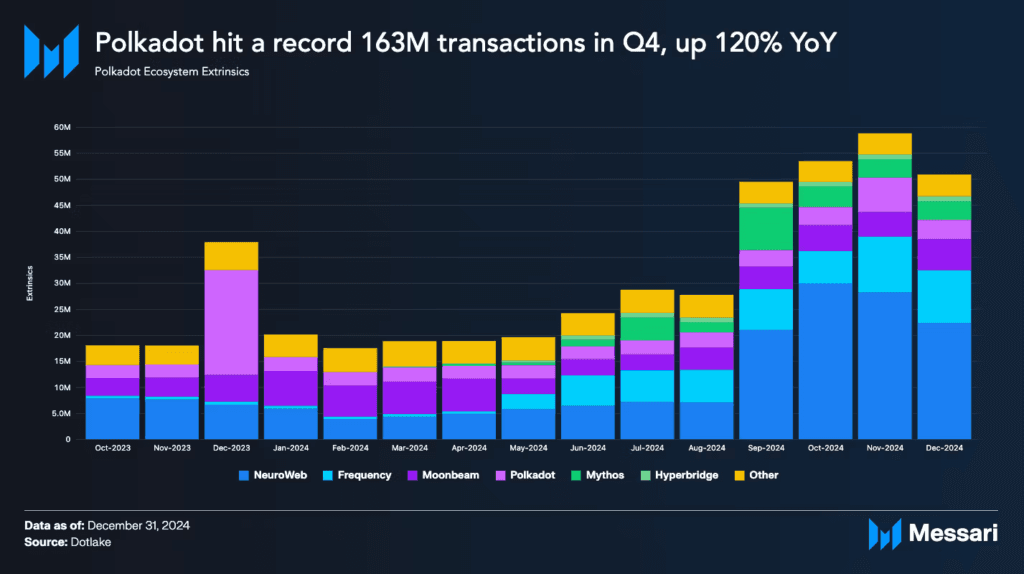

Polkadot (DOT) transaction activity surged in the second half of 2024, with a 200% rise. Monthly transactions jumped from 20 million in January to nearly 60 million by November.

According to Messari’s report, Neuroweb led Q4 with 26 million monthly transactions, a 136% QoQ rise from 12 million in Q3. Frequency followed, increasing from 7 million to 9 million monthly transactions. Other contributors included Phala, Litentry, and Mythos.

The adoption of cross-chain bridges fueled this growth. Snowbridge, launched in June 2024, connects Polkadot and Ethereum. By year-end, its TVL exceeded $70 million. Its trustless design and XCM compatibility made it a favored choice for asset transfers.

On Nov. 7, Polkadot introduced Hyperbridge, a multi-chain bridge between Ethereum, Optimism, Arbitrum, Base, BNB, and Gnosis. Hyperbridge added security with zk-proofs and processed over 600,000 cross-chain messages in testnet cycles.

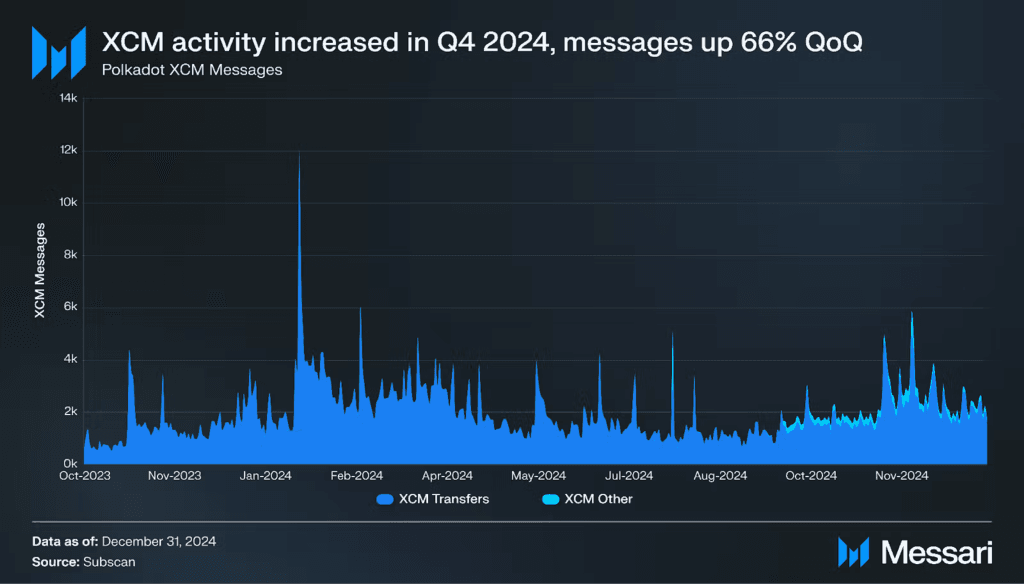

XCM activity grew in Q4 2024, as well. XCM transfers averaged 1,841 (+53% QoQ), and other messages averaged 255 (+300% QoQ) per day. In all, 2,096 XCM messages a day, a 66% QoQ improvement, reached an all-time high.

