Bitcoin is a groundbreaking technology that has revolutionized the financial industry. Over time, it has become a worldwide phenomenon, drawing in millions of developers, investors, and users. Bitcoin has demonstrated resilience and volatility, from its enigmatic origins to price spikes and regulatory obstacles.

This article examines Bitcoin’s origins, from the mysterious Satoshi Nakamoto whitepaper to its current standing as a major international financial asset.

Bitcoin’s launch: The Genesis block and the first transaction

Bitcoin, launched in Jan. 2009 by the mysterious creator Satoshi Nakamoto, began with mining the Genesis block. This first block contained a message referencing the 2008 financial crisis. By embedding this critique of traditional systems into Bitcoin’s foundation, Nakamoto highlighted the need for an alternative financial network powered by its users rather than centralized authorities.

Shortly after the genesis block, Nakamoto conducted the first Bitcoin transaction. Nakamoto sent 10 BTC to Hal Finney, a cryptographic pioneer, marking the start of a peer-to-peer financial system.

Nakamoto envisioned Bitcoin as a lifeboat in the turbulent seas of traditional financial systems. It offers a decentralized alternative during economic crises. Imagine a scenario in hyperinflation-stricken Venezuela, where citizens have seen their national currency devalue to the point of worthlessness.

Bitcoin has become a tool for preserving wealth and facilitating cross-border payments, bypassing corrupt or failing financial institutions. In such cases, Bitcoin serves not just as an investment but as an essential financial lifeline.

The mystery of Satoshi Nakamoto’s identity

Satoshi Nakamoto, the pseudonymous creator of Bitcoin, remains one of the greatest mysteries in the tech world. Speculation over Nakamoto’s identity has led to numerous theories, with some believing Nakamoto is an individual and others suggesting a group. Despite several individuals claiming to be Nakamoto, none have been conclusively proven.

Nakamoto’s anonymity aligns with Bitcoin’s decentralization ethos, which emphasizes the network over any single person. After stepping away in 2010, Nakamoto left Bitcoin’s development to the community, avoiding scrutiny and potential legal risks as the project grew.

Adding to the intrigue, Nakamoto is believed to hold over one million BTC, which remain untouched, fueling speculation about their intentions. In Oct. 2024, filmmaker Cullen Hoback released a documentary, Money Electric: The Bitcoin Mystery, sparking renewed interest in Nakamoto’s identity.

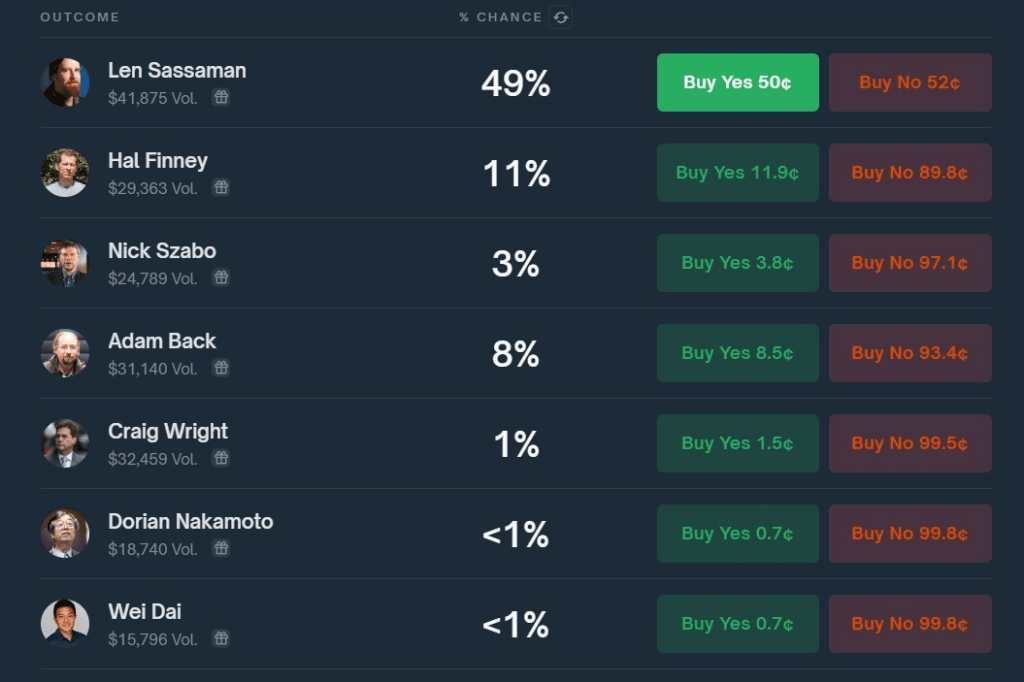

Many speculated that Len Sassaman, a cypherpunk, was the creator, with nearly 49% of Polymarket gamblers backing him. However, the documentary claimed that Bitcoin developer Peter Todd was Nakamoto, although Todd firmly denied the assertion.

