Solana has experienced an extraordinary price surge of +2,143% over the past two years. This remarkable recovery follows a brutal crash after the collapse of FTX, which had sent Solana’s price to a low of $9.64.

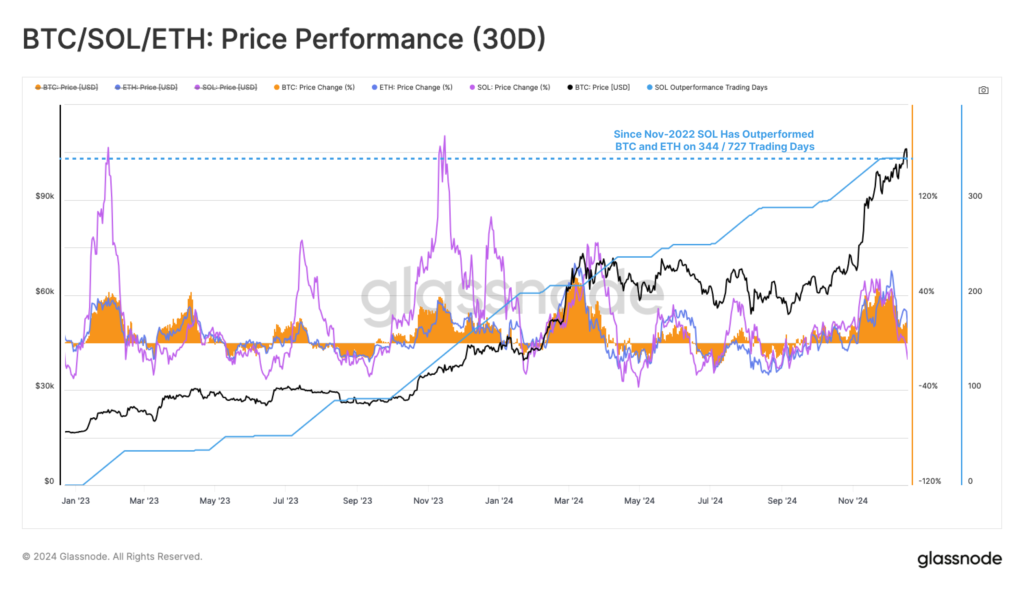

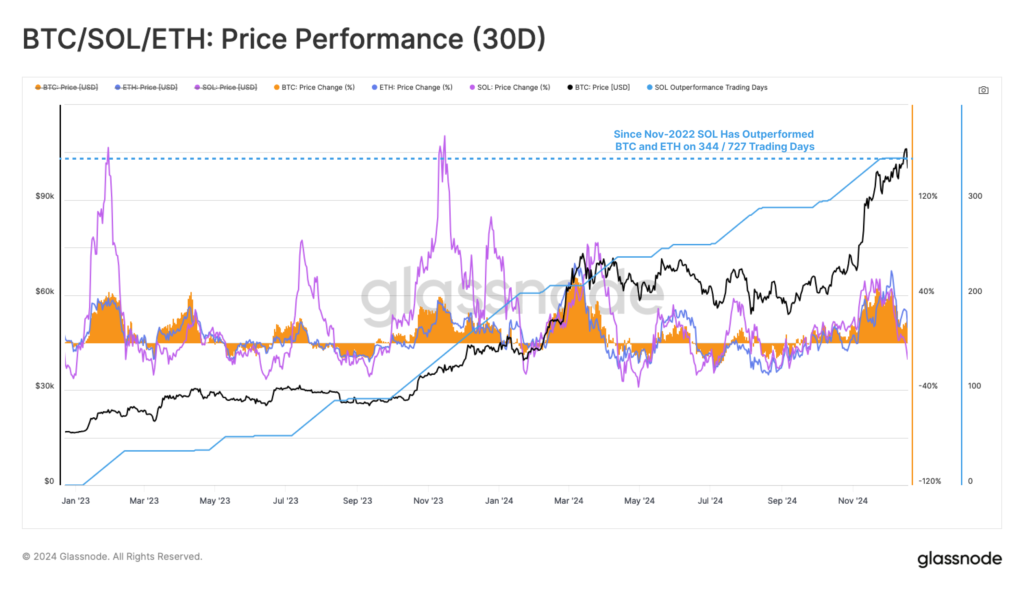

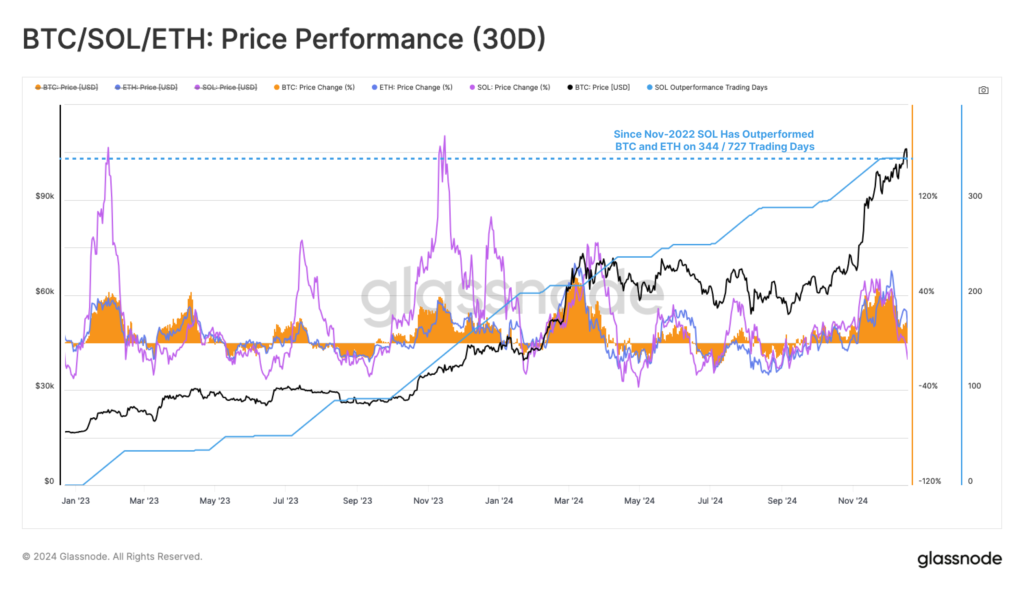

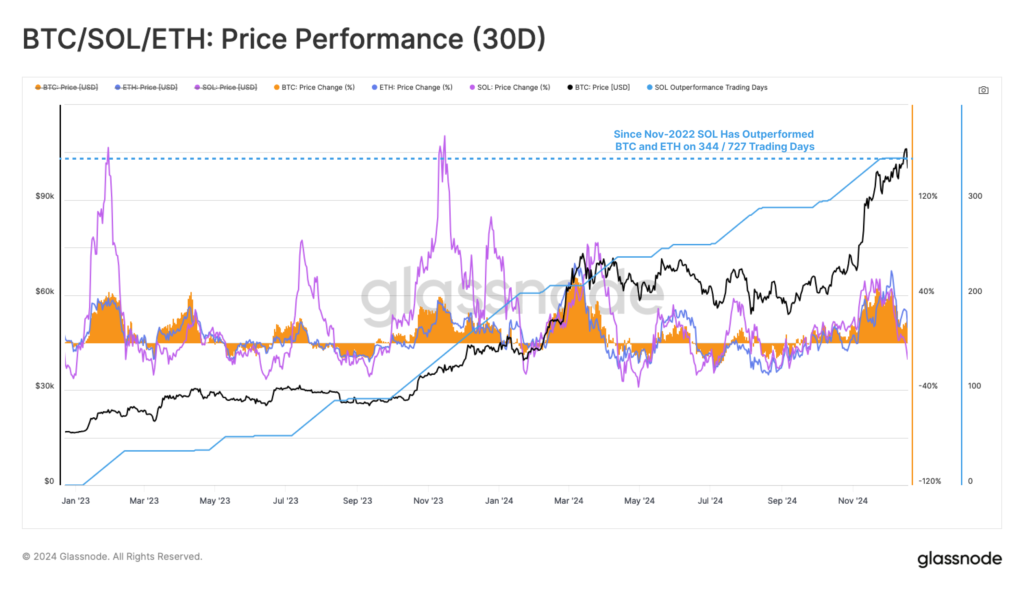

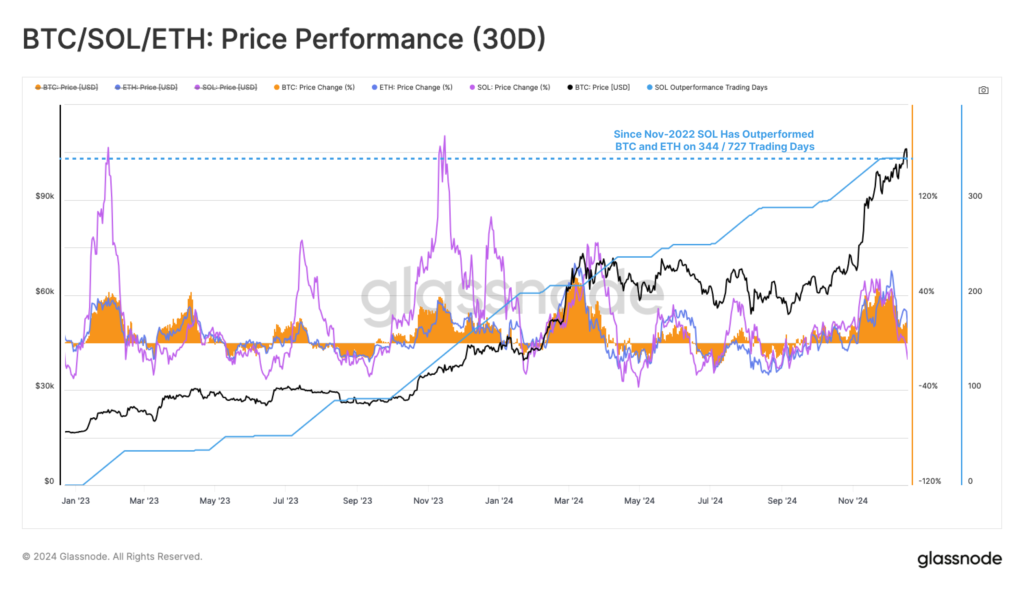

Despite these setbacks, Solana has staged an impressive comeback, outperforming both Bitcoin and Ethereum on 344 of 727 trading days since the FTX fallout.

According to the recent report by Glassnode, the surge in Solana’s price has also attracted significant fresh capital. Since Dec. 2022, Solana has seen a larger increase in capital inflow than Bitcoin and Ethereum across 389 of those 727 trading days. This underscores its growth and growing liquidity.

