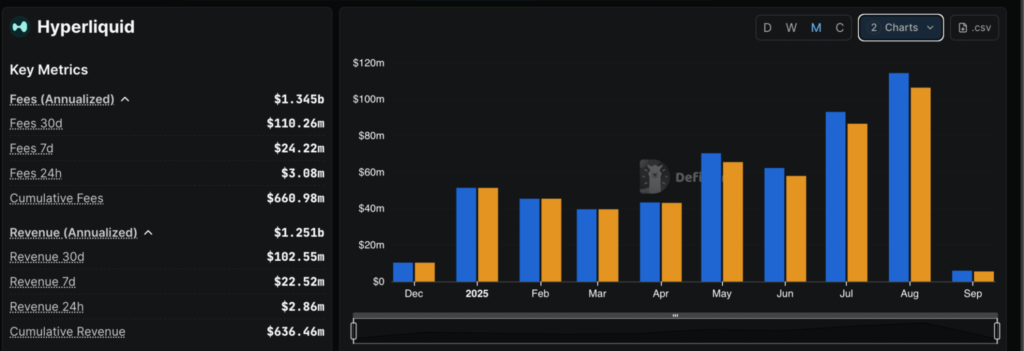

Hyperliquid posted its strongest month in August, generating $106 million in revenue. DefiLlama data shows a 23% jump compared to July’s $86.6 million. Traders pushed this rise with nearly $400 billion in perpetual trading activity.

The platform’s strong revenue has grown its Assistance Fund, which buys HYPE tokens directly from the market. Since January, the fund has raised its stash from 3 million tokens to 29.8 million. That pile now tops $1.5 billion, showing the project’s fast growth.

At the same time, Hyperliquid boosted its daily activity. It now handles over $8 billion each day through HyperEVM, its Layer-1 blockchain that cuts reliance on off-chain oracles and order matching. Since its launch, total trading volume has crossed $2 trillion.

HYPE surged 10% to $51.17 before a pullback

Revenue milestone was hit while HYPE reached a new all-time high. The token went up by more than 10% in a day to $51.17. Traders attributed this to whale accumulation and rising derivatives fees. Currently, the price stands at approximately $44 after a 1% drop within a week.

BitMEX CEO Arthur Hayes shared his long-term view, saying the token could grow 126 times. He predicted that by 2028, the supply of stablecoins could reach $10 trillion. He expects Hyperliquid could capture a quarter of that, generating $258 billion in revenue over three years.

The market felt more confident when 21Shares launched the first regulated Hyperliquid ETP on the SIX Swiss Exchange. This product lets people use a protocol that handles 80% of decentralized perpetual trading around the world.

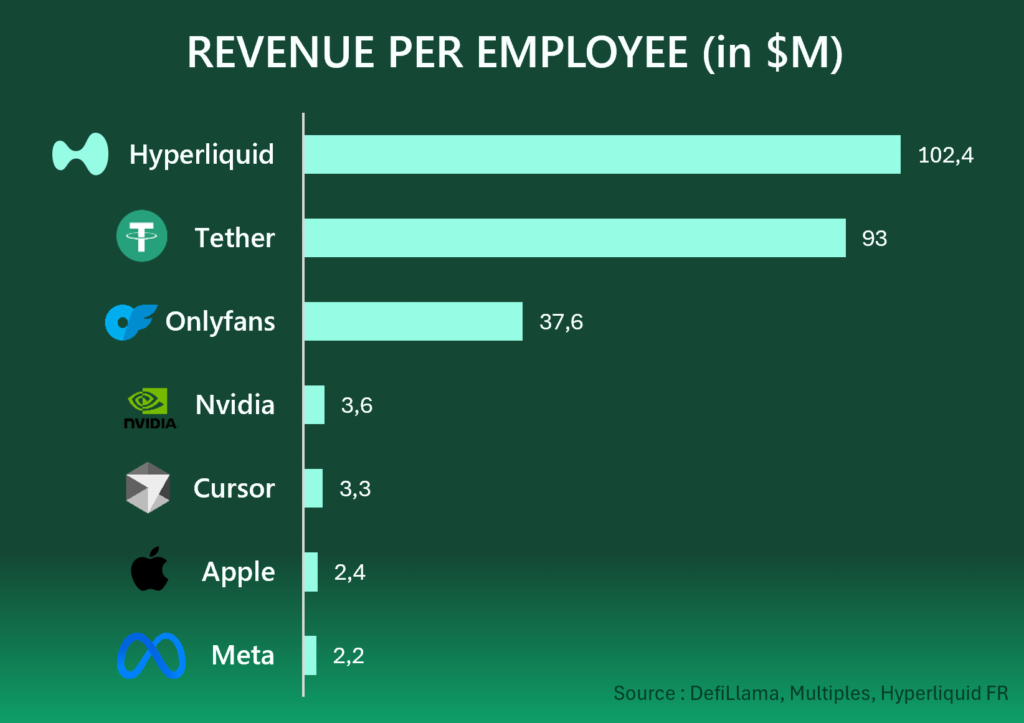

Revenue per employee outpaces tech giants

Hyperliquid works more efficiently than big names. Each employee earns more revenue than Tether’s $93 million and OnlyFans’ $37.6 million. Experts expect it could make $1.17 billion a year, putting it ahead of giants like Apple, Nvidia, and Meta.

Trading activity hit a milestone through Hyperliquidity’s cluster. In 24 hours, traders moved $3.4 billion, with Bitcoin alone making up $1.5 billion. This success made Hyperliquid the second-largest platform in the world for Bitcoin spot trading.

Even with strong momentum, analysts see some risks. Only a third of Hyperliquid tokens are circulating, while the company could be worth $50 billion. Token unlocks later this year might push prices down, even though the fundamentals stay strong.