On Nov. 20, Bloomberg ETF analyst James Seyffart reported that BlackRock’s spot Bitcoin ETF, the iShares Bitcoin Trust ETF (IBIT), saw nearly $2 billion in total exposure traded on its first day of options.

As a result, this surge in trading, with 354,000 contracts changing hands, may have driven Bitcoin to a new high of over $94,000. He mentioned that these options are crucial in pushing Bitcoin to its new all-time high today.

According to TradingView data, Bitcoin peaked at $94,105 on Coinbase on Nov. 19. Bloomberg’s senior ETF analyst Eric Balchunas said that $1.9 billion is unheard of for day one. Additionally, he compared it to the first ETF offering Bitcoin exposure in the U.S., the ProShares Bitcoin Strategy ETF (BITO), which raised $363 million on its debut.

IBIT options spark Bitcoin optimism

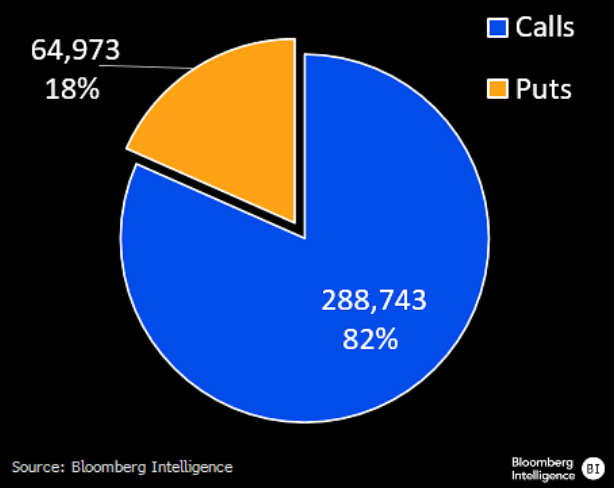

The new options contracts give investors the right to trade ETF shares at set prices, letting them speculate on how the ETF’s price will move. In addition, notional exposure refers to the market exposure from the options, considering how Bitcoin’s price changes and the total value of the cryptocurrency controlled through those contracts. Moreover, the put/call ratio was 0.225 on IBIT’s first trading day.

This means far more investors were buying call options, betting that Bitcoin’s price would go up, than those buying put options, betting it would go down. Balchunas said that this is a strong sign of optimism, especially for contracts that will expire in a month.

These bets essentially predict that Bitcoin’s price will double in the next 30 days. Former CNBC Africa host Ran Neuner agreed that the launch of IBIT options contributed to today’s market surge.

On Nov. 19, industry executive Joe Consorti stated that these contracts are a significant development since listing options on spot BTC ETFs “unlocks some of the largest and deepest liquidity pools worldwide.” Meanwhile, leading crypto asset manager Grayscale is also preparing to introduce options for its spot Bitcoin ETFs in the U.S. on Wednesday.

Related | Bitfinity raises $12M for Bitcoin layer-2 DeFi expansion