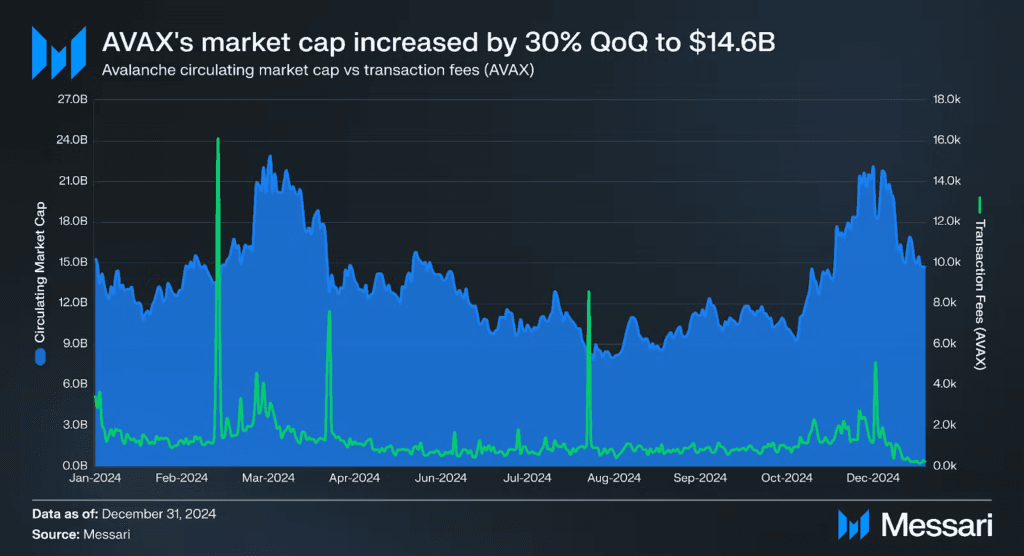

Avalanche showcased remarkable growth in Q4 2024, solidifying its position in the cryptocurrency sphere. Messari’s latest report saw a 30% quarter-over-quarter jump in AVAX’s market capitalization to $14.6 billion. The improvement changed AVAX’s position in all tokens to 11th position from 12th position.

Transaction fees also surged, driven by AVAX’s price appreciation. Fees in AVAX rose 24% QoQ, while revenue in USD jumped 88%, hitting $4 million. However, both metrics remained significantly lower year-over-year due to reduced transactions and Avalanche9000’s fee optimization.

Avalanche’s supply dynamics revealed steady token distribution. Staking rewards played a pivotal role, with an annualized inflation rate dropping to 3.9% in Q4. Liquid genesis supply unlocked 91% of its allocation, with major vesting nearing completion.

