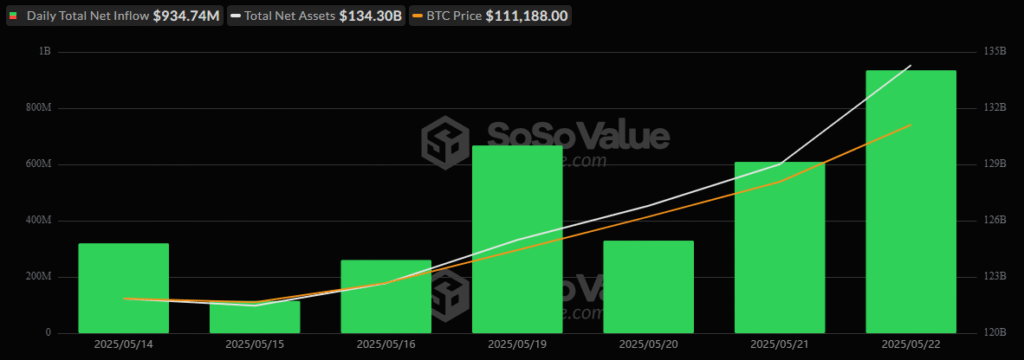

Bitcoin exchange-traded funds had a record-breaking week. From May 19 to May 22, they pulled in a stunning $2.001 billion. Thursday alone brought $935 million in net inflows. This marked the seventh day in a row of gains.

BlackRock’s IBIT spearheaded the rush with a take-in of $877.18 million in one day alone. That accounted for over 93% of the combined total. Fidelity’s FBTC took in $48.66 million. ARK’s ARKB contributed $8.90 million. There wasn’t any outflow from any Bitcoin ETF that day.

Grayscale and Fidelity lead Ether ETF gains

Volume in those funds reached $5.39 billion. Net assets totaled $134.30 billion. Institutions continued buying. They didn’t show any indication of letting up. The demand remained consistent. Confidence increased further. Bitcoin ETFs are now a prominent vehicle for institutional investors to get crypto exposure.

Ether ETFs also rallied. They accumulated five consecutive days of inflows. Thursday’s reading stood at $110.54 million. Grayscale’s ETHE registered $43.75 million. Fidelity’s FETH amassed $42.25 million. Grayscale’s Ether Mini Trust attracted $18.86 million. Bitwise’s ETHW drew $5.69 million.

Net assets increased to $9.33 billion. The $10 billion mark appears near at hand now. Trading in Ethereum ETFs totaled $697.46 million in the day. This mirrored the enthusiasm displayed in Bitcoin products. Market observers recognized the trend. Institutions seemed to rotate their money into crypto ETFs with steady hands.

Bitcoin and Ether attract heavy Interest

The flows indicated increasing trust in digital assets. This week was a strong turning point. Both Bitcoin and Ether funds attracted strong attention. They continued to report gains. Investors reacted to the increasing prices and regulatory momentum.

The structure in the form of an ETF provided a more streamlined window to the market. Buyers opted for it instead of direct holdings. Convenience and extra protection attracted them towards it. The rally remained evident in its vigor. Bitcoin and Ether remained at the forefront. The ETF universe provided them with a strong boost.

From asset managers to the world of hedge funds, participants appeared in force. The numbers confirmed it. And with no indication of outflows, the move might continue to build. Momentum remained intact. Bitcoin ETFs paved the way. Ether ETFs trailed behind. But both indicated institutional conviction remained undented.