The latest edition of the Altcoin Newsletter is out, providing an in-depth analysis of six key altcoins. These include Ethereum (ETH), Celestia (TIA), Render Token (RENDER), Realio Network (RIO), Filecoin (FIL), and VeChain (VET).

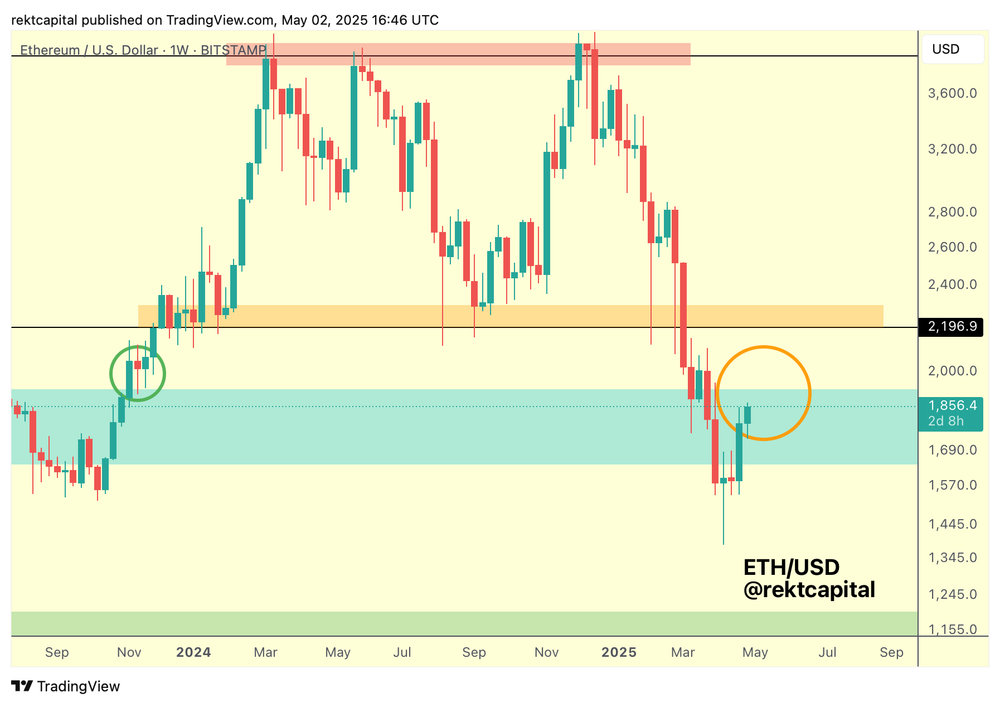

Every analysis is from the readers of the Rekt Capital Premium Newsletter, providing insightful views on these assets. Ethereum (ETH) continues to trade sideways in its deeply established range.

In the last year, ETH has repeatedly responded to the price levels at the high and low points of this range. During 2023, it often rejected the high and bounced off the low, and it took several months to finish these actions.

Altcoins at the edge can ETH and TIA break through

The current trend is one of increased pace with ETH fluctuating between these points rapidly. For Ethereum to move forward, it must sustain this support zone and hold this area of demand.

Alternatively, if we see a close above the apex of this range, we will have the potential to break through into a new price range with ETH. A successful weekly close above the apex will further substantiate the break and possible change in market trend.

Celestia (TIA) is looking to return to the blue macro range, between $4.47 and $9.41. But in order to do so, TIA needs to build support first at $2.25, a threshold that it has been able to hold in recent weeks.

TIA nears key breakout as altcoin momentum builds

Also, breaking the existing downtrend line is essential. If TIA has the ability to break this, it will shift into an uptrend and target a weekly close above $4.47. The weekly RSI is showing signs of possible strength and is in the shape of a triangular pattern.

A break from this RSI pattern may signal the build-up of bullish strength, potentially showing an additional increasing price movement in TIA. TIA’s price is already showing a subtle divergence with the RSI, indicating that the currency may be on the verge of switching directions.

These developments offer essential insights to investors who are keen on monitoring the performance of these altcoins. The altcoin market keeps on changing, and insights into the technical analysis of every movement are effective in guiding traders toward making informed decisions. Monitor these assets as market dynamics keep unfolding.