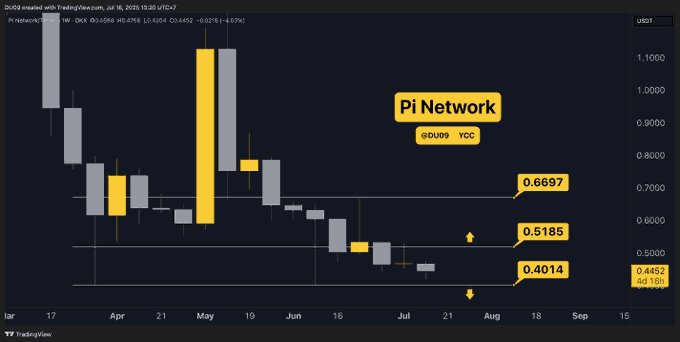

Pi Coin continues its downward trend after weeks of consistent decline, now trading around $0.446 as per TradingView. With a weekly dip of over 3%, market participants are growing cautious. The lack of buying pressure has weighed heavily on investor sentiment, triggering concern as July approaches its end.

Throughout July, Pi Coin continuously tested the resistance level of $0.50 but could not succumb. These unsuccessful rallies have strengthened the bearish trend. As the price succumbs further, it indicates a general lack of momentum, with sell pressure growing and the confidence of the bulls continually eroding.

Bearish momentum dominates price trends

Current price action shows Pi Coin dropped by nearly 3.5% for a span of just seven days. Insecurities of being unable to regain momentum were intensified following a consistent decline in trading volume, now near $88 million for 24 hours.

Meanwhile, technical indicators offer small relief for bulls. The Relative Strength Index (RSI) is still a small above 50, a zone that underlines market indecision. The sideways moving RSI implies a scarcity of definite direction, neither the bears nor the bulls having a clear upperhand, leaving the market vulnerable to surprise reversals.

Pi Coin market value is now lower at approximately $3.44 billion, which further highlights the reluctant atmosphere. The downtrend signals fading investor enthusiasm, particularly as July nears its end.

Crypto analysts predict that the token is trading between key support at $0.40 and resistance at $0.52. With bearish momentum clearly dominating, market sentiment remains cautious unless these levels are decisively tested.

Can Pi Coin reclaim the $0.50 level?

With bearish momentum dominating, analysts anticipate further downside risks with Pi Coin unable to stay above the $0.44 support zone. A fall below the region can trigger another sell-off frenzy that pushes the token downwards towards the $0.40 zone, a 10% decline from the current level.

To reattain bull interest, Pi can retake the $0.50 level convincingly and maintain substantial volume. Until then, traders can be on the sidelines, awaiting clearer guidance. As the bigger picture market seeks better-quality vehicles, Pi Coin’s near-term path remains uncertain and tilted toward continued downside risk.