Bitcoin (BTC) is under increasing market pressure, but the average investor has still profited even with the recent price drop. According to a report by Glassnode, Bitcoin is currently undergoing its maximum drawdown of this cycle.

However, the general picture for the investors is still bright. The report explains that the current spot price is about 22% lower than Bitcoin’s all-time high (ATH), which is a relatively small drop when we consider historical bull market corrections.

Unrealized losses are a major emphasis of the report. Although total unrealized losses, which equate to just 2.9% of Bitcoin’s market cap, are not very high, Short-Term Holders (STHs) are really struggling.

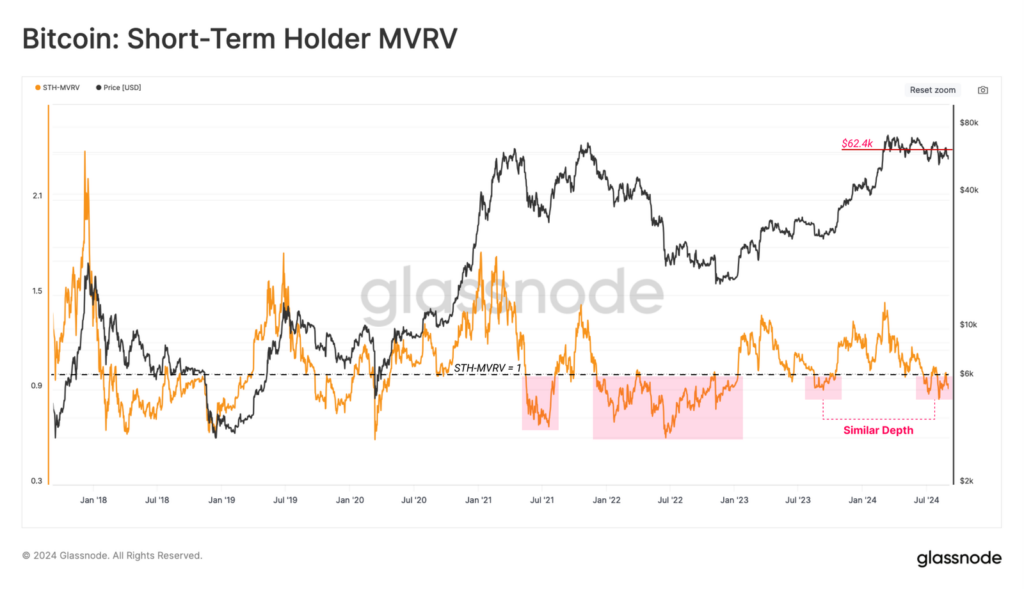

This group is also new to the game, and in their case, it has become very clear that their unrealized losses have been increasing significantly over the past few months. The STH Market Value to Realized Value (MVRV) Ratio has dropped down under 1.0, which indicates that these newly joined individuals are actually holding onto their losses.

This is quite similar to the market conditions of August 2023 following the FTX collapse. Currently, all STH age bands are underwater, with an average cost of between $59,000 and $65,000. A price recovery to $62,400 is needed to alleviate this pressure.

Declining realized profits and Bitcoin market behavior

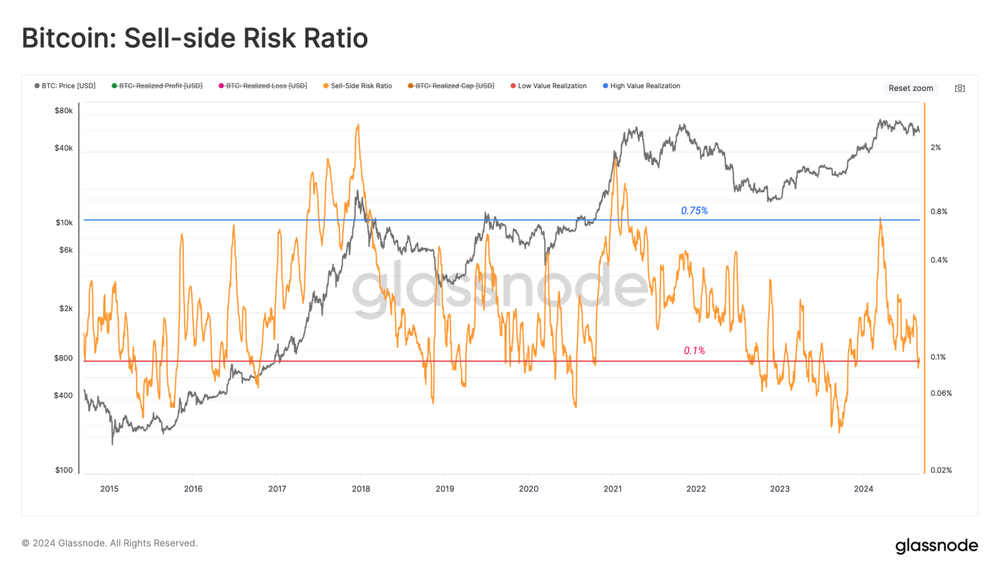

The decrease in realized profits post-ATH illustrates a more general tendency towards a higher degree of loss-taking by investors. Although these losses have not yet reached the desperate levels that were the case during some past stock market crashes, they are still a sign of growing investor anxiety.

Sell-Side Risk Ratio, which indicates whether net profits or losses are realized, is the measure of the balance of the realized profits and losses. However, it also sends signals of future volatility, where the can be tipped from stable equilibrium to a different state.

New data from the increased Long-Term Holders (LTH) and the decreased new buyers reveals that the market is going to a bear market phase, similar to 2019. Bitcoin’s price action still stays in the range of “Enthusiastic Bull Market.” But if it drops to $51,000, it might become a concern.

Despite Bitcoin having unbearable pressures in the short term, the overall market still stands relatively steady. There is a sharp contrast between the experiences of Long-Term and Short-Term Holders.