The VeChain (VET) is ranging out in a long-term weekly uptrending broadening wedge. It recently bounced back from a very significant trendline support, once again boosting bulls’ inclination of both traders as well as investors.

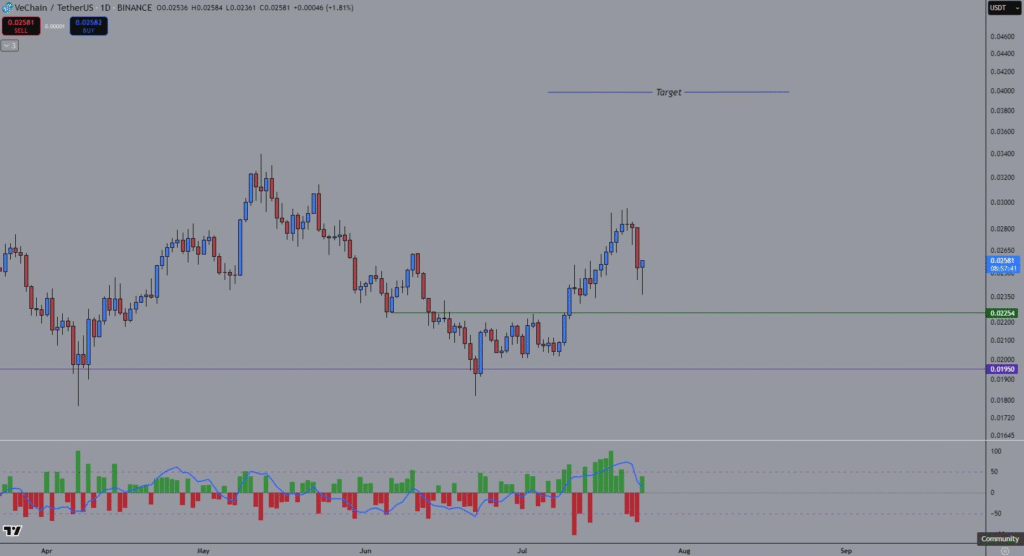

VET trades at $0.02555 with a slight 0.03% increase daily. Intraday trading is between $0.02414 and $0.02591, indicating strong compression of price action. Furthermore, market cap stands at about $2.2 billion, with trading volume between $60-$90 million on major exchanges.

VeChain technical structure signals breakout potential

VeChain is creating an upward movement towards a crucial resistance zone of $0.033 to $0.035. It was a major roadblock to previous gains in price. Bulls would test this barrier after recovering from support in the recent past.

A breakout over $0.035 can initiate a strong rally. Technical analysts project immediate upside targets of $0.06 to $0.10 should further gains be realized. In a bullish scenario, VET can advance to the high end of the wedge formation, keeping its long-term bullish formation intact.

CryptoPulse indicates that VeChain’s setup is a classic textbook example. After a successful profitable entry, VET is retracing towards its structural buy zone of $0.022 – $0.024 right now. Traders are closely watching this level for new entry points into the market.

The clean formation in $0.022–$0.024 is a signal for buyers not to pursue the rally. The next rally leg is poised to commence, with early targets due soon from this support area.

Crucial support levels could fuel next rally

Analysts’ short-term goals are in the $0.03 range, an approximately 20% increase from current levels. Medium-term goals are $0.028 to $0.0339, with up to 30% implied gains. Going through $0.035 can initiate a breakout to $0.06, $0.10, or more into the wedge. The VeChain technical indicators are generally bullish but not without risk.

Ongoing volume is of foremost importance with RSI not entering the overbought region. Should momentum slow down below $0.025, the bulls’ case can be hurt, with further risk of corrections or sideward price action in upcoming weeks.