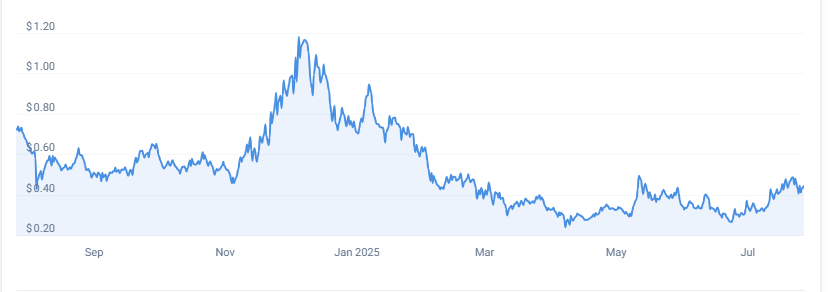

Arbitrum has climbed 42.09% over the last 30 days, showing strong bullish momentum. The token likewise went up 25.67% in the last three months, reconfirming a medium-term upward trend. Nevertheless, price movement in the last one year remains in the red at -36.75%, depicting more generic long-term weakness in its trend.

In this same period last year, ARB traded at $0.698550, far higher than today’s trading range. It traded to the all-time high of $8.67 on March 23, 2023. ARB in this current cycle recently traded to $0.508496, with the lowest trading to $0.243839, indicative of its very volatile trading nature. Arbitrum experienced sharp price action with 15.40% monthly volatility.

Support and resistance define bullish sentiment

Technically, ARB stays higher than the two major moving averages. Supportively, the 7-day simple moving average at $0.46 marks immediate resistance. Conversely, the 20-day SMA offers good support around $0.42. Currently, price stands in-between these points, reflecting a consolidative but bullish trend.

The relative strength index (RSI) is currently 60.42, and that is neutral with more room to the upside. Previously, the RSI jumped to 76.53 when ARB hit $0.49, so this latest upward action could be more stable and less prone to near-term reversals.

Earlier, however, ARB fell below $0.44, into an important liquidation zone highlighted in Jesse Peralta’s post. The zone is filled with upwards of $300,000 in precarious shorts, and will make for an excellent setup to a possible short squeeze if the price comes back to this point.

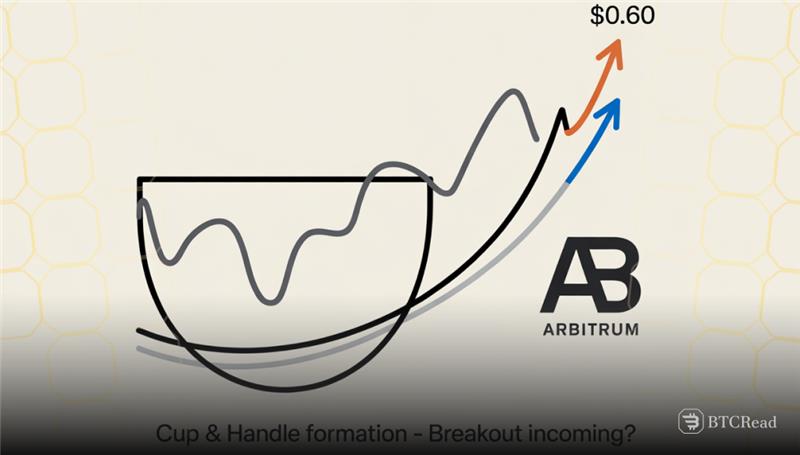

Arbitrum Signals Potential Breakout to $0.60

Technical analysts are seeing a cup-and-handle formation on the 4-hour chart. The rounded bottom was already in place, and the handle is emerging below neckline resistance in the $0.44 area. Analysts predict the breakout above this level should initiate a rally to the $0.60 target.

The bullish formation aligns with ongoing buying traction from the Ichimoku Cloud and collections of short-seller covering stacked up above. The configuration supplies technical construct and fuel from the market. If momentum confirms the breakout, ARB can ascend up by 43% from the current point in the near term.