Investors are dealing with significant losses due to the recent high volatility in the digital asset market. With a steep drop in values indicating difficult times for the industry, altcoins took the brunt of the sell-off. On the other hand, Bitcoin showed a mixed picture.

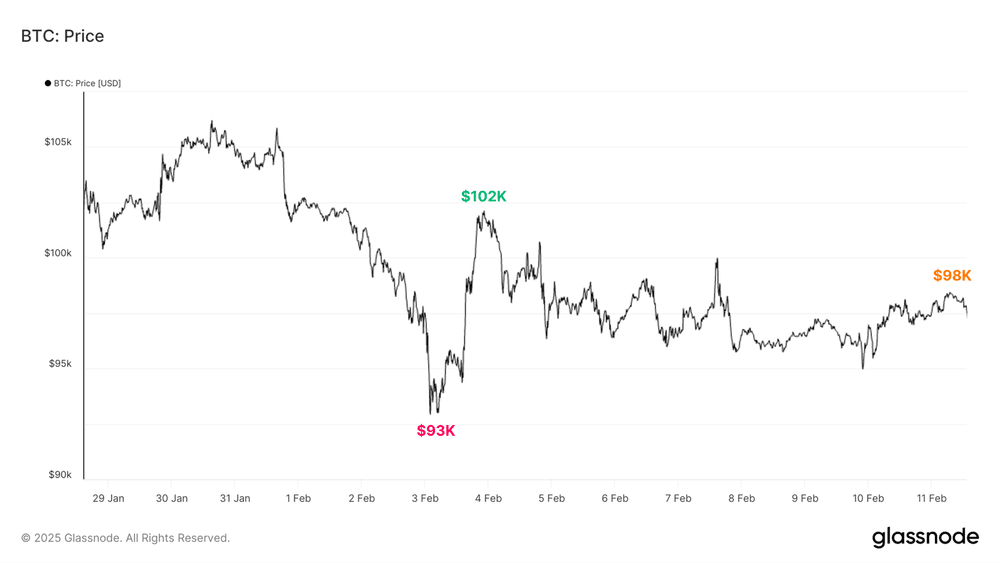

Glassnode observed that BTC had wild price swings last week, dipping to $93K before recovering to $102K and settling at $98K currently. Macro uncertainty from tariff threats and a strong US dollar added to liquidity pressure. Despite such volatility, Bitcoin’s price was relatively range-bound, reflecting a sideways market trend.

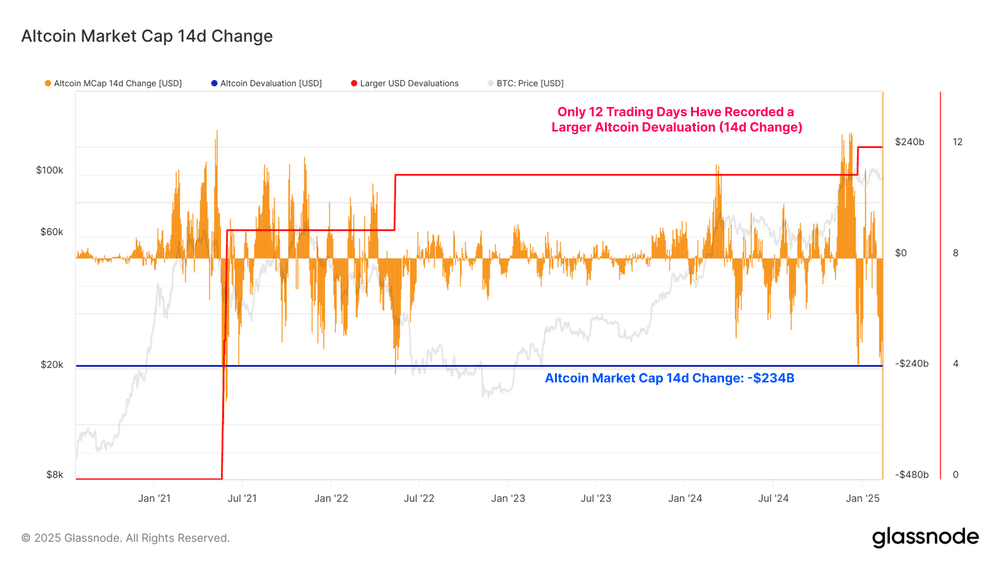

Altcoins, on the other hand, faced significant challenges. Many tokens struggled to find adoption or utility, leading to a collective price drop. Principal Component Analysis revealed that most ERC-20 tokens experienced correlated declines, showing a lack of unique behavior across the market. Over the last two weeks, the altcoin market value experienced one of the sharpest declines in recent months, dropping $234 billion.

