Digital asset investment products extended their winning streak, clocking a tenth straight week of inflows. The latest figures from CoinShares show inflows hit $1.24 billion last week. Year-to-date inflows now stand at a record $15.1 billion.

As per the report, early-week momentum was strong but slowed down later. The Juneteenth holiday and news of U.S. involvement in the Iran conflict likely muted activity. Still, investor appetite remained firm.

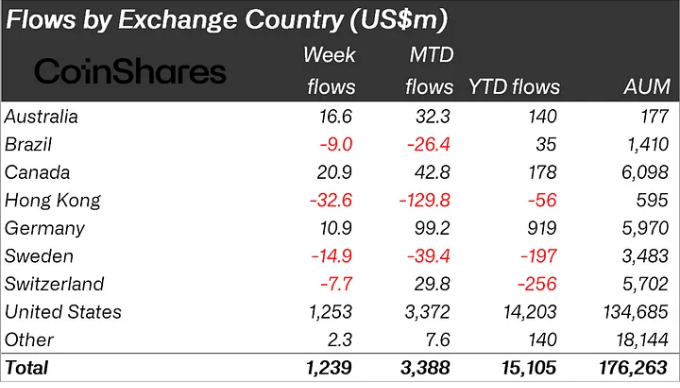

The United States led with $1.25 billion in inflows. Canada followed with $20.9 million, and Germany added $10.9 million. Meanwhile, Hong Kong and Switzerland posted outflows of $32.6 million and $7.7 million, respectively.

Bitcoin defies dip with fresh capital

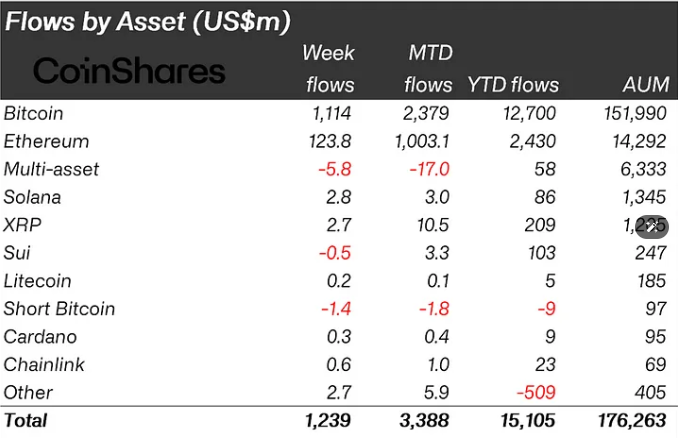

For a second consecutive week, Bitcoin has recorded inflows amounting to $1.1 billion. Contrary to what some expected, many investors saw the price correction as an opportunity and not a scare.

Outflows of $1.4 million from short-Bitcoin products indicate that traders expect prices to bounce back further. The dominance of Bitcoin in digital asset products continues to increase which indicates stronger commitments by institutions.

Ethereum, Solana, and XRP attract fresh money

Ethereum kept its positive trajectory with inflows of $124 million giving it an inflow total of$ 2.2 billion over nine straight weeks. This marks Ethereum’s longest stretch of demand since mid-2021.

Solana brought in 2.78 million while XRP closely followed with the influx of $2.69 million per week reinforcing confidence across the broader altcoin market outside of Bitcoin and Ethereum.

The data paints a picture for institutional digital asset demand spiking further, especially during periods of lower liquidity stemming from geopolitics and holiday breaks . Digital asset products continue to act as a focal point for investors leading into summer with Bitcoin and Ethereum spearheading the charge