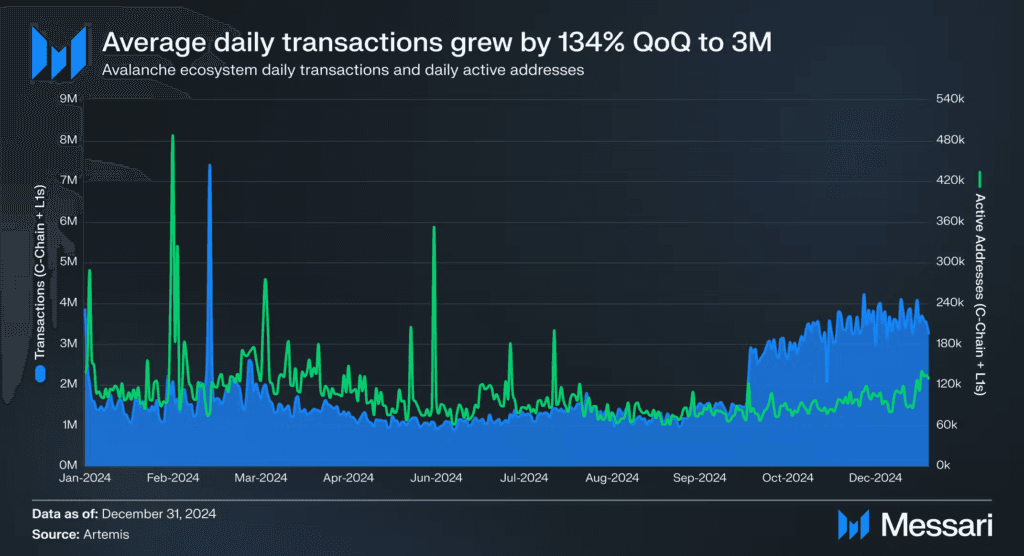

Avalanche network sees increased activity

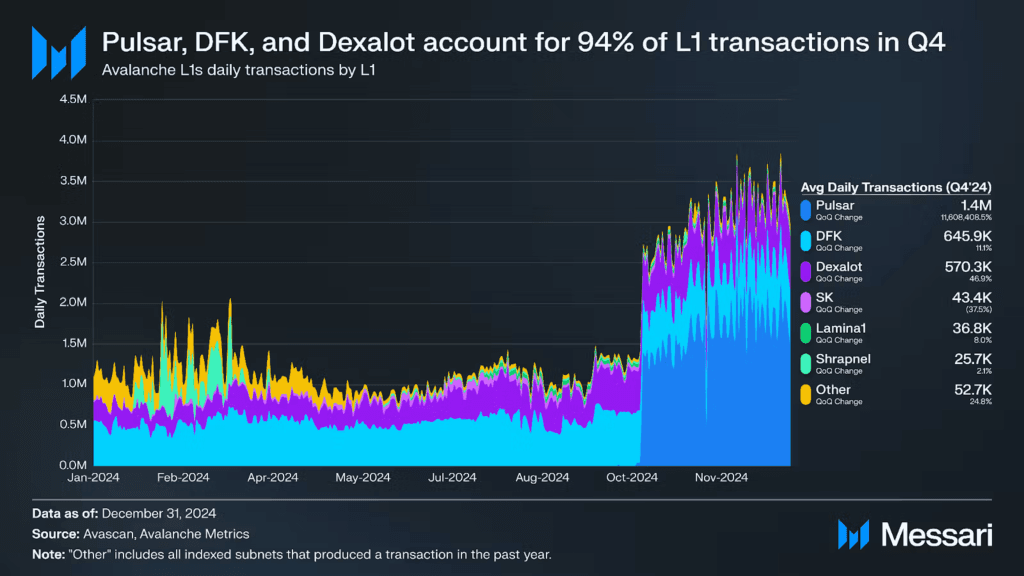

The network witnessed a 134% surge in average daily transactions, climbing to 3 million. Pulsar L1, launched in October, accounted for 1.4 million of these transactions. Average daily active addresses also grew, up 7% QoQ to 92,300. DeFi maintained its dominance on the C-Chain with a 32% market share, as wallet-to-wallet transactions surged 53%.

Avalanche’s security and decentralization efforts saw progress. Validator count rose by 2%, reaching 1,465. The Icebreaker Program bolstered staking metrics, contributing 500,000 AVAX to liquid staking initiatives. AVAX staked in USD grew 7% QoQ, hitting $7.4 billion, aided by Coinbase’s support for AVAX staking.

DeFi and enterprise partnerships flourish

The launch of Avalanche9000 marked a critical milestone, enhancing scalability and reducing deployment costs. This upgrade fostered interconnectedness within the ecosystem, attracting developers and enterprises. DeFi activity surged, with Avalanche’s TVL reaching $1.6 billion.

Gaming further strengthened the network’s presence. Pulsar’s launch boosted L1 activity by 146%, while Off the Grid secured top ranks on the Epic Games store. Partnerships with entities like MeWe and Sports Illustrated expanded Avalanche’s real-world asset tokenization and on-chain utility. However, Avalanche’s strategic focus on scalability, institutional adoption, and gaming sets the stage for continued growth in 2025.