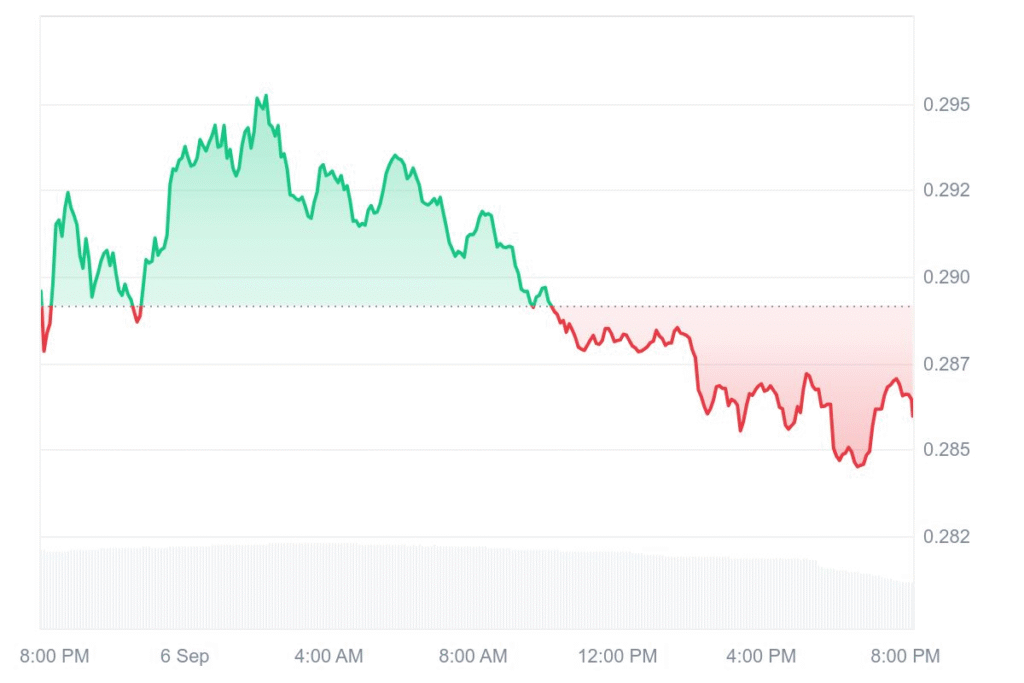

Sei (SEI) is currently trading at $0.2859, down by 0.86% in the last 24 hours. Trading volume also plummeted and stands at $99.3 million, showing a massive drop of 40.52%. The token has not shifted significantly in the last week either, dipping by a mere 0.18%.

The analysts explain weak momentum with the price staying above a primary technical level. The sideway movement for the coin suggests that traders expect a decisive breakout. The liquidity is there but sliding volume has created near-term demand concerns.

SEI Price Pattern Suggests Bullish Direction

Crypto analyst Jonathan Carter is looking at SEI in a “neckline retest confirmation phase.” The token now supports the inverse head-and-shoulders breakout level near $0.285. Carter argues that it is an important support area that must stay in place for any such rebound upwards.

He looks for potential upside targets if the support takes hold. His levels are $0.350, then $0.430, then $0.480 and even $0.555. Traders trading these signals remain on high alert, but the pattern offers a potential direction. The confirmation of the bounce is less precise at the moment.

SEI Forecasts for 2025

The prediction by DigitalCoinPrice sees SEI reach the year-end target of $0.63, and there is a chance it will test its all-time high of around $1.14. The prediction by them sees SEI at the $0.55–$0.63 region if momentum improves.

Changelly analysts have less optimistic predictions. They anticipate that in 2025, SEI will fluctuate from $0.224 to $0.256, at an average of approximately $0.287. The prediction even calls for a possible correction to $0.201 by September, and limited potential upside of only $0.287. The comparison revealed great future uncertainty for SEI.