Other notable suspects include Nick Szabo, Hal Finney, Adam Back, and Craig Wright, who has long claimed to be Nakamoto. However, a UK court dismissed Wright’s claim in March 2024 after the Crypto Open Patent Alliance (COPA) argued that Wright had forged documents to support his assertions.

The court ruling prevents Wright from claiming Bitcoin’s intellectual property, further discrediting his claim. However, Nakamoto’s true identity remains elusive.

Early days: Bitcoin as an experiment

Initially perceived as a niche experiment by cryptography enthusiasts, Bitcoin’s development in its early years was guided by Satoshi Nakamoto. By 2010, Nakamoto handed over control to the community, allowing open-source contributors to advance the protocol.

During this period, Bitcoin’s value was negligible. This is exemplified by the now-famous transaction where Laszlo Hanyecz paid 10,000 BTC for two pizzas in May 2010. At the time, the BTC was worth $41, but its current value has soared to hundreds of millions.

As Bitcoin’s user base expanded and its price rose, the project transitioned from a specialized concept to a global financial innovation. It captured the attention of investors, technologists, and institutions alike.

1983: The Birth of eCash

The path to Bitcoin started in 1983 when cryptographer David Chaum put forth the idea of eCash. eCash, the precursor to cryptocurrency, was a digital currency system created to offer privacy to online transactions.

Despite being ahead of its time, Chaum’s idea was not widely adopted. It provided the theoretical foundation for Bitcoin’s decentralized and anonymous features. He started the digital payment system Digicash in 1989. But despite its early potential, it also had trouble gaining much traction.

2008: The release of the Bitcoin whitepaper

When an unidentified person going by the name Satoshi Nakamoto released the well-known whitepaper Bitcoin: A Peer-to-Peer Electronic Cash System in 2008, it was the most important turning point in Bitcoin’s history.

The decentralized digital currency described by Nakamoto in this document is based on a blockchain, a publicly accessible ledger of transactions that can be validated without the involvement of a central authority.

By establishing a peer-to-peer network of users who could exchange value without the need for middlemen like banks or governments, the system presented in the paper could offer an alternative to traditional banking.

2009: Bitcoin is born

In 2009, Nakamoto mined the genesis block, the first block of the Bitcoin blockchain, and published the initial version of the software formally launching Bitcoin. A message about the 2008 financial crisis was included in this block: “The Times 03/Jan/2009 hancellor on brink of second bailout for banks.”

This demonstrated that Nakamoto wanted Bitcoin to provide a substitute for the conventional financial system, which was viewed as having flaws and being susceptible to crises. Bitcoin’s decentralized cryptographic nature made it a revolutionary concept even though its value was almost nonexistent then.

