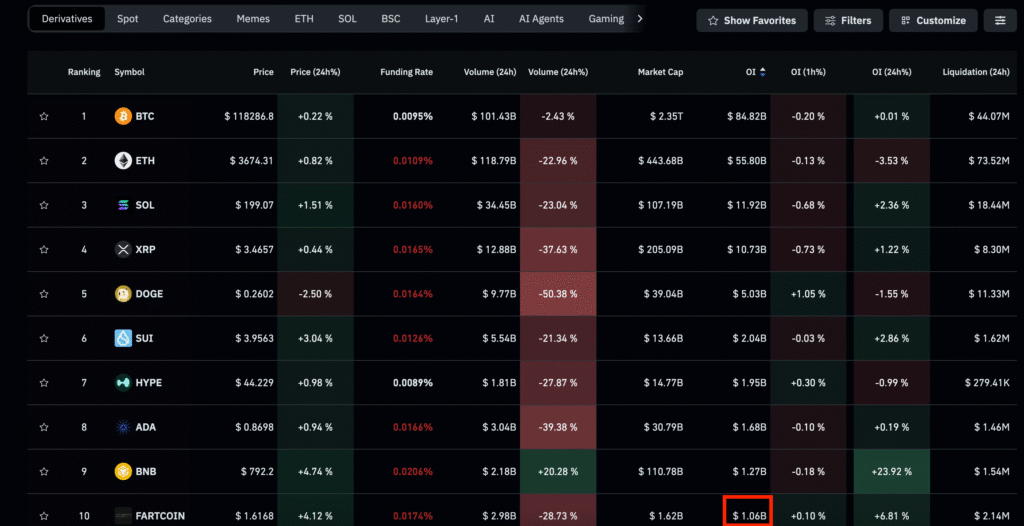

Speculators are piling into fartcoin. The Solana-based memecoin now ranks 10th worldwide by derivatives open interest, according to data from Coinglass. This puts it ahead of well-known assets like Litecoin, Chainlink, and Avalanche.

The open interest for Fartcoin surged by more than $1 billion. That is 65% of its roughly $1.62 billion market cap. Bitcoin’s open interest of $84.7 billion amounts to a paltry 3.5% of its total value. The numbers show a staggering difference.

Solana tokens fuel new wave of risk trading

That level of leverage for a small coin is indicative of a bout of irresponsible speculation. Derivatives trading on Fartcoin is nothing more than ranking it 83rd in market cap while traders trade it as if it’s a top cryptocurrency. Few see that as anything other than a sign of retail-led madness.

Speculators most often turn to inexpensive tokens in rising bull markets in the hope of dramatic gains. The pattern does not stop with Fartcoin. Corresponding activity in other minor altcoins yields Alphractal indicators. Open interest jumps more than market value from the top 300 assets.

That means more speculators wagering big on less-traded coins. In that environment, one should be prepared for drastic volatility with big liquidations. Derivatives both make profits and losses bigger. Where prices move swiftly, highly leveraged positions get liquidated. Speculators hoping for quick profits in memecoins could encounter sudden reversals.

Fartcoin surge shows speculation in full swing

It is a common phenomenon in speculative peaks. There is a glaring gap between the humongous futures market of Fartcoin and its intrinsic value. Risk appetite is scorching. Fartcoin has no fundamental utility in DeFi, payments, or infrastructure.

But it is worth billions in wagers. Hype can create value in cryptocurrency. Leverage from hype does not usually persist. Speculators longing or shorting must be prudent. Abrupt changes tend to happen when momentum vanishes.

There was recently a sharp jump in these derivatives, showing how quickly speculation jumps from market to market. Currently, Fartcoin leads a new surge of risk trading. Whether it continues to lead that rank or sinks back into the ground again depends on how long a mania lasts.