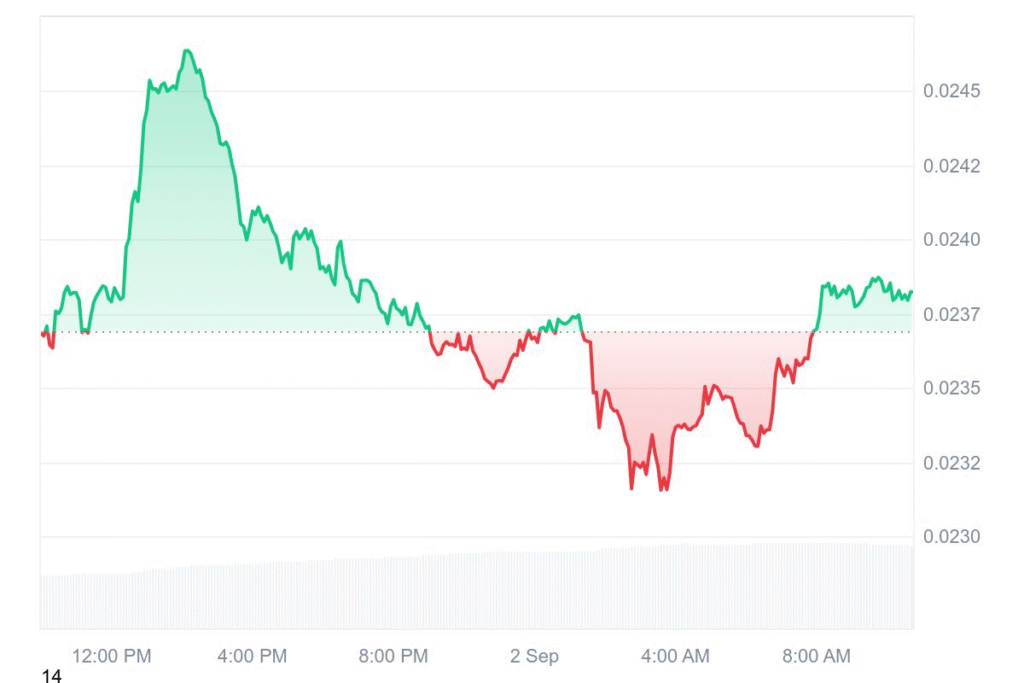

VeChain (VET) is currently trading at $0.02382 after going down slightly by 0.17%. Trading volume surged to $61.53 million in a matter of 24 hours. That’s an increase of 52.76%, a confirmation that the market is still active.

Trading in the recent week shows a minor depreciation of 2.74% compared to last week’s closing. Traders remain cautious while testing the short-term levels of support in the digital coin.

Investors will tolerate minor fluctuations to be typical in highly volatile cryptocurrency markets. VeChain’s development continues to be at the focal point due to uses of its technology in supply chains. Sentiment seems cautious but not overly bearish. Analyst opinion suggests liquidity and volume might indicate a latent bullish catalyst.

Liquidity draws indicating possible upside

Crypto analyst Crypto Patel highlights a possible bullish setup for VeChain. VET recently removed sell-side liquidity and struck the 1D Order Block. That trade is a bull structure shift (MSS) signal. Patel’s call is a long entry at $0.02491 with a $0.02278 stop. Targets are $0.02587, $0.02725, and $0.02955.

It is advised to wait until confirmation of MSS before making firm decisions. Liquidity drags in the market can drive VET higher than current levels. Traders can potentially benefit through tracking these key technical levels. Profitability within a very short period can be realized if this bull structure continues to solidify. Precision and attention characterize this approach.

VeChain long-term price forecast

Long-term predictions predict a bright future for VeChain. DigitalCoinPrice is predicting that VET could go up to $0.0494 to $0.0519 in 2025. It could pass its previous all-time high at $0.28 en route to these prices, predict analysts. Key players believe use cases and adoption across blockchain will cause long-term growth.

Coincodex gives a shorter-term perspective. VeChain could be trading at $0.023585 in September 2025 after a recent monthly appreciation of 5.86. Its likely range in trading will be $0.022595 to $0.025653. This estimation has a likely return on investment of 7.99%. Investors appear to be both bullish and cautious, eyeing both short-term changes but long-term gains.