2013: Recognition as the best investment

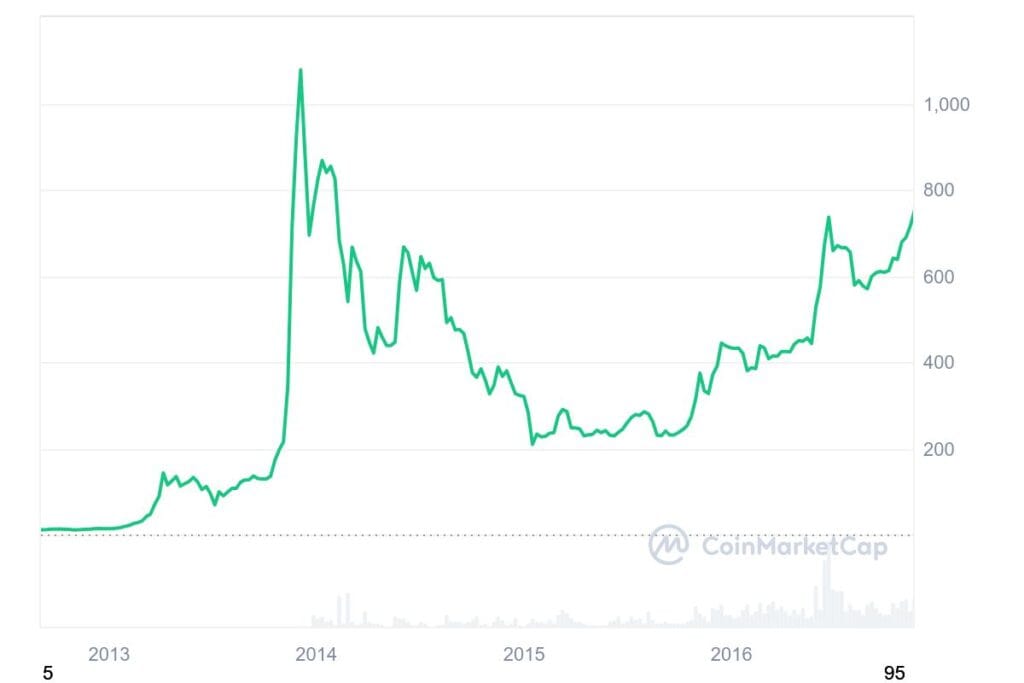

When Forbes named Bitcoin the best investment in 2013, it began to gain widespread recognition. By the end of the year, its price had skyrocketed from about $13 to over $1000, raising questions about its potential as a store of value.

During this period, Bitcoin also started to attract the interest of libertarian technologists and investors because they believed it could upend established financial systems and act as an inflation hedge.

2014: Volatility and setbacks

The enthusiasm surrounding Bitcoin was dampened in 2014 by significant setbacks such as the decline of Mt. A prominent Bitcoin exchange at the time was Gox. As Bitcoin fell below $300, Bloomberg dubbed it the worst investment of the year. There was skepticism during the exchanges, demise, regulatory uncertainty, and worries about Bitcoin being used illegally. One of the main characteristics of Bitcoin’s market behavior was its volatility.

2021-2024: The emergence of ETFs and legitimacy

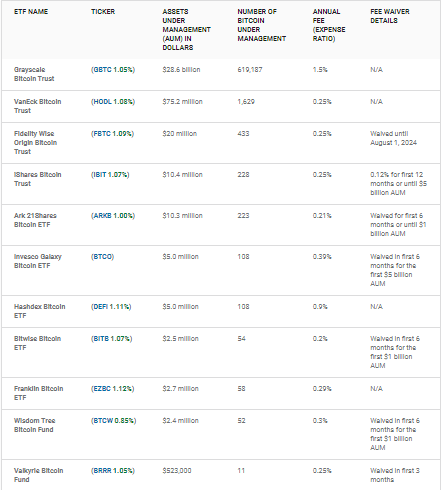

An important moment for Bitcoin occurred in Oct. 2021 when the U. S. A. The first exchange-traded fund (ETF) based on Bitcoin futures ProShares, Bitcoin Strategy ETF (BITO), was authorized by the Securities and Exchange Commission (SEC). With this approval, Bitcoin became a part of the mainstream financial markets, giving institutional investors access to the cryptocurrency without owning any.

The SEC authorized 11 Bitcoin spot ETFs in 2024, giving institutional and individual investors even greater direct access to Bitcoin. The approval of these ETFs has been a major milestone in Bitcoin’s path to widespread acceptance, indicating a rise in institutional trust in the cryptocurrency.