Bitcoin investors lock in significant losses

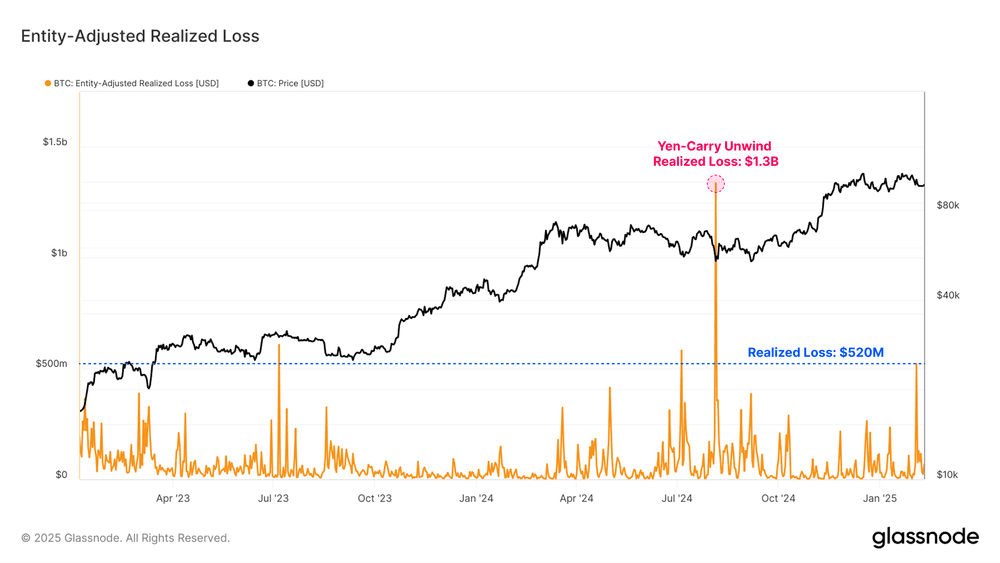

Bitcoin was strong against the backdrop of the broader market meltdown. Investors realized $520 million in losses to $93K during the sell-off, one of the largest capitulation events of the present bull run. However, these losses were routine when adjusted for Bitcoin’s growing market size, a bull market’s usual ebb and flow.

The majority of losses were realized by short-term holders, with those holding coins for under a month accounting for a significant proportion. This demonstrates the higher sensitivity to the volatility of newer market entrants. Realized losses by short-term holders totaled $520 million last week, indicating their exposure during market declines.

Key support levels and market thresholds ahead

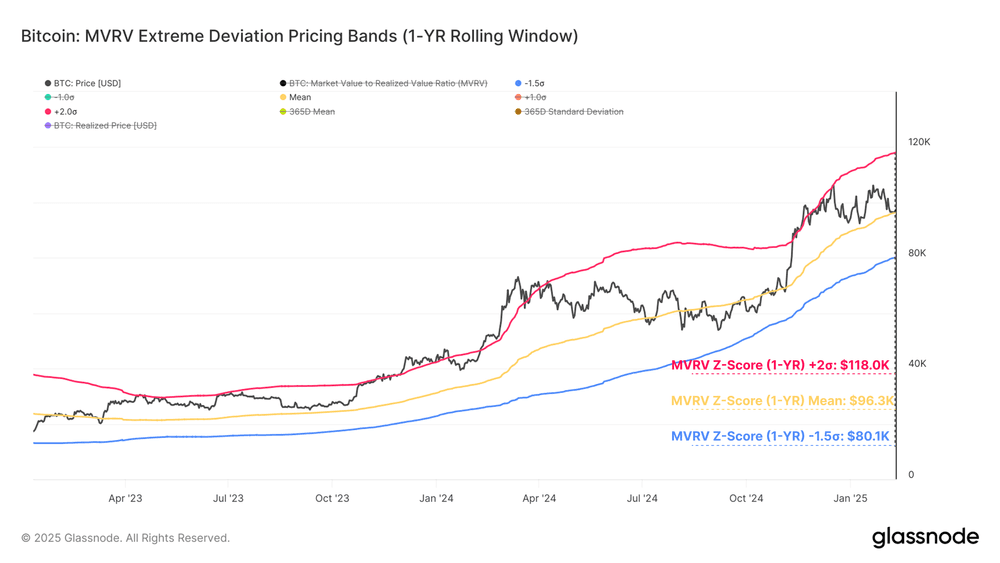

Looking ahead, important support levels for Bitcoin are provided by the MVRV Z-Score model. The average level of $96.3K has been a robust support, with potential downside risk at $80.1K. Short-term holders’ cost basis, at $92.2K, is also an important level for the market. Breaking below these levels can be a sign of further downside.

Despite the challenges, bulls are currently in control, with Bitcoin trading above key support levels. However, the pressure on altcoins and the ominous uncertainties in the macro space means the path ahead for the market may remain choppy.