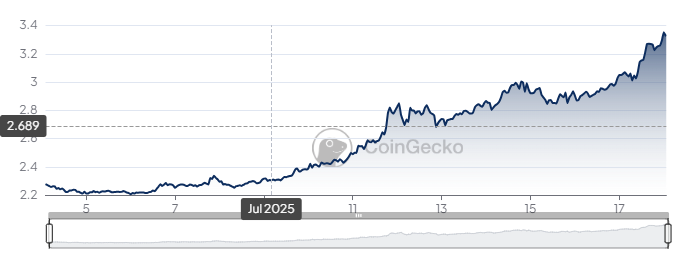

Chris Larsen, co-founder of Ripple, has moved another large batch of XRP. This week, his crypto wallet sent $26 million worth of XRP to Coinbase. The transfer happened as XRP neared its highest price in more than seven months. The asset surged 32% over the past week and now trades just 3.8% below its record high of $3.40, set in January 2018.

Since January, Larsen’s wallet has moved around 106 million XRP to exchanges and linked wallets. The total value of these transfers stands at about $344 million. Though it remains unconfirmed whether Larsen sold the tokens, sending them to centralized platforms like Coinbase suggests a possible liquidation.

XRP overtakes USDT as investor confidence grows

XRP’s rise follows broader momentum in the crypto market. Bitcoin broke past $122,000 on July 14, lifting altcoins with it. XRP now holds the third spot in market value, behind only Bitcoin and Ethereum. It has overtaken Tether’s USDT, signaling renewed investor confidence.

Larsen co-founded Ripple in 2013 to speed up cross-border payments using blockchain. He left his role as CEO in 2016 but continues as executive chairman. His known wallets still hold 2.6 billion XRP. At current prices, that stake is worth over $8.3 billion.

Larsen’s total net worth has soared to $9.7 billion, according to Forbes, up sharply from $3.2 billion a year ago. His influence stretches beyond crypto. In 2024, Larsen donated $1 million worth of XRP to a super PAC supporting Kamala Harris’ presidential run. He has also supported several Democratic candidates in recent years.

Ripple and Circle seek national trust bank status

Meanwhile, Ripple’s reach continues to grow. The company recently applied for a US National Trust Bank charter alongside Circle. If approved, this move would bring both firms under federal oversight. It could also ease regulatory hurdles for future XRP products like exchange-traded funds.

Ripple’s legal dispute with the SEC over XRP’s classification has cooled. The company dropped an appeal in June, a step analysts believe clears the path for wider adoption and more financial products based on XRP.

Adding to the momentum, Chinese Nasdaq-listed firm Webus International disclosed plans to build a $300 million XRP treasury.

The news adds another vote of confidence in Ripple’s ecosystem.

As XRP climbs toward its former peak, all eyes remain on Larsen’s next move. His continued transfers raise questions about timing and intent in a market full of rapid changes.