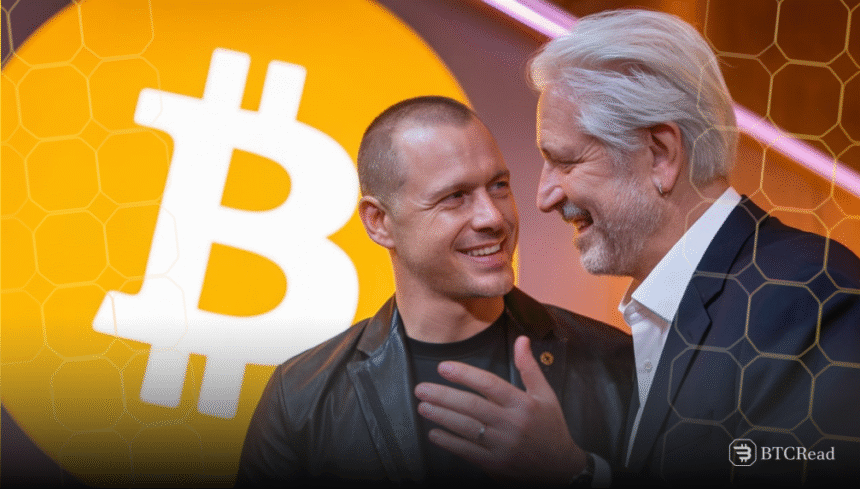

Roger Ver, the investor known as “Bitcoin Jesus,” has engaged political consultant Roger Stone to assist with his legal issues. Ver, who is facing criminal tax and fraud charges in the U.S., has paid Stone $600,000.

The pay aims to lobby for changes to the tax laws that are central to his case, as reported by NYT. This payment follows Ver’s arrest in Spain in 2024, where he is accused of evading taxes.

Ver’s legal challenge and political appeal

Roger Ver became a lawless citizen in 2014 before U.S. officials claimed he evaded taxes by hiding his Bitcoin possessions. The U.S. Justice Department has moved forward with the case, seeking Ver’s extradition to face trial. Ver claims that the charges are politically motivated, drawing comparisons to former President Donald Trump’s legal battles.

In a video released in January, Ver stated that he could face over 100 years in prison and directly appealed to Trump for support. Trump’s close ally Roger Stone has joined the lobbying effort to contest the exit tax law, which Ver’s defense claims is unfair and ambiguous when it comes to cryptocurrencies.

According to Stone’s filings, he has been compensated to advocate for reform, concentrating on doing away with the exit tax and changing the taxation of cryptocurrencies. Stone has not directly contacted the White House, but instead, he advises Ver’s legal team on pushing for legislative changes.

Crypto industry’s growing political involvement

Stone and Ver’s efforts come at a time when cryptocurrency’s relationship with U.S. politics is under increasing scrutiny. Trump’s administration has been notably supportive of the crypto industry, pulling back enforcement and granting pardons to crypto figures.

Recently, Trump pardoned the founders of BitMEX, further cementing his position as a key ally to the crypto sector. As Ver and Stone continue their push for tax reform, the political landscape surrounding crypto remains a hot topic.

The legal battles facing Roger, along with his choice to hire Roger Stone, demonstrate an extended effort within the crypto world to shape U.S. legislation. Through his relationship with Stone, he aims to modify the current cryptocurrency tax laws in order to change U.S. tax regulations regarding digital assets. The proposed outcome of this campaign will shape significant aspects of industry development.