Tether has minted over 1 billion USDT on the Tron blockchain, adding significantly to its total circulating supply. The strategic print shows growing demand for stablecoins worldwide, with institutions and institutions increasingly seek fast, cost-efficient tools for digital asset transfers and liquidity management.

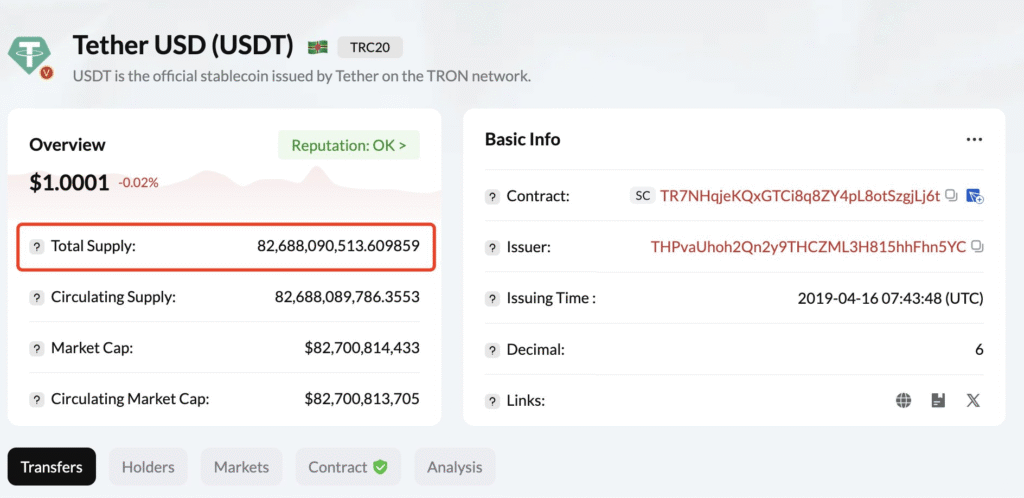

This minting, which equates to approximately $1.001 billion, was made without paying gas fees. The move pushed Tether’s overall USDT supply on Tron up to 82.69 billion, making up over 50% of total USDT supply. The zero-fee strategy solidifies Tron as a budget-friendly blockchain for stablecoin creation.

Tether supports liquidity amid Bitcoin rally

Tether has minted 1 billion USDT on Tron blockchain today, data provided by Spot On Chain indicates. The minting is part of a total 8 billion USDT minted within the past 25 days with 2 billion USDT minted on Tron and 6 billion minted on Ethereum.

Recent growth of USDT parallels a healthy Bitcoin price upsurge. Over the same 25 days, Bitcoin climbed 16.5%, up from $105,430 to a new all-time high of $122,780. Additionally, the growth of prices reflects strong demand within liquidity and stablecoin markets.

Moreover, as Bitcoin hits new highs, Tether’s increased supply is intended to enable orderly digital asset trading and liquidity on major blockchain platforms, primarily Tron and Ethereum.

Monitoring key support levels on TRX/USDT

But we could witness drastic corrections at overbought RSI conditions. Traders should expect correction. Key levels to look out for are 50-period EMA at $0.2703, 100-period EMA at $0.2416, and 200-period EMA at $0.1992 on 3-day TRX/USDT chart.

Meanwhile, USDT investors are paying attention to price action following a neutral close to the week. Analyst illustrates a potential liquidity chase at the $4.01 level. Sharp price responses usually target liquidity sites where condensed orders fuel price action as momentum builds.

As USDT approaches the $4.01 liquidity threshold, there can be swift corrections that follow. These movements often precede rebalancing phases, especially in markets saturated with leveraged positions. Tether’s action, with Tron’s growing participation, suggests an evolutionary shift within stablecoin adoption and infrastructure.