SUI is on the way to its upward momentum and is eyeing an increment in its price with the overall market. The coin is currently moving in a bullish pennant pattern, which often leads to a bullish reversal. If a successful breakout occurs, it will lead to a maximum target around $10.

At the time of writing, SUI is trading at $3.60 with a 24-hour trading volume of $997.66 million and a market capitalization of $12.87 billion. The SUI price over the last 24 hours is showing stability, and over the last week it is also up by 10.33%.

SUI eyes $10 breakout after 300-day consolidation

SUI (SUI), the high-performing Layer-1 blockchain protocol, is increasingly one of the most underappreciated assets within the marketplace. Despite sound fundamentals, accelerating ecosystem development, and rising usage by the developer community, the token’s valuation presently doesn’t mirror its future prospects very accurately. Most analysts regard such disconnect as the precursing phase for an upcoming repricing event.

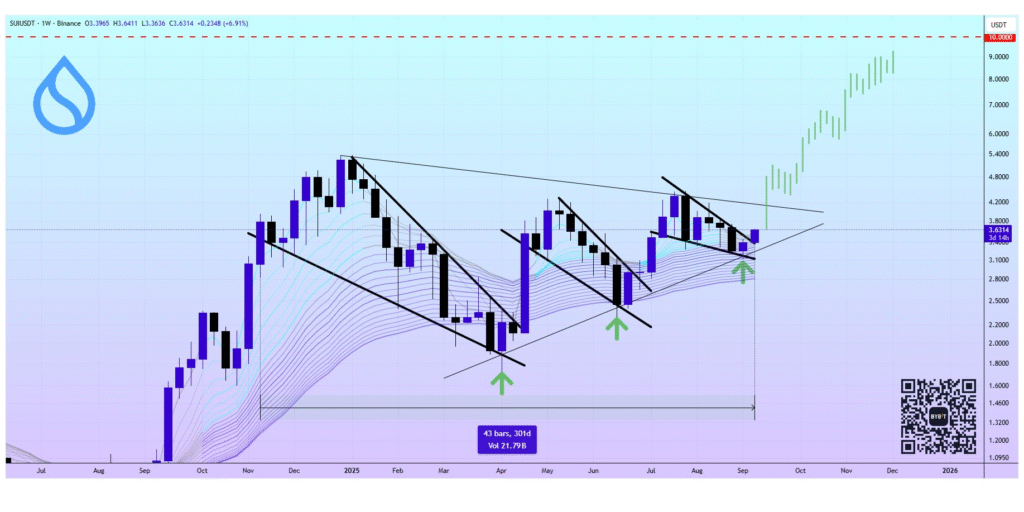

Technically, SUI is bullish. Charts form a regional bullish pennant, the very classical continuation pattern prior to sudden rallies. What provides more strength to the formation is the reality that it happens within an even larger context, i.e., a 300-day accumulative phase within a symmetrical triangle. Such longer consolidation moves act like coiled-up springs, where breakouts usually trigger lengthier rallies.

This weekly chart shows sustained bullish reversal, with multiple falling wedges breaking upwards and the price now trading within a larger symmetrical triangle at $3.63. EMA ribbon support is around $3.00, with backup support at $2.50 and resistance at $4.20, $6.00, and the key $10.00 target.

A green projection sees an upward rally toward $10 if the breakout from the triangle were to emulate the past bullish formations, backed by 302 days of consolidation and $21.79 billion in volume.

The broader scenario is evident: with fundamentals catching up with the strong technical signals, SUI is increasingly seen as one such sleeper coin of the current market phase. If momentum continues along the trajectory, double-figure valuation for SUI can be more a matter of when than if.