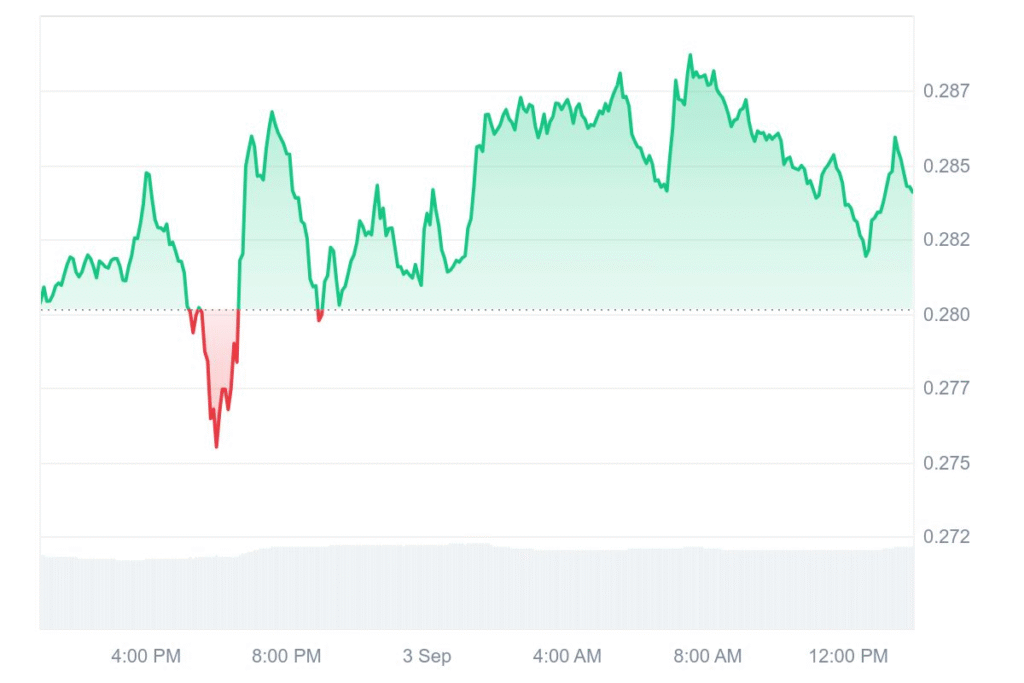

SEI is currently trading at $0.2841, having recorded a slight increase of 0.69%. The 24-hour trading volume jumped to $160.99 million, a growth of 14.59%. In spite of that thrust, however, the coin performed poorly over the last week. SEI dipped by 4.04% over seven days, leaving investors vigilant.

Market sentiment is neutral. Some bulls expect SEI to stabilize at its current price points. Other bulls regard the ongoing increase in daily volume as a sign of future volatility to come. The coin is at a pivotal level, probing tolerance throughout the trading world.

Risk of selling early in SEI rally

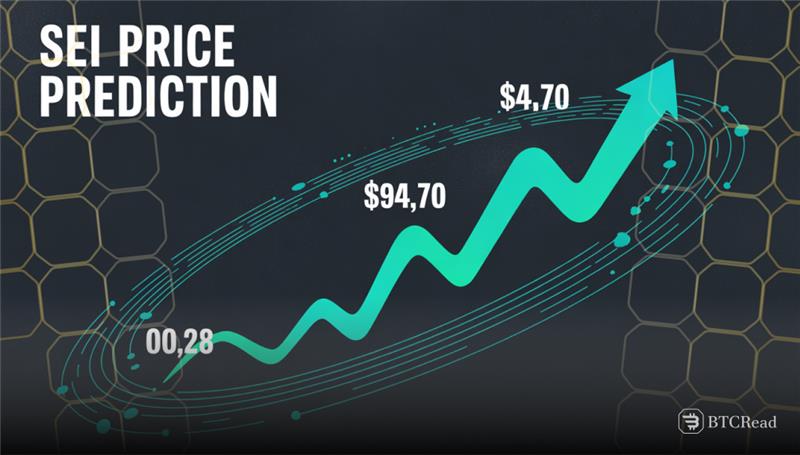

Crypto analyst X Finance Bull suggests that SEI is ready to breakout. He describes it as a textbook setup on the existing chart. His first target is $1.13 with aggressive target of $4.70. He advises that only patient holders will get full potential for the upside. Impulsive shorters are at risk of missing out on the larger move.

This forecast gives cause for optimism, but divides opinion. Most operators are fearful of aggressive calls after recent losses. The “buy zone” theme has come with differences over timing entries. SEI’s rally from $0.28 to over $1 will require strong momentum and universal support across markets.

SEI price forecasts for 2025

DigitalCoinPrice predicts that SEI can regain its strength by December 2025. Forecasts show that it can move to $0.62, with a potential spike above $1.14. Analysts think breaking through old high can set up further adoption. However, they expect SEI to move between $0.55 and $0.62 before a sustained spike.

Changelly offers a more modest forecast, however. Their analysis places SEI’s average cost of trading at $0.280 in 2025. Prognostications vary from a low of $0.217 to a cap of $0.249. For next year in September, pointers are for $0.196 to $0.280. This would amount to a negative ROI forecast, and that leaves traders in a predicament with choices to make..