The capital inflow has remained, marked by the continued influx of new investors. Notice that the demand for Solana has flipped over to Ethereum for the first time, which has caused a positive change in investor sentiment.

Sustained net capital inflows in Solana

There is the regular capital inflow into Solana, and its average number of new money intakes at its peak reached as high as $776 million per day since early Sept. 2023. This consistently pouring liquidity was driving the appreciation of this asset. The picture depicted Solana as always present with a net inflow other than for minor outflows.

The increase in liquidity is reflected in its Realized Cap, which has surged from $22 billion to $77 billion, showing a total liquidity gain of more than $55 billion.

When analyzing the market’s behavior, it’s clear that sell-side pressure is coming from coins aged between 1 day and 12 months, with these coins making up over 50% of the total profit realized.

This indicates that Solana attracts a wide range of investors, from short-term traders to long-term holders. Solana’s recent price movement suggests the market is heating up but has yet to reach extreme levels.

Solana’s MVRV ratio and market heating

The MVRV ratio, which essentially shows investor profitability, tends to point toward price consolidation between the long-term mean and the upper band of +0.5 standard deviation, indicating some more room for growth upwards prior to any major sell-offs for profit-taking.

The growth momentum of Solana has continued with over $55 billion in fresh liquidity. The market is watching whether such momentum can last for the next few months.