Bitcoin price history: A rollercoaster ride

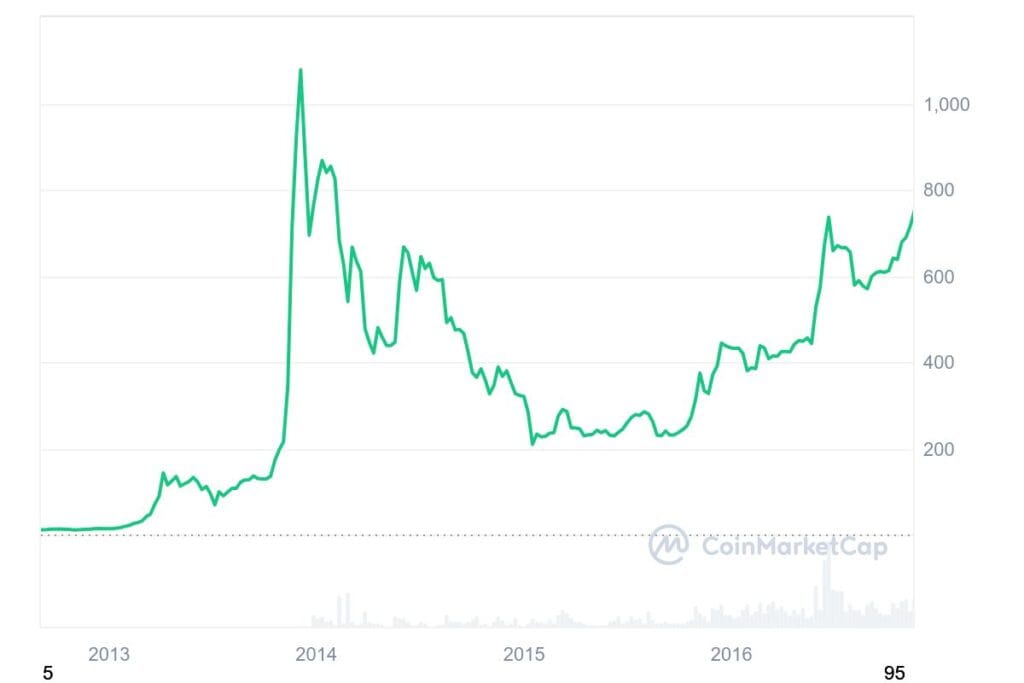

Ever since its creation, Bitcoin’s price has fluctuated wildly. Early on, it was practically worthless. However, the cost rose as the network expanded and attracted more attention. Bitcoin saw its first significant price spike in 2013, going from about $13 to over $1000 by the end of the year.

The mainstream media noticed this price increase, and investors, financial analysts, and governments became aware of BTC. Following the 2013 spike, the price of BTC plummeted, falling to less than $300 by the beginning of 2015. Bitcoin went through several cycles of boom and bust, and the volatility persisted for a number of years.

However, the digital currency has acquired more traction as a hedge against inflation and a store of value. BTC saw another enormous price spike in 2017, peaking at almost $20,000 in December. Another steep decline ensued, and in 2018, the price of BTC fell to about $3,000.

Price swings for BTC have persisted into the 2020s. After a bull market in 2021 saw BTC soar to $66,000, the bear market of 2023 seized it and sent it plunging to a low of about $16,600. The introduction of Bitcoin ETFs in January, such as the iShares Bitcoin Trust (IBIT), which currently oversees $50 billion in assets, helped the cryptocurrency soar by more than 140% in 2024.

Bitcoin’s role in the U.S. and its increasing adoption on Wall Street drove its price to surpass $100,000. This year, institutional investors have net-bought 683,000 BTC, of which 245,000 were purchased after the U.S. election, fueling the price spike.

Bitcoin’s adoption: Institutional interest and government scrutiny

Bitcoin’s adoption trajectory has been one of growing recognition among organizations, nations, and people. Nevertheless, it has also encountered strong opposition from governments and detractors who doubt its environmental effects and volatility.

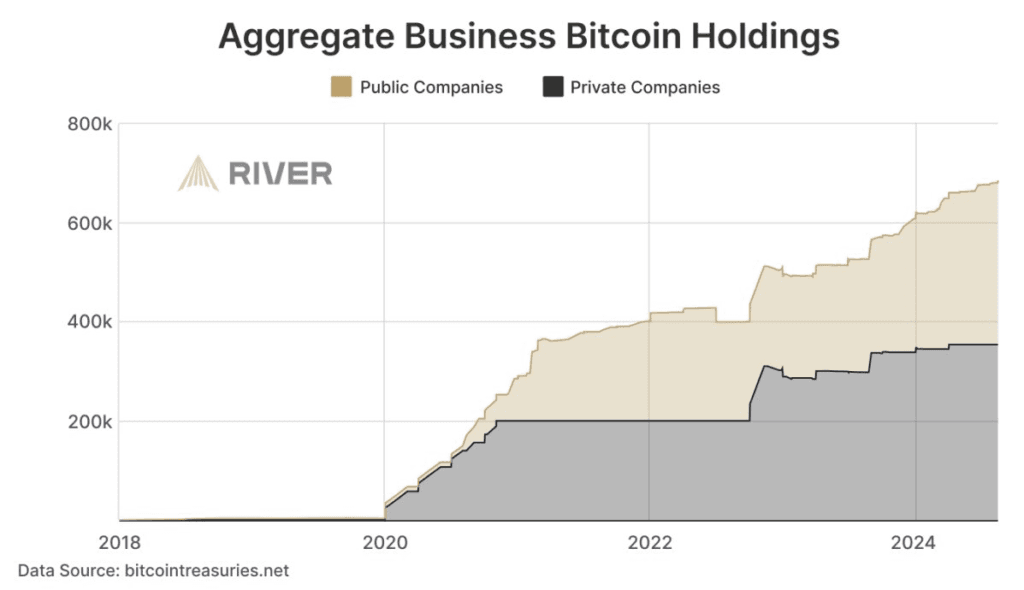

Institutional adoption

In the 2020s, institutional players began to take Bitcoin seriously, which accelerated the cryptocurrency’s mainstream adoption. Businesses like Michael Saylors MicroStrategy gained notoriety when they started buying substantial quantities of BTC to use as a treasury reserve asset.