Incentives for liquidity spurred heightened use. In October, a 1 million DOT campaign was started by Bifrost, spurring yield farming. StellaSwap’s trading pair of BNC-DOT hit a 423% APR, and its vDOT-DOT pool saw a twenty-fold increase in TVL to $622 million.

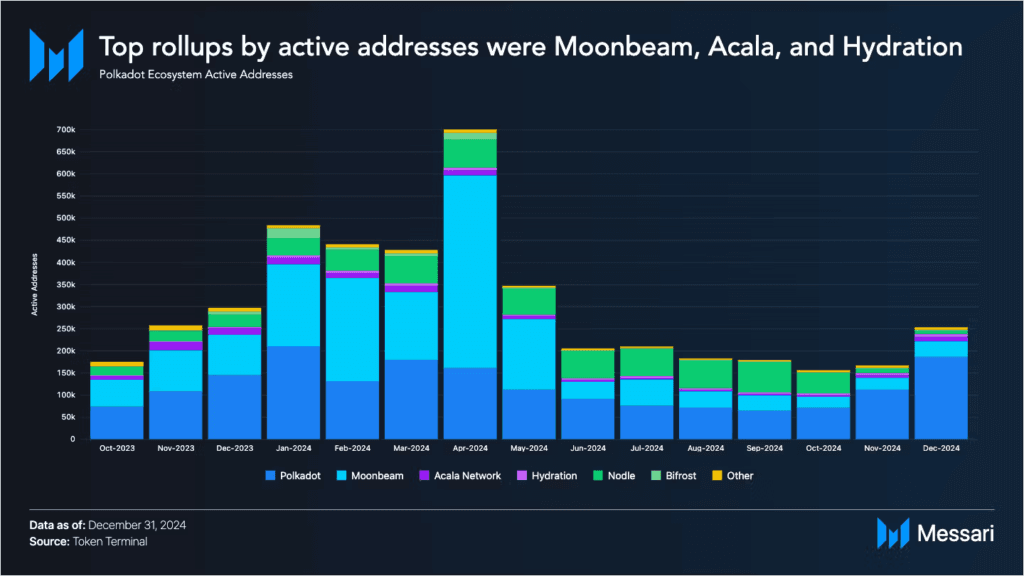

Decline in Polkadot active addresses despite volume growth

Despite transaction volumes, active addresses lowered. Q3 averaged 14,000 per day, but Q4 averaged 11,500. 122,919 monthly active addresses in Relay Chain averaged 68,847 in rollups. In terms of market share, 15%, 3.6%, and 2.7% represented Moonbeam, Acala, and Mythos, respectively.

Polkadot maintained a strong developer presence. Electric Capital tallied 1,261 active developers in October, ranking Polkadot fourth behind Ethereum, Base, and Polygon. Q4 saw 117 weekly active core developers and 420 ecosystem developers.

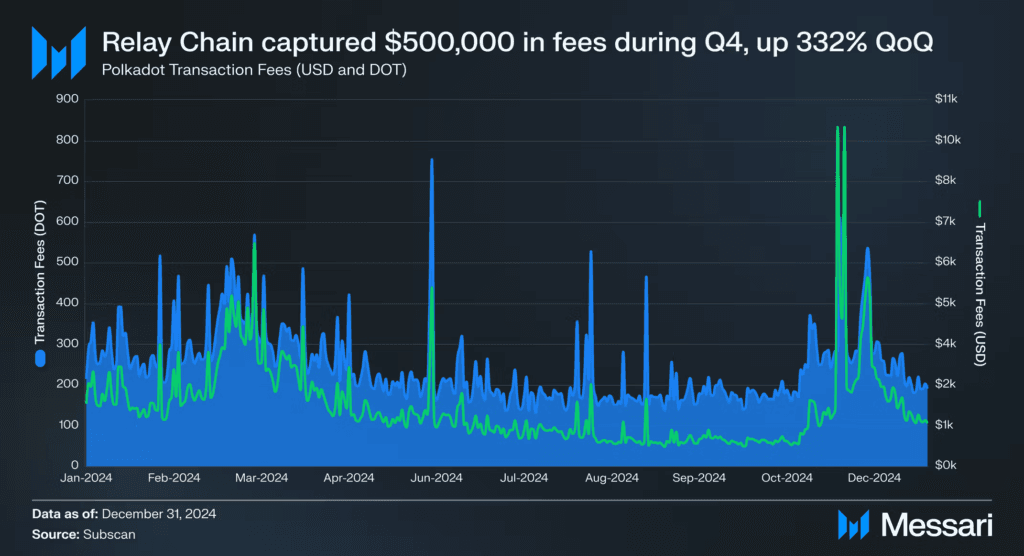

DOT’s market value increased 71% QoQ to $10.2 billion from $6.2 billion. It peaked in December at $16.4 billion, a two-year high. Transaction fee increased 333% QoQ, to $492,141 in Q4, from $113,737 in Q3. Governance saw increased activity. Referendum filings rose 150%, and voting rose 40%. Referendum 1200 added 400 to 500 validators, and it passed with 99.7% approval.

Nevertheless, Polkadot’s Q4 updates, including its XCM and Hyperbridge improvements, strengthened its position in the universe of blockchain. All these enhancements placed Polkadot in a position for heightened interoperability and ecosystem expansion in 2025.