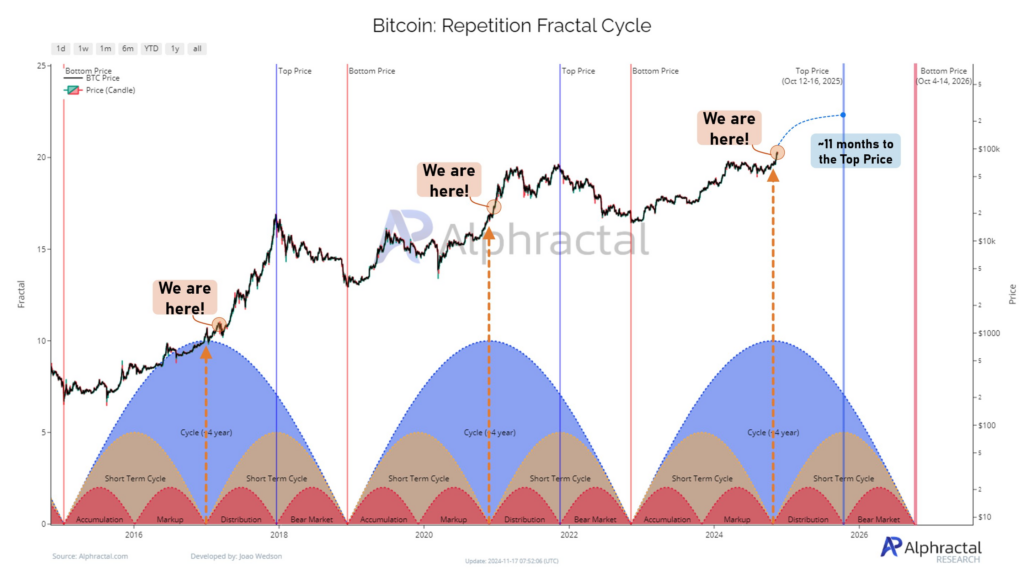

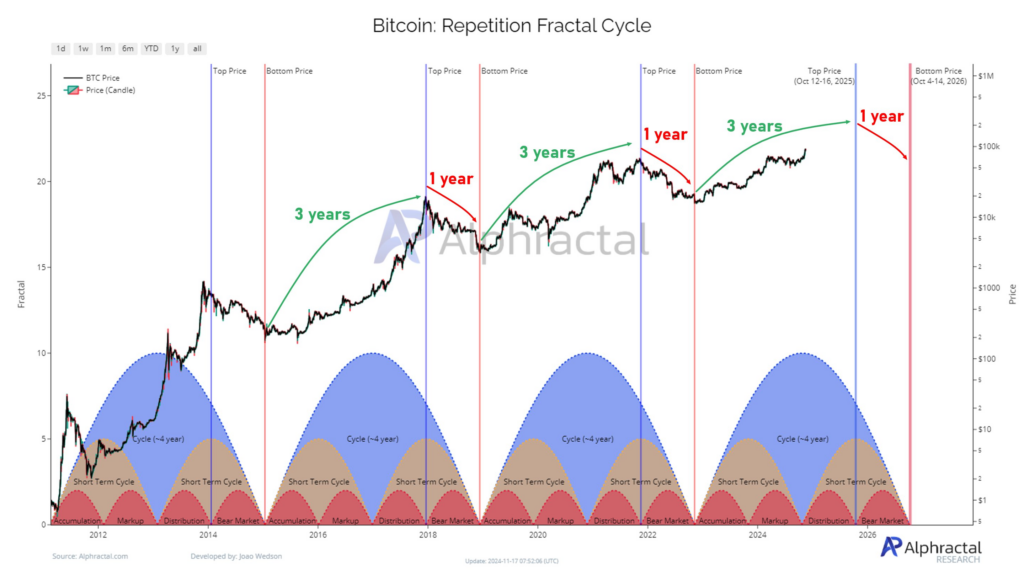

Bitcoin has followed a remarkably consistent 4-year cycle since 2015, according to data from Alphractal, an investment analysis platform. The cycle comprises four clear phases: accumulation, markup (uptrend), distribution, and a year-long bear market (downtrend). This fractal pattern has proven highly accurate, pinpointing the tops and bottoms of each cycle.

Alphractal projects the next cycle top could fall between Oct. 12-16, 2025, with a possible price bottom falling between Oct. 4-14, 2026. In comparison, living in this current moment to others of its kind, it is clear that Bitcoin remains in the uptrend phase of the current cycle. That represents a pocket for growth, as months of upside may be ahead.

Fractal analysis, a method studied in academia and used in financial markets, shows that Bitcoin is a unique case. The repetition of this cycle highlights the asset’s resilience and predictability, even in a volatile market. If history repeats, we are entering the three years of growth and accumulation.

Analyst’s Bullish Bitcoin Prediction

Meanwhile, analyst Stockmoney Lizards tweeted about Bitcoin’s breakout, referring to a setup that projects a move to the next level. Retail investors could drive the price toward $100k and trigger the next stage of the market rally.

According to the analyst, it forms a symmetrical triangle in such a way that the descending resistance and ascending support lines meet. As it closes in on the apex of this formation, Bitcoin will break above resistance for a bullish move or fall below support for a bearish trend.

This means one looks for a spike in volume, accompanied by at least two closes over the trendline, for confirmation of whether it is broken out or not. However, the uptrend continuation will push Bitcoin up further, signaling the start of the next big move.