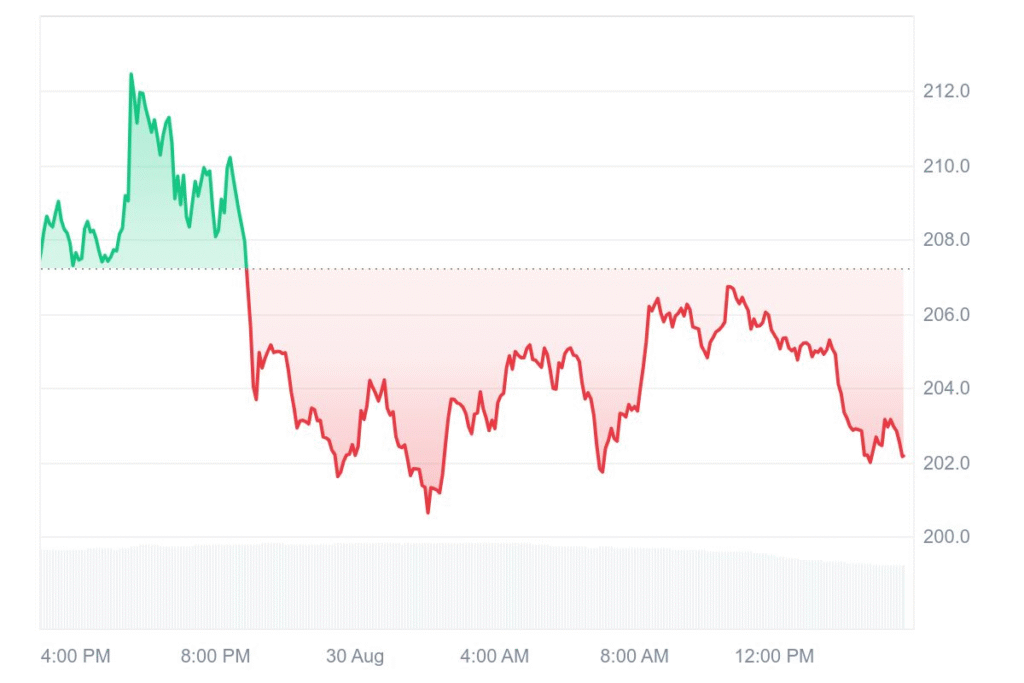

Solana (SOL) is currently trading at $202.44 and has dropped by 2.43% in the last 24 hours. Trading volumes dropped significantly with a traded quantity of $10.35 billion and a loss of 20.9%. Despite the loss, the one-week movement is robust with the token up 0.3% in the last week and remaining at the $202.58 level.

Traders keep a keen eye because volatility in the short term remains present but analysts remain adamant about the strength of the big picture trend. The larger support remains in the $180 to $160 region where bulls wait eagerly for confirmation of tranquility. Resistance zones remain around $225 and $275 and persist in indicating scant range room.

Strong uptrend across all timeframes

CoinCodeCap market analyst reports that SOL has come out of a bullish break-up from an Ascending Triangle pattern and has penetrated the $200–$210 resistance barrier. Such a pattern very often suggests that the rally continues. Then Solana is likely to approach $225 in the near future and possibly set $275–$300, that is, the 52-week highs.

Momentum indicators also support this viewpoint. The MACD broke through 27 days ago in a bullish fashion, supportinghealthy sentiment, and the RSI continues in the neutral region with some potential for further upward momentum. Short-term and medium-term and long-term trends remain rated at “strong up,” and indicate continuation through the end of the year.

Solana forecasts for 2025

Forecasting prices for 2025 are a mixed bag. DigitalCoinPrice forecasts that Solana may beat its previous record of $294.33 and perhaps touch $445.24 in the latter part of 2025. Pundits believe the coin will consolidate between $401.66 and $445.24 in the event of continued purchasing momentum that propels it into new waters. Such a projection is a depiction of the optimism from the investors that Solana will regain market traction.

On the other hand, the estimate of Changelly is a more conservative one. Theirs is a minimum of $167.68 and a maximum of $194.75 in the year 2025 at an average of $221.81. August of the year 2025 estimates are stable at $214.48 with only minor growth prospects. It translates into a modest 4.7% ROI and the risk of overestimating long bull runs.