The rise of stablecoins has sparked debate around global finance. Many see them as a threat to the traditional system. But their real role looks very different. Instead of disrupting the U.S. dollar, stablecoins are expanding their reach.

They now function as digital representatives of U.S. monetary policy. Their architecture is indicative of a modified incarnation of the Bretton Woods system. Most stablecoins are backed by short-term U.S. Treasury bills. This ensures they have excellent liquidity, a consistent value, and government backing.

Their worth is not determined by any speculation but by the fiscal credit of the United States. They make the dollar a programmable, blockchain-based asset. That does greatly alter the mechanism of global finance. Stablecoins like USDC, FDUSD, and others depend on very simple mechanics.

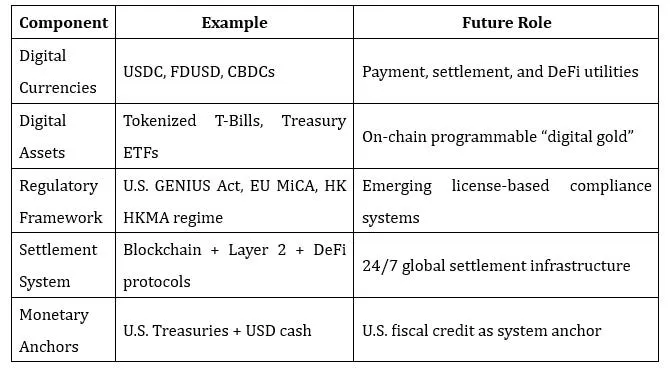

Stablecoin infrastructure for a global Dollar

They issue tokens backed with 1:1 backing to cash or Treasuries. Such tokens would be essentially digital certificates, proving in reality ownership over U.S. financial assets. Thus, in this system, gold is replaced by Treasuries and central bank settlement by consensus on the blockchain.

This setup gives stablecoins a new identity. They are no longer just financial tools. They now serve as private extensions of U.S. financial governance. Each token pushed into circulation spreads the dollar further. It reaches users in places where traditional banks cannot go.

It moves wirelessly, without armies or banks, just code and digital wallets. Treasuries fit perfectly in the system: they are yield-generating, safe, and have light regulation. All these attributes are attractive to stablecoin issuers. In exchange, they provide a dollar equivalent to global users.

The quiet reinvention of Monetary power

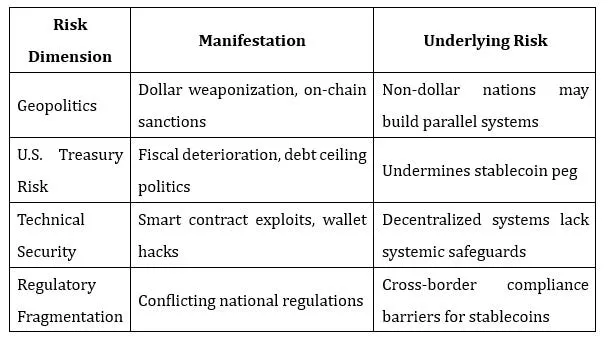

The result is a silent reconfiguration of monetary governance. What it offers is a digital version of a model from the middle of the 20th century. This new Bretton Woods does not rely on gold but rather on T-Bills. It does not reside in vaults but in ledgers. Its rules are not penned by diplomats but by developers.

This version keeps the dollar dominant in a changed world. It risks but also shows strength in that system. Stablecoins can create a middle ground, sitting between traditional finance and the new code.

They link physical assets to global smart contracts. A stablecoin keeps the dollar in control even though money has never moved faster and further than it does today. In that sense, stablecoins do not end the dollar’s reign; they reinvigorate it for the digital age.