Bitcoin climbed back above $107,000 after briefly falling under the $100,000 level for the first time in over six weeks. The drop came early in the week amid rising global tensions. But the tone shifted fast after Iran and Israel agreed to a ceasefire. Traders reacted quickly, pushing Bitcoin higher by more than 7% by week’s end.

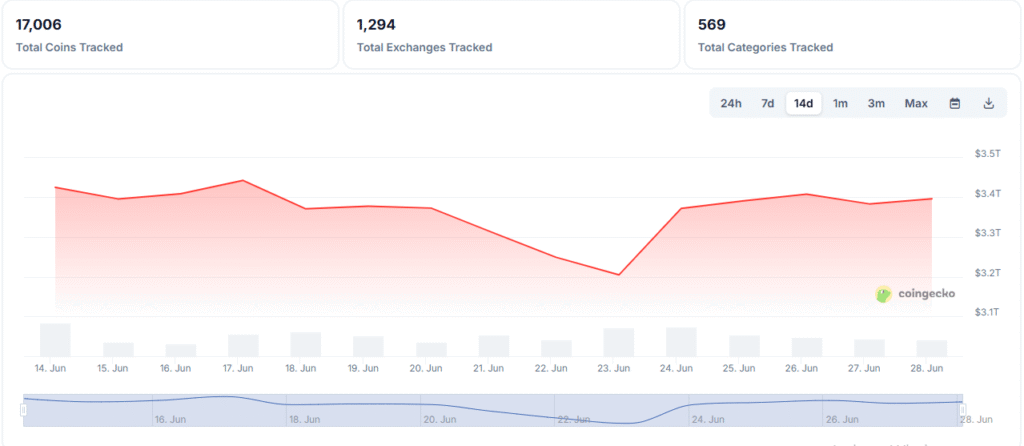

The crypto market as a whole responded with strong gains. Total market capitalization moved from nearly $3.2 trillion to around $3.4 trillion in just five days. Investors welcomed signs of stability after weeks of uncertainty. The return of calm gave digital assets some breathing space.

Bitcoin surge fuels broader market growth

Tensions had peaked after Iran launched missiles toward U.S. bases in Qatar on June 23. Markets braced for wider conflict. But within hours, both sides paused. That moment changed the direction for risk assets. Bitcoin, sitting near $101,000, began to climb.

It passed $103,000 later that day. By June 25, the price crossed $107,000 and stayed there. Not just Bitcoin, but most top tokens gained. HYPE stood out with a 7.2% jump to $36.64. Chainlink gained 5.3%, showing strength in the DeFi space. Solana added 4.3%, and Bitcoin Cash rose by 4.2%. Developers stayed active.

Investors embrace risk after global calm

Chainlink led in code updates, logging over 360 GitHub activities in a month. But not all coins moved up. Cardano led the downside, slipping by 3%. Stellar fell 1.4%. Matchain took a hard hit, losing over half its value. On the other end, Banana for Scale soared, rising 119% in a single week.

The market’s recovery this week shows how closely crypto reacts to global events. War worries can push prices down fast. But even a fragile peace can send them rising just as quickly. Investors seemed ready to take on more risk after signs that the worst might be over.

In the bigger picture, the rebound shows that confidence in crypto remains strong. Even after sharp declines, buyers step in when the mood shifts. The rally could continue if peace holds and new developments support digital assets.