trends and price direction of the token.

The chart reveals an early sharp drop that is likely associated with early distribution activity with a higher lower pattern that forms a characteristic rising trendline. The trendline provided moving support that is a continuous buying demand. Currently, the price is about $0.01545 for $PENGU with recent day gains at approximately 9.10% and a week gain at 69.10%, as CoinMarketCap data reveals.

PENGU faces resistance amid high trading volume

The chart shows that PENGU is approaching resistance at the $0.015 to $0.020 range. A breach through this resistance could forge the foundations for a potential 200% surge, targeting $0.044. The aim is a bullish upside of $0.0285 from the current range of prices, a prospect that is dependent upon healthy volumes in trade.

With that analysis in consideration, the 24-hour volume having crossed at around $814 million is a sign that the market is picking up. Technicals also note elevated volume and spells of consolidation characteristic of impending breakout formations.

However, the access to leveraged futures contracts, i.e., “Perpetual Contract 50x,” is associated with increased risk. This leverage can amplify profits but can also magnify losses. Traders are understandably cautious considering the past concerns regarding potential manipulations or “rug pulls” within the crypto sphere.

PENGU gains listings on Upbit and Revolut

Major developments support the bullish narrative for $PENGU. New partnerships that include a NASCAR agreement, listings with major exchanges including Upbit and Revolut, and an announcement for an upcoming CBOE exchange-traded fund (ETF) assist the credibility and demand for the coin.

These are signals that the ecosystem is building momentum with expanding uses for the Pudgy Penguins. Technically, the configuration implies a possible direction for the breakout to $0.044 as a significant profit area.

Traders should carefully follow the direction of the price with the volume activity and overall sentiment in the market considering the inherent natural volatility and leverage with this instrument.