The Ondo Finance token, which is represented by the ticker ONDO, is currently hovering at the level of $0.9370 with robust investor interest.

The daily trading volume of the token is still at $140 million, and its total market size is at $2.96 billion. Analysts have continued to note the bullish activity from April, with consistent gains and upward-moving support levels being established.

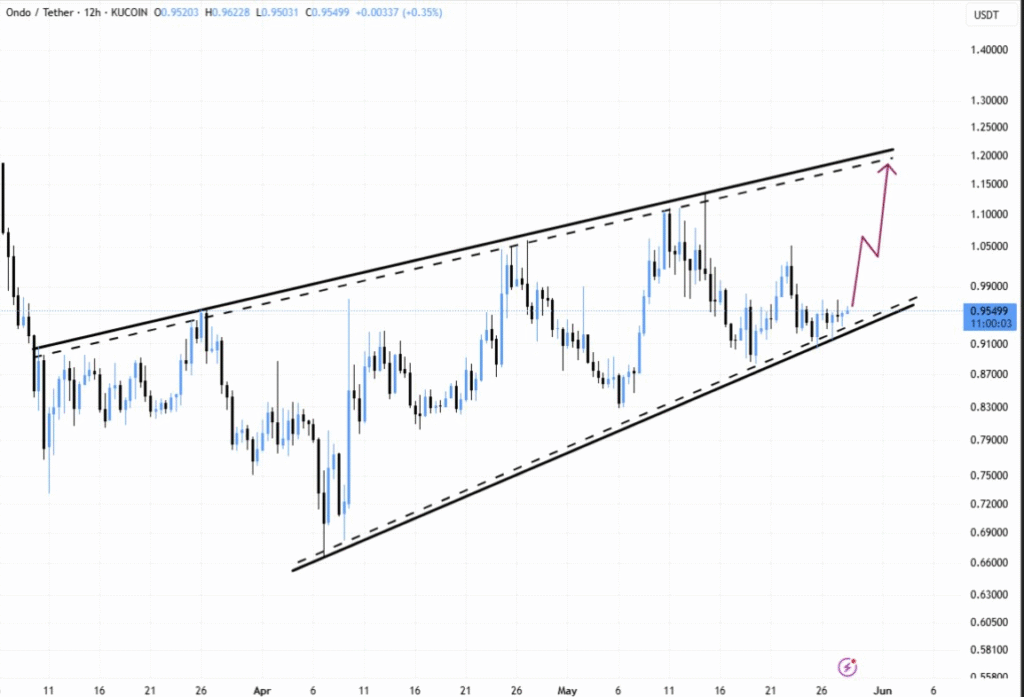

From late March to now, the ONDO price has shown consistent upward movement, beginning near $0.80 and climbing gradually. The price reached approximately $0.98 in late May, displaying higher lows and higher highs throughout the chart.

This is evidence of rising buying pressure, supporting the continued strength of the short-term trend. A recent chart published by crypto analyst Web3Niels on 28 May 2025 is indicative of an emerging ascending triangle pattern.

It is a pattern of technical analysis indicating the continuation of the dominant bullish trend. The lower trendline continuously rises, with the upper trendline remaining steady at around $1.00, indicating significant selling resistance.

Ondo approaches key resistance at $1.00

In late May, the price approached the $1.00 resistance line but pulled back slightly after touching that level. Trading volume spiked during this attempt, which often signals breakout strength.

If the price closes strongly above the $1.00 mark on rising volume, then the next likely target could range from $1.25 to $1.30 in June. Essentially, the token has no unlocks scheduled before January 2026, which minimizes the possibility of escalated supply impacting price movements.

This lack of token unlocks releases pressure from early sellers, creating space for organic growth. The combination of the technical and fundamental indicators gives a bullish view of the prospects of $ONDO in the near term.

Nonetheless, investors and traders will closely observe the $1.00 level as the key point of decision for the next direction of the instrument.