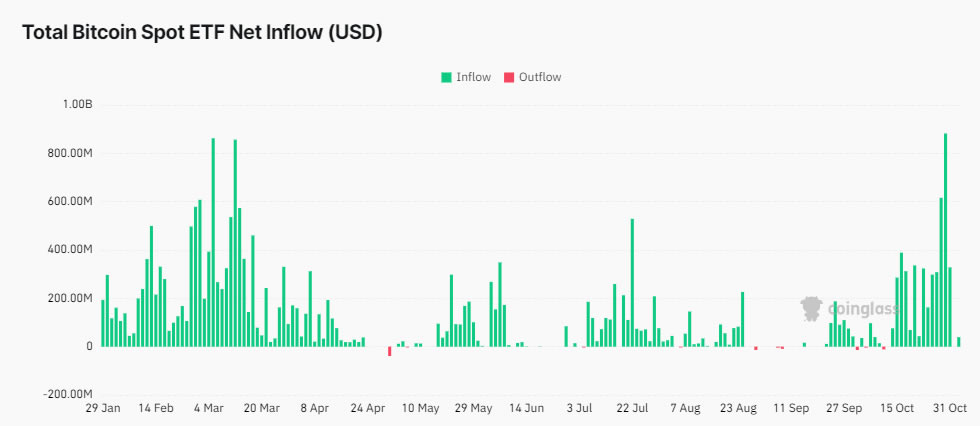

BlackRock’s spot Bitcoin ETF, launched in January, just saw its sixth consecutive day of net outflows. On Nov. 5, U.S. election day, large investors pulled back, with the iShares Bitcoin Trust recording an outflow of $44.2 million, as reported by CoinGlass. For the sixth time since its launch, the ETF saw a net outflow, with the last instance being on Oct. 10, when $10.8 million exited the fund.

Overall, U.S. spot Bitcoin ETFs recorded a net outflow of $116.8 million, driven primarily by a $68.2 million withdrawal from the Fidelity Wise Origin Bitcoin Fund. Moreover, the only fund bringing in money for the day was the Bitwise Bitcoin ETF, which attracted $19.3 million in new investments.

This marked the third day that U.S. spot Bitcoin ETFs saw withdrawals. Following a major sell-off the day before, investors pulled out over $541.1 million, the second-largest outflow on record for these funds.

Election impact and predictions for $100K

Crypto markets rose after the U.S. trading day as election results came in, pushing Bitcoin to a record high of $75,000. Apollo Crypto’s Chief Investment Officer, Henrik Andersson, noted that Bitcoin has become the go-to election trade for traders worldwide. Based on what he saw in betting markets and other usual sources, he figured an 80-90% chance of Donald Trump winning.

If Trump does win, he’s predicting Bitcoin could hit $100,000 by the end of the year. In a blog post on Nov. 5, ETF Store president Nate Geraci shared that while elections don’t usually have as big an impact on investments as people might think, the regulatory landscape, particularly the leadership at the SEC, can play a significant role in shaping ETF innovation. He added:

Nobody knows for sure how this all might play out–and the best longer-term solution is the implementation of a bipartisan, comprehensive crypto framework–but it seems highly likely this election will affect the speed of crypto ETF innovation one way or another.

Related | USDG stablecoin debuts on Ethereum