MicroStrategy is one of the biggest institutional Bitcoin holders by 2024, with over 444262 Bitcoin in its possession. Although the company later sold some of its holdings, Tesla, under the leadership of Elon Musk, made a splash in 2021 by investing $1. 05 billion in Bitcoin. Due to these actions, other businesses and financial institutions became interested in BTC, which helped validate it as an asset class.

Bitcoin as legal tender

Another significant turning point in BTC’s history was El Salvador’s 2021 acceptance of it as legal tender. President Nayib Bukele introduced Bitcoin in an effort to modernize the nation’s financial system and offer financial services to the majority of its unbanked citizens.

The government of El Salvador established Chivo Wallet, a state-backed digital wallet, and issued Bitcoin bonds in spite of the controversy surrounding cryptocurrency volatility in 2021. The move made El Salvador the first nation in the world to accept Bitcoin as legal tender despite critics raising concerns about the risks associated with its price fluctuations. But later, in December 2024, El Salvador plans to privatize or shut down the “Chivo” cryptocurrency wallet.

The decision follows a $1.4 billion loan deal with the IMF, which addressed Bitcoin-related risks. While BTC remains legal tender, Stacy Herbert of the National Bitcoin Office stated that Chivo “will be sold or wound down.” She also noted El Salvador may accelerate BTC purchases for its Strategic Reserve. The IMF emphasized that BTC use in the private sector will remain voluntary, with the public sector limiting Bitcoin-related activities.

Michael Saylor urges U.S. to adopt Bitcoin as a national asset

Michael Saylor has recently called for the United States to embrace Bitcoin as a strategic national asset after spending the last four years incorporating the cryptocurrency into MicroStrategy’s holdings and making over $15 billion in profits.

He suggests designating Bitcoin as a digital commodity with explicit rules for owners, issuers, and exchanges. According to Saylor, the U. S. could receive up to $81 trillion from Bitcoin reserves. To unlock its full potential, stakeholders across industries and governments must collaborate to address regulatory concerns and environmental challenges.

Final thoughts

Bitcoin’s evolution from its enigmatic origins to become a well-known financial asset worldwide is evidence of its revolutionary potential. Despite its wild price swings, regulatory obstacles, and skepticism, it still attracts the interest of governments, institutions, and investors everywhere.

From its inception during the 2008 financial crisis to its legal tender status and incorporation into popular financial products such as exchange-traded funds (ETFs), Bitcoin has fundamentally changed our understanding of value and money.

Bitcoin’s influence on the financial system and overall economy will only increase as it develops further. The issues of its regulatory environment, the potential for additional adoption, and environmental impacts continue to influence its future course heavily.

Nevertheless, Bitcoin has become a powerful force transcending its beginnings as a niche experiment representing financial independence, innovation, and decentralization. Bitcoin’s journey is far from over. The next decade will likely see unprecedented innovations, broader adoption, and possibly a redefinition of global finance.

FAQs

Bitcoin was created by an anonymous entity or individual known as Satoshi Nakamoto, who published the Bitcoin whitepaper in 2008 and launched the network in 2009.

The Genesis Block, mined by Satoshi Nakamoto in January 2009, was the first block on the Bitcoin blockchain and contained a message referencing the 2008 financial crisis.

Nakamoto’s identity remains unknown, likely to emphasize Bitcoin’s decentralized nature and avoid legal or personal risks as the cryptocurrency gained prominence.

In May 2010, programmer Laszlo Hanyecz bought two pizzas for 10,000 BTC, marking Bitcoin’s first commercial use.

Bitcoin gained recognition through significant price spikes, institutional adoption, and the launch of financial products like ETFs, cementing its legitimacy in global markets.

El Salvador adopted Bitcoin in 2021 to modernize its financial system, promote financial inclusion, and attract investment despite criticism over volatility risks.

Bitcoin ETFs provide a regulated and accessible way for institutional and individual investors to gain exposure to Bitcoin without directly owning it, boosting adoption.

Bitcoin’s price has been highly volatile, with notable spikes in 2013, 2017, and 2021-2024. Due to increasing institutional interest, it reached over $100,000 in 2024.

Bitcoin mining consumes significant energy, raising concerns about its environmental impact. Efforts to transition to renewable energy sources are ongoing.

Bitcoin’s future potential lies in its adoption as a global store of value, inflation hedge, and decentralized financial system, though it faces challenges from regulation and competition.