Solana’s on-chain revenue declined sharply over recent weeks. The network, which had reported all-time-high revenue in January, took a sharp hit as memecoin trading slowed. Weekly revenue peaked at $55.3 million in mid-January, fueled by a memecoin minting mania.

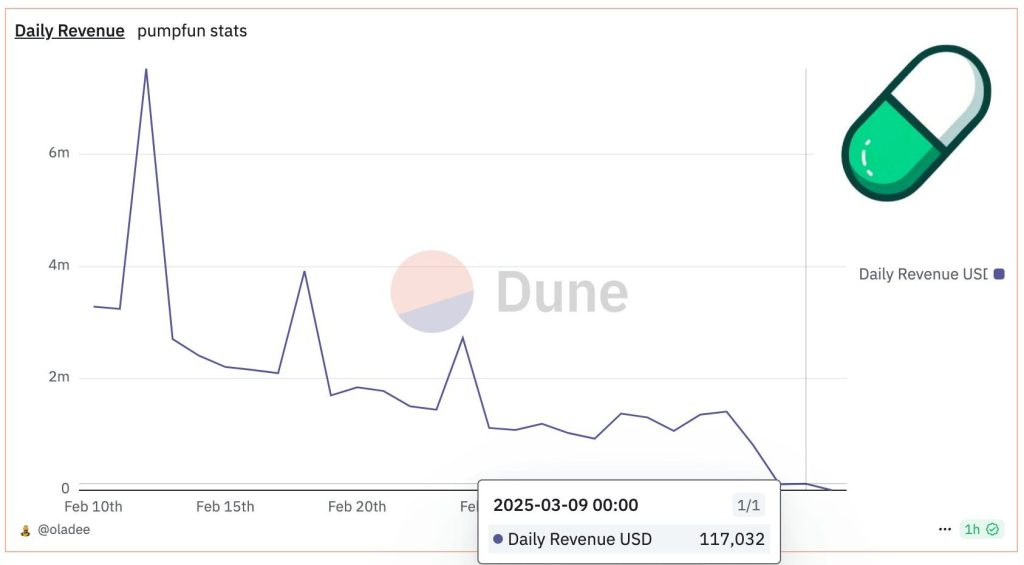

That figure is down 93% to $4 million, a level not reached since September, according to DeFiLlama. The memecoin area is a major earner, contributing to around 80% of Solana’s revenue. The leading memecoin launchpad, pump.fun, has made over $577 million in fees in a single year.

Memecoin trading is, though, tarnished by controversy because it is plagued by high-frequency trading and manipulation by insiders. Some traders exploit new listings by buying tokens before individual buyers.

In February, the memecoin trading collapse hit Solana hard. Stablecoin transfers, which are critical for on-chain activity, fell 80% from January levels. DEX volumes dropped 55%, collected fees declined 63%, and MEV activity shrank 63%. These setbacks contributed to SOL’s price pullback.

Solana developers are working on several upgrades to strengthen the network. The most significant proposal, SIMD 0228, looks to adjust Solana’s inflation rate based on staking levels.

If staking participation increases, inflation will decrease, reducing dilution and selling pressure. This could help maintain network security while keeping SOL’s supply in check. The vote on SIMD 0228 is set for March 6, 2025.

Solana price holds key support at $125

Despite the decline in revenue, Solana’s price is strong. SOL is trading at $125.75, an increase of 4.22% over the last 24 hours. The price is holding strong between $125 and $110. Where it will head from here may be determined by that range.

The futures open interest is 19% lower from where we started in March. This reflects less conviction by traders. If SOL holds above $125, it will recover. Break below $110 will push the price to $95–$100. Resistance is found between $140 and $150, and it will take a strong move to recover to $188.

The market mood is uncertain. Macroeconomic uncertainty, FTX estate token unlock, and underperformance by altcoins put pressure. If Bitcoin and Ethereum recover, Solana could follow. Else, traders are on tenterhooks.