BNB Chain native token BNB saw a 4.1% rise between Oct. 10 and Oct. 11, showing some strength after dipping near the $555 support level. While most altcoins dropped by 15.6% since July, BNB has stayed relatively steady. This stability has helped BNB secure its position as the third-largest cryptocurrency, holding a $15 billion market cap lead over Solana.

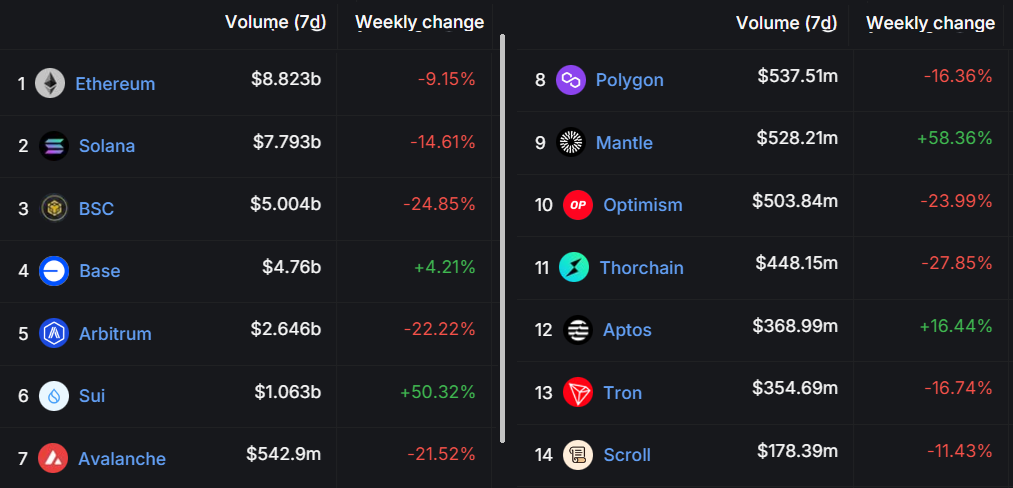

BNB Chain’s on-chain activity dropped 37% last week, causing investors to question whether BNB’s recent strong performance can last. Traders are also cautious as Ethereum’s layer-2 solutions continue to gain momentum, particularly after the launch of the Base network. Base provides fast, low-cost integration with Coinbase, the top U.S. exchange, and Web3 wallet provider.

BNB chain activity and price correlation

BNB’s value largely comes from what Binance offers, like exclusive launchpad access and trading fee discounts, which might lower the need to use BNB directly on the BNB Chain. However, BNB is still significant in other ways across the ecosystem, especially in decentralized apps (DApps) for things like trading, staking, yield farming, real-world assets, lending, launchpads, gaming, and derivatives markets.

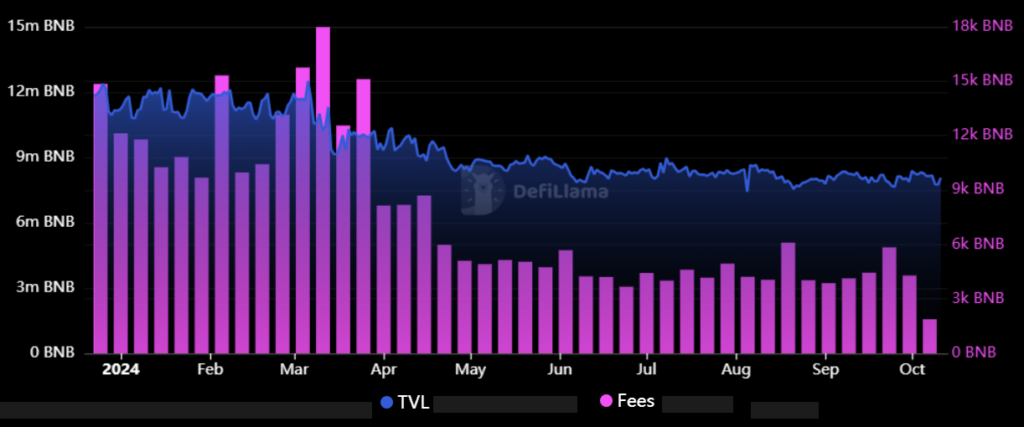

To understand if activity on the BNB Chain is helping support the price of BNB, we need to look at key factors like on-chain deposits and network fees. Currently, the BNB Chain’s total value locked (TVL) is 8.1 million BNB, which hasn’t changed much over the past two months.

However, network fees hit a four-year low in the week ending on Oct. 7. The total fees for that week amounted to 1,880 BNB, which is a sharp 56% drop compared to the previous week. A drop in DApp activity on the BNB Chain has led to a 25% decrease in fees, raising concerns about how this could impact the price of BNB.

Some of the biggest declines came from platforms like PancakeSwap, which saw a 25% dip in weekly volume, and Uniswap, down by 22%. In contrast, Ethereum DApps saw a smaller 9% decrease in volume, while Solana’s on-chain activity fell by 15%, according to the DefiLlama data.

Related | Bitnomial sues SEC over XRP futures jurisdiction dispute