Messari recently released its Q4 2024 report on the BNB Chain, showcasing significant growth and evolving dynamics. Despite challenges, BNB recently reached a new all-time high of $750, driven by the broader crypto market surge following U.S. President Donald Trump’s election.

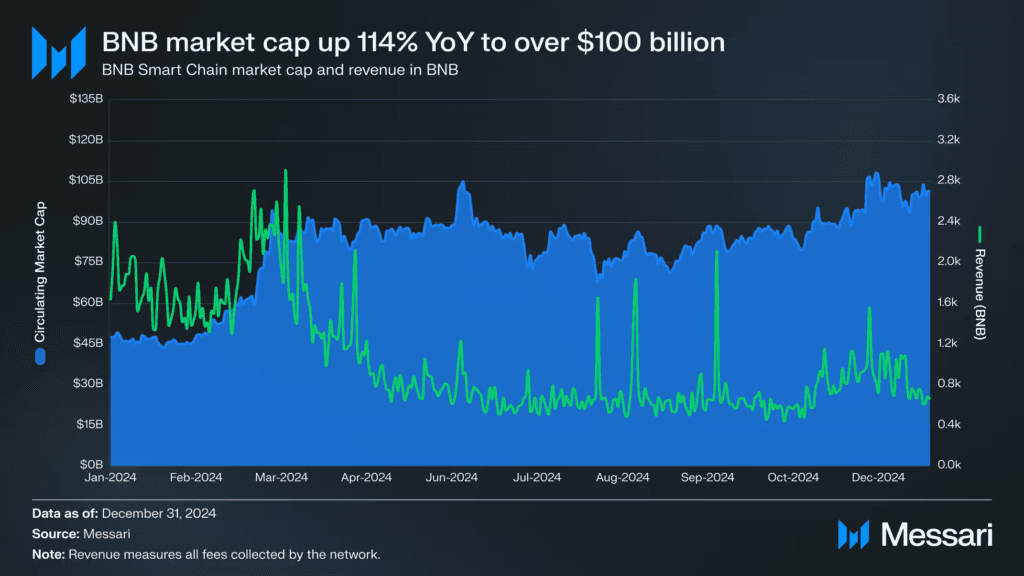

By the end of the quarter, BNB’s market cap soared to $101.09 billion, up 22% QoQ. However, XRP’s strong performance pushed BNB down one rank in market capitalization, although BNB’s annual growth remained impressive at 114% YoY.

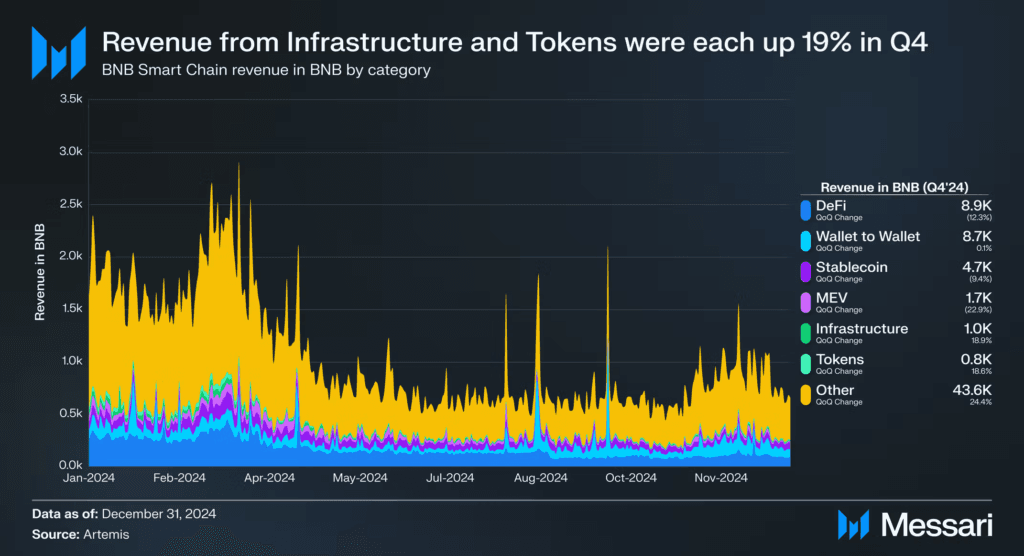

Revenue for Q4 showed a notable boost, with BNB earning $44.6 million in USD, a 28% QoQ rise from Q3. This growth was reflected in BNB revenue too, rising 10% QoQ to 69,500 BNB. DeFi continued to drive gas fees, although it saw a slight decline in contribution. Wallet-to-wallet transactions held steady, while infrastructure and token-related revenues saw solid gains. The DeFi category contributed the most gas fees but dropped 12% QoQ.

BNB supply and quarterly burns

On the supply front, BNB burned a significant amount in Q4. By the quarter’s close, the circulating supply stood at 144 million, with an annualized deflation rate of 5.3%. The 29th quarterly burn, on Nov. 1, saw 1.8 million tokens, worth $1.07 billion, removed from circulation.

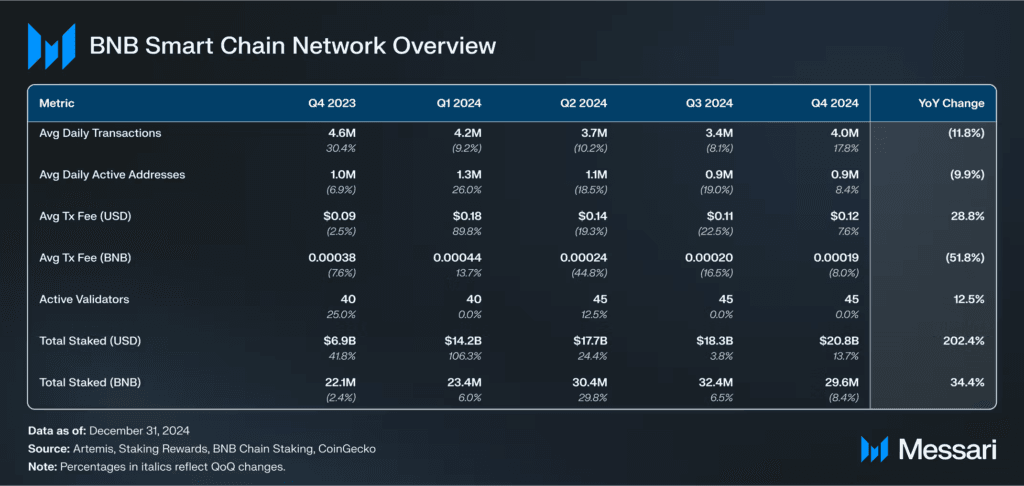

Onchain activity showed resilience. Daily transactions climbed 18% QoQ, reaching 4 million, and active addresses increased by 8%. Stablecoin transactions led the charge, making up 45% of total activity, with wallet-to-wallet transfers not far behind. DeFi’s total value locked (TVL) saw a 10% QoQ increase, reaching $5.35 billion, although BNB’s TVL in BNB declined slightly. PancakeSwap maintained its dominance in TVL, growing 7% QoQ.

Stablecoin growth was another highlight, with the market cap rising 37% QoQ to $6.84 billion. New entrants like USDX and lisUSD made a significant impact, with USDX reaching $438.8 million by December’s end. The “Gas-Free Carnival” initiative, allowing gas-free stablecoin transfers, boosted adoption.