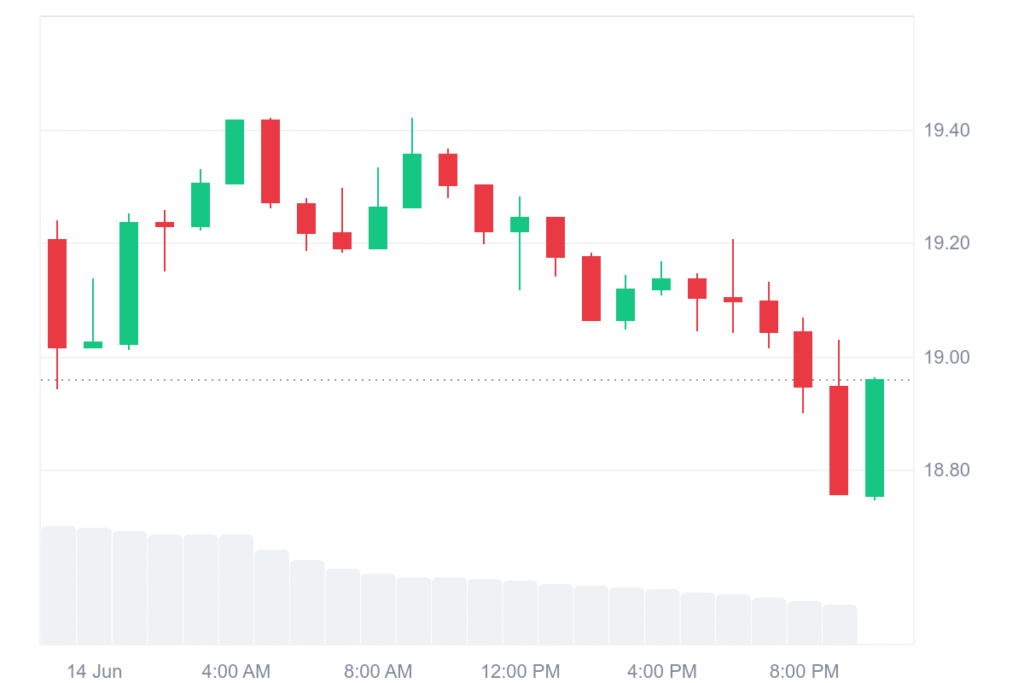

Avalanche (AVAX) is currently trading at $18.83, retaining support during price volatility with a daily volume of $252.73 million. The market capitalization of AVAX totals $7.94 billion, which makes it one of the significant assets in the cryptocurrency market today.

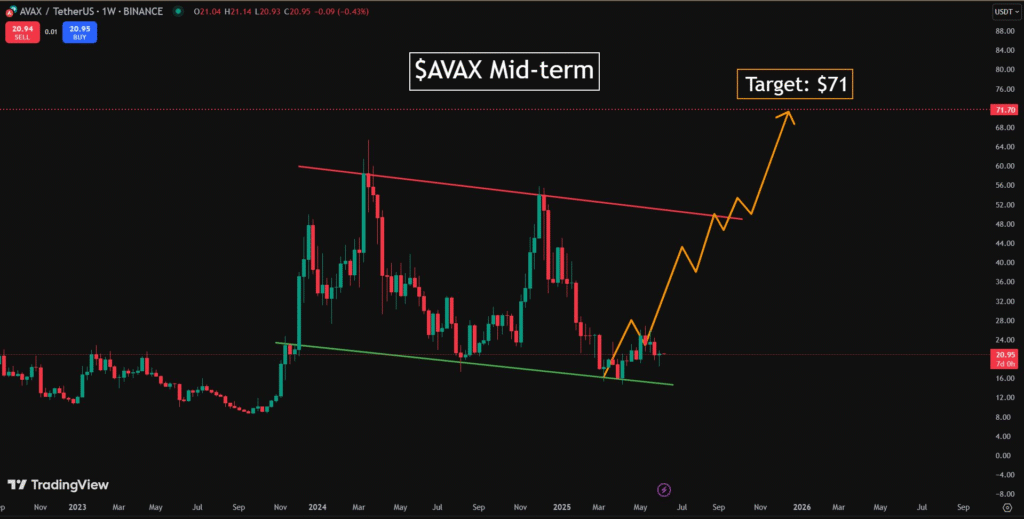

In spite of the downward inclination in price over several time frames, experts see good scope for an increase in the short term. The chart displayed here from investor Adrian Solberg shows the price movement of Avalanche on a logarithmic chart over two years.

The chart, named “$AVAX Mid-term,” illustrates price movements from mid-2023 through mid-2025 and includes accurate technical elements. The strongest trendline, the red one that slopes downward, demonstrates a recent break upwards, indicating an alteration of price sentiment.

A key support zone around $21 appears well-established, based on past buying activity and current market interest levels. The chart also includes a yellow ascending trendline suggesting a target of $71, a large rally from current prices.

Technical indicators support bullish AVAX outlook

Volume indicators beneath the chart reflect active trading patterns, particularly during crucial moments of price reversal. A green candlestick forming near the $21 support line signals renewed investor confidence. This comes after weeks of sustained downward pressure in the market.

While there is some minor resistance around the $30 to $40 range, traders expect those levels to be broken with some serious bullish momentum. Although the chart lacks some labels, it seems like moving averages and Fibonacci retracements are probably guiding the underlying analysis strategy.

Utilizing a logarithmic scale enhances the readability of AVAX’s price movements, which may be quite steeply volatile over the course of months. Based on projections by CoinCodex, the price of AVAX can surge anywhere between $21.43 to $53.34 which adds credence to a bullish sentiment.

The longer-term target of $71 coincides with more aggressive bullish expectations, although traders will need to pay attention to prevailing market mood and resistance levels. All in all, the historical data alongside technical indicators provides more bullish optimism regarding the recovery trajectory of